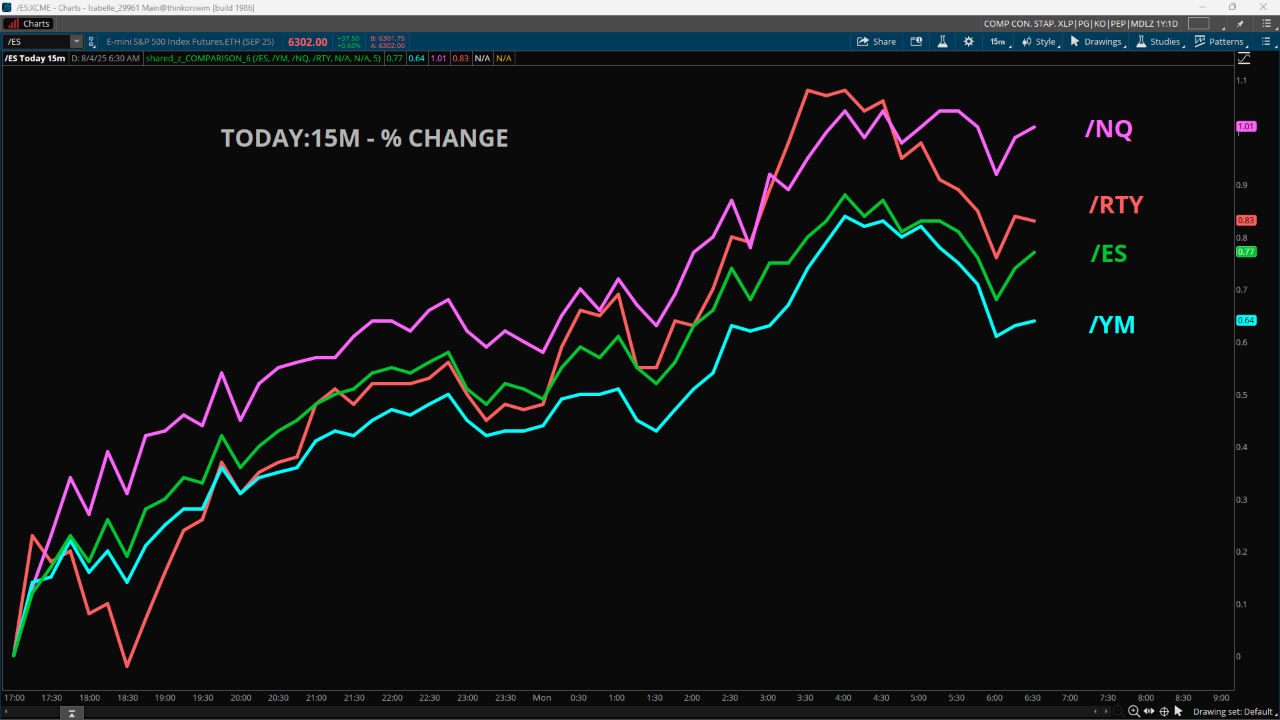

Bouncing Back from Friday's Sell-Off?

U.S. stock futures are higher in premarket trading as markets attempt to rebound from the steep losses seen in Friday’s session that were sparked by concerns over the economy and a new round of tariffs from the Trump administration. Friday’s worse than expected jobs data and the massive drop in revisions left stocks deep in the red last week.

Friday’s sell-off was also driven by uncertainty about President Donald Trump’s new modified tariff rates. Trump signed an executive order late last week that updated his “reciprocal” tariffs on dozens of U.S. trading partners, ranging from Syria to Taiwan, with updated duties ranging from 10% to 41%. The CBOE Volatility Index (VIX) spiked 22% on Friday and settled at its highest level in six weeks.

Snapshot (as of 7 AM ET)

- Oil (/CL) – Oil prices are down around 2% near $66 a barrel after OPEC+ agreed to another large output hike in September, though traders remained wary of further sanctions on Russia. OPEC+ members agreed to increase oil production by 547K barrels per day in September. The eight OPEC+ member states continue to scale back the 2.2 million barrels a day output cut they agreed in 2023. Production quotas have been boosted in recent months and on Sunday, the group agreed to boost oil production by 547K barrels a day next month. OPEC+ repeated that the phase-out of the additional voluntary production cuts may be paused or reversed subject to evolving market conditions. Indeed, Bloomberg reported that "delegates emphasized privately that the next move could just as easily be a cut as a hike."

- Gold (/GC) – Gold prices are up over 0.5% near $3,420 as the dollar fell following weaker-than-expected U.S. jobs data that boosted expectations for a Federal Reserve interest rate cut in September.

- Bitcoin (/BTC) – The Crypto Future is up over 1% near $114.8K in the premarket.

- VIX – The CBOE Volatility Index spiked higher by 22% on Friday and settled at 20.38 as stocks sold off. It was the highest closing price for the VIX in six weeks.

- U.S. Dollar (/DX) – The dollar is 0.3% lower to 98.6.

Biggest Premarket Movers (Mark % Change as of 7 AM ET)

- Idexx Labs (IDXX): +8.30%

- Amphenol (APH): +3.55%

- Super Micro Computer (SMCI): +2.82%

- On Semiconductor (ON): -0.74%

- Blackstone (BX): -0.60%

- Berkshire Hathaway (BRK/B): -0.60%

Economic Data

- 10:00AM ET: Factory Orders

- 11:30AM ET: 3-Month Bill Auction, 6-Month Bill Auction

Notable Earnings

- Premarket: BNTX, CAN, ENR, IEP, ON, TSN, W

- Postmarket: ACM, AL, ALGT, BMRN, CTRA, HIMS, KD, MELI, OKE, PLTR, PAY, SBAC, SPG, RIG, TREX, VRTX, VMEO, VNO, VMEO, WMB

- Premarket Tomorrow: APO, ARMK, ADM, BALL, BLDE, BP, CAT, CCO, CMI, DAN, DOCN, DUK, DD, ETN, ERJ, EVGO, EXPD, FIS, FOXA, ULCC, GFS, HSIC, J, LDOS, MPC, MAR, TAP, PFE, PTLO, SBH, FOUR, TDG, EVTL, SEAT, WLK, KLG, WW, YUM, ZBRA, ZTS

- Postmarket Tomorrow: AMD, AFL, AMGN, ANET, CHGG, CC, CRUS, CLOV, DVA, DVN, FLYW, GO, GXO, IFF, LCID, MASI, MTCH, MOS, NWS, OPEN, PCTY, RVLV, RNG, RIVN, SWKS, SNAP, SU, SMCI, TDC, TOST, UPST, VSAT, ZETA

Upgrades/Downgrades

- Phillip Securities upgrades Spotify (SPOT) to Neutral from Reduce

- Wells Fargo upgrades Doximity (DOCS) to Equal Weight from Underweight

- Compass Point downgrades Coinbase (COIN) to Sell from Neutral

- Stifel downgrades Baxter (BAX) to Hold from Buy