China’s Soybean Purchases Lag Expectations

The grain markets are often overlooked by traders, but this year and next, the soybean market may become a key leading indicator of U.S.–China trade relations. Right now, China is falling short of the soybean purchases that Treasury Secretary Scott Bessent said it committed to, which is 12 million metric tons by January.

As of last Friday’s USDA Export Sales data, China has purchased only 332,000 metric tons since the agreement, just 2.76% of the total commitment. With only six weeks left in 2025, China would need to buy 1.95 million metric tons per week to fulfill its pledge. That’s a tall order, but still theoretically possible, and soybean traders are currently betting on a ramp-up in Chinese buying.

Bearish news hit the grain markets on Friday after the USDA’s November WASDE report, the first since the U.S. government shutdown, showed higher-than-expected corn production and neutral U.S. ending-stocks estimates for soybeans. The report did not indicate any meaningful pickup in export demand for the soybean complex, so grain traders believe the data may already be stale and may be underestimating 2026 demand.

Soybean purchases have become a key indicator for the broader U.S.–China relationship because China has increasingly shifted its buying from the U.S. to South American producers, especially Brazil and Argentina. Any goodwill gesture, such as China sharply increasing U.S. agricultural imports, could signal progress in other areas of contention between the two countries. That includes areas like rare earth minerals, which could see more positive momentum in the months ahead.

So even if you’re not a grains trader, it’s worth paying attention. During the first Trump administration, soybean flows acted as a leading indicator of broader bilateral activity and this dynamic could again serve as a positive catalyst for equity markets. But China will need to step up purchases soon before markets conclude that it failed to follow through on its commitment, potentially putting trade tensions back at the forefront of investors’ minds.

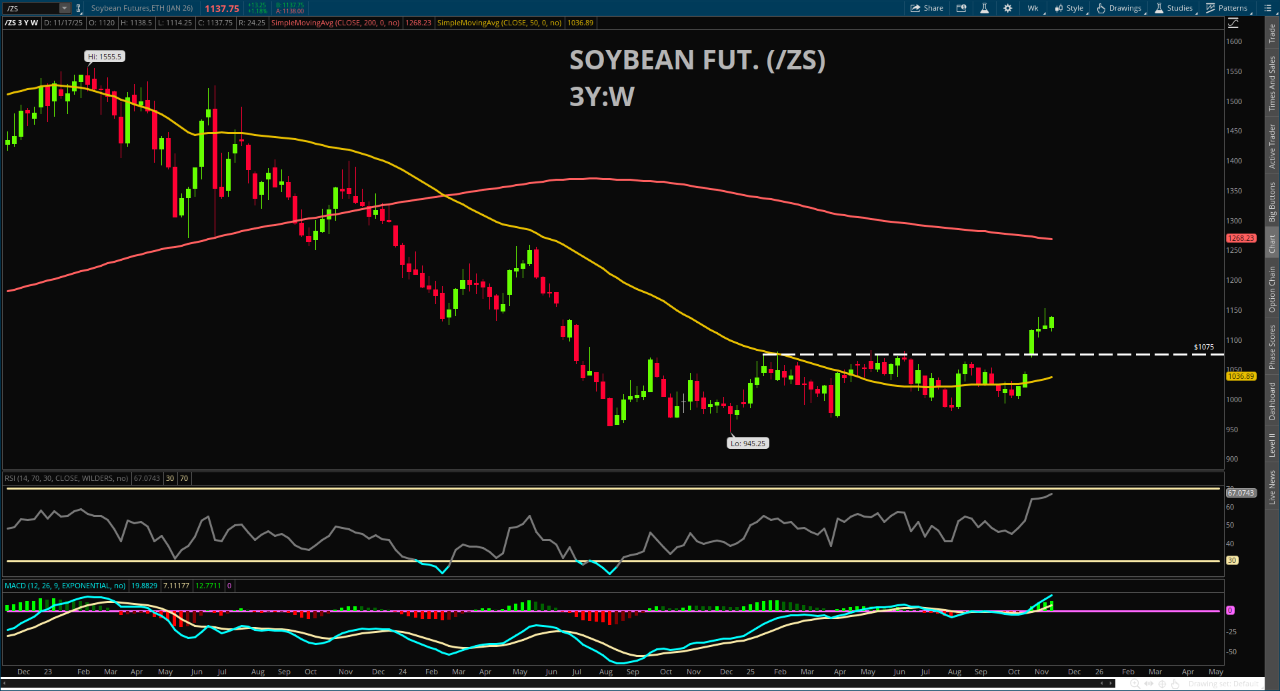

For now, soybeans remain bid on optimism that China will follow through in the coming weeks.

Featured Clips