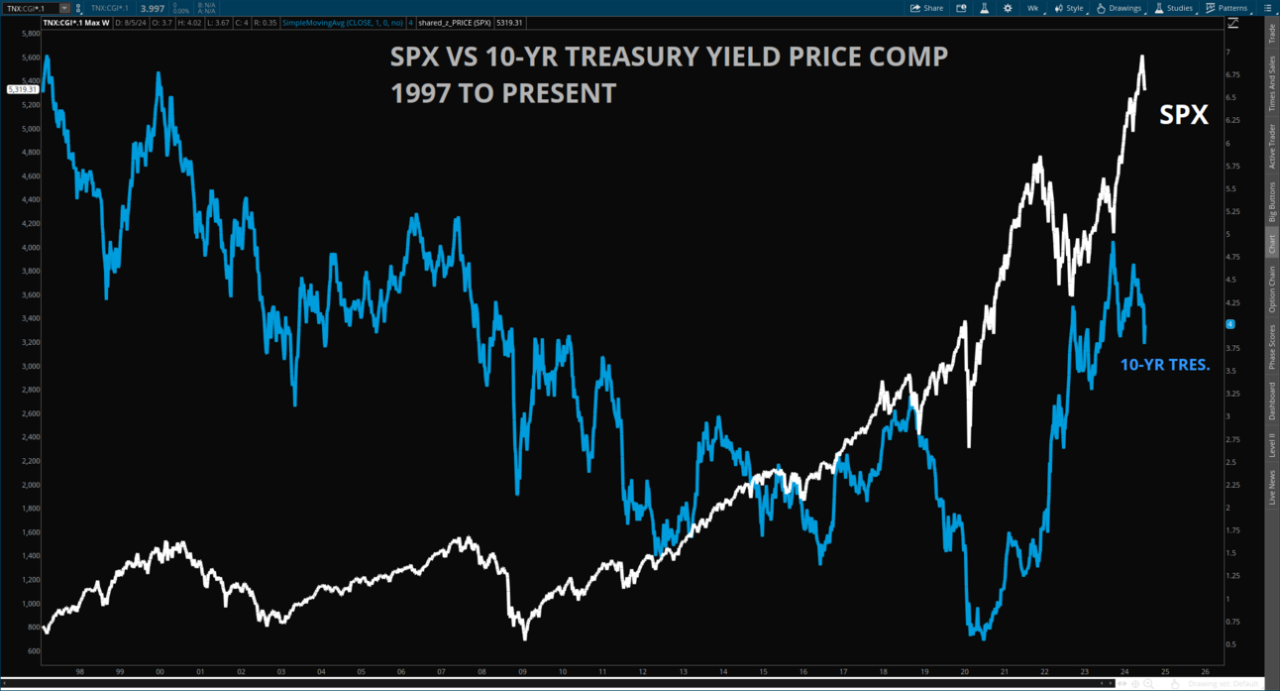

A New Regime in Yields and Equity Correlation

This week, the market experienced a more pronounced shift in the correlation between yields and equities, frustrating some traders who are grappling with this new regime, which differs from what we've seen over the past year. The week exemplified a true "risk-off" trade as investors sold equities and bought treasuries to shield themselves from market uncertainties and to lock in higher yields. This move was driven by speculation around the possibility of larger-than-expected rate cuts from the Fed, or even discussions of emergency cuts. Notably, we witnessed the technical un-inversion of the 10-year/2-year treasury spread, signaling a significant shift in market dynamics.

The correlation of rising yields with rising equities is not an anomaly, but rather a part of the cycle that traders should take seriously, especially as the treasury curve begins to normalize—meaning shorter-duration fixed income products yield less than their long-duration counterparts.

The relationship is straightforward: when yields rise, it signifies that investors are selling their debt positions and redirecting capital into riskier assets like equities. Consequently, both yields and equities tend to move higher together. Conversely, when yields decline, it indicates that investors are buying up fixed-income assets, thereby lowering yields and selling equities to fund these positions (yields down, equities down).

This correlation is further supported by the fact that the market has already priced in Fed rate cuts and anticipates such moves based on signals from Fed officials. As the yield curve begins to renormalize—with shorter-duration debt instruments trending toward lower yields compared to longer-duration ones—this correlation between yields and equities becomes even more crucial to monitor. It reflects a transition from late-cycle to early-cycle behavior, barring the onset of an "aggressive" recession, as opposed to a mild one.

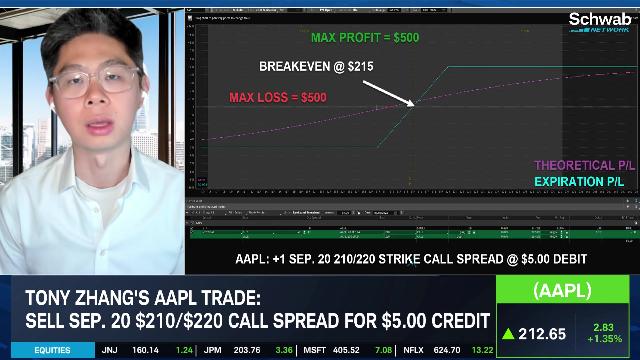

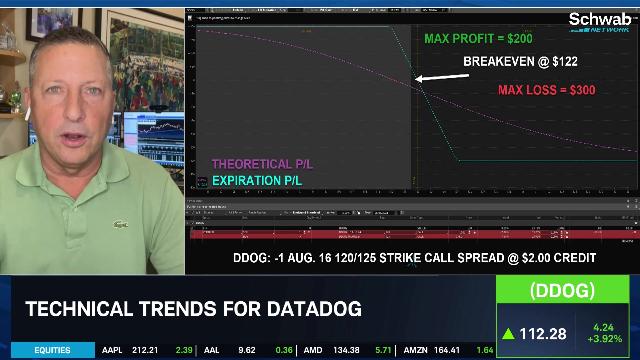

Featured clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.