CES 2026: Why Partnerships Matter More Than Product Demos

CES 2026 is already shaping up like a mega cap platform contest, and far less like a showcase for one off gadgets. The real story is who controls the full technology stack, from silicon to software to cloud, and which partnerships are strong enough to turn impressive demos into products that actually ship at scale. The keynote spotlight reflects that shift, led by publicly traded U.S. chip giants Nvidia (NVDA), AMD (AMD), Intel (INTC), and Qualcomm (QCOM), each using CES week to frame what the next phase of AI looks like.

The clearest message so far is that Nvidia wants to push “physical AI” from an idea into a roadmap. On stage and in early coverage, Jensen Huang introduced the Vera Rubin platform and positioned it as the company’s next major computing architecture. The narrative is straightforward: the next wave of AI is not only about generating text or images, but about systems that can perceive the real world and take action inside it.

That theme quickly extends beyond the data center into mobility partnerships. Uber (UBER), Lucid (LCID), and autonomy developer Nuro unveiled a robotaxi concept built on Lucid’s Gravity SUV and Nvidia’s DRIVE platform, with plans for Uber to integrate the service into its app. It is a clean example of what CES does best for investors: it takes a collaboration and turns it into a product story with a plausible path to commercialization.

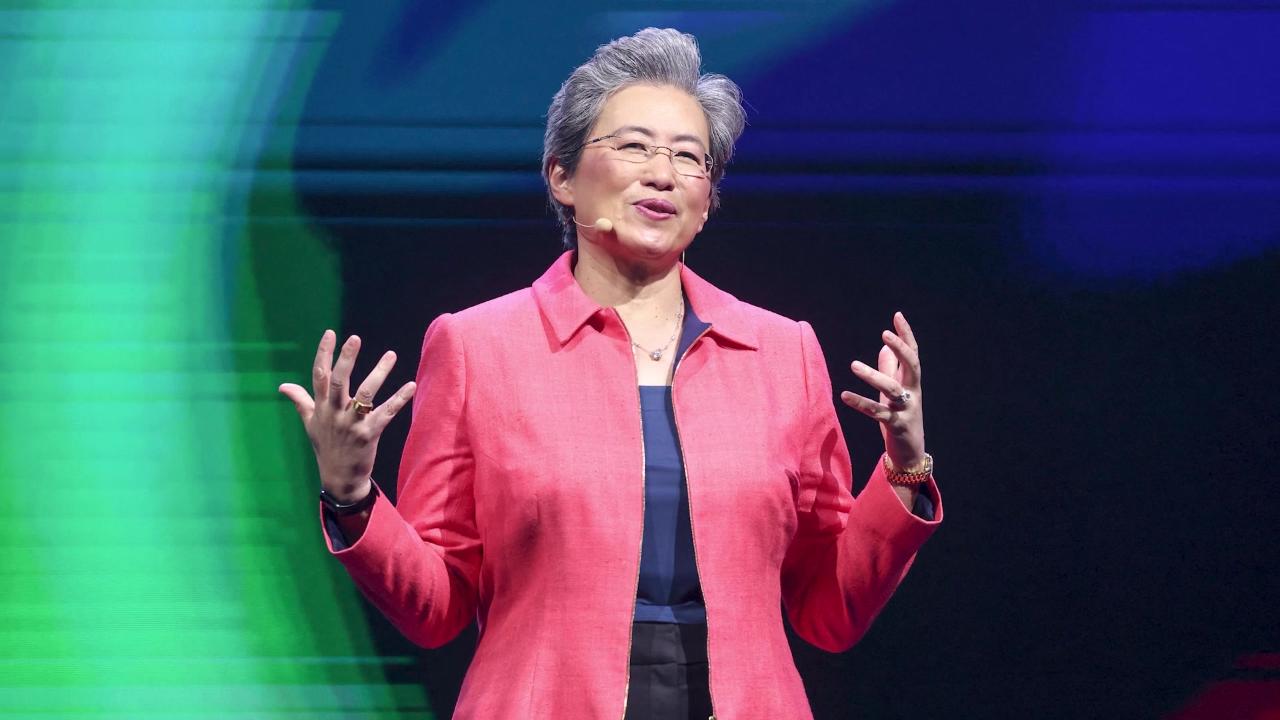

AMD’s CES keynote, meanwhile, is focused on narrowing the gap at the high end while expanding its reach across the rest of the market. Lisa Su highlighted new AI chips aimed at rack scale deployments and enterprise inference, while also pushing “AI PC” silicon designed for on device models and local inference workloads. AMD is also being linked to a large-scale collaboration with OpenAI connected to its upcoming MI400 family, which would be a meaningful ecosystem signal if it converts into real deployments.

Intel is using CES to argue it is returning on two fronts at once: performance and manufacturing. The company introduced its next generation Panther Lake laptop chips and emphasized the debut of its 18A process as an inflection point after a long period of heavier reliance on outside foundries. On the consumer side, Intel and its partners are leaning into AI PCs as the next upgrade cycle, where the value proposition is increasingly about local AI features, privacy, and responsiveness, rather than raw CPU speed alone.

Qualcomm’s message is about expansion in two directions: Windows PCs and the software-defined car. On the PC side, the Snapdragon X2 family is arriving in the first wave of new laptops from major manufacturers, with Qualcomm pitching multi day battery life and meaningful on-device AI performance as a direct challenge to both Intel and AMD. In autos, Qualcomm also announced a broader collaboration with Alphabet (GOOGL) to blend Snapdragon Digital Chassis hardware with Google’s automotive software stack, the kind of alignment that can compound over multiple product cycles when developers and carmakers build around it.

Two additional U.S. megacaps are also using CES partnerships to reinforce their platform narratives. Microsoft (MSFT) is positioning Azure as ready for the Rubin era, highlighting long range data center planning and collaboration with Nvidia so next generation systems can be deployed at scale. Amazon (AMZN) is leaning into in vehicle experiences as well, highlighting work around AI navigation and assistants with mapping partners such as HERE and TomTom.

The bottom line is that the most investable CES signals in 2026 are not single devices. They are collaborations that lock in distribution through OEMs, define future compute roadmaps through chips and platforms, and support recurring revenue through cloud, services, and automotive ecosystems.

Featured Clips