Closing Bell: Nvidia Tops Estimates, Sparks After-Hours Rally

Key Points

- Markets ended mostly higher today, with megacap tech stocks leading the way. The S&P 500 (SPX) closed up 0.38%, the Nasdaq-100 rose 0.56%, while small caps finished relatively flat

- Nvidia (NVDA) reported earnings after the close that exceeded market expectations. The company posted Q3 revenue of $57 billion compared to analyst estimates of $54.92 billion.

- Target reported lackluster earnings on Wednesday morning, with Q3 revenue of $25.27 billion versus analyst consensus estimates of $25.32 billion and adjusted EPS of $1.78 compared to Street estimates of $1.72.

Markets ended mostly higher today, with megacap tech stocks leading the way. The S&P 500 (SPX) closed up 0.38%, the Nasdaq-100 rose 0.56%, while small caps finished relatively flat, with the Russell 2000 (RUT) down 0.04%. Information Technology, Communication Services, and Materials were the top-gaining sectors for the session, while Energy and Utilities were the biggest decliners.

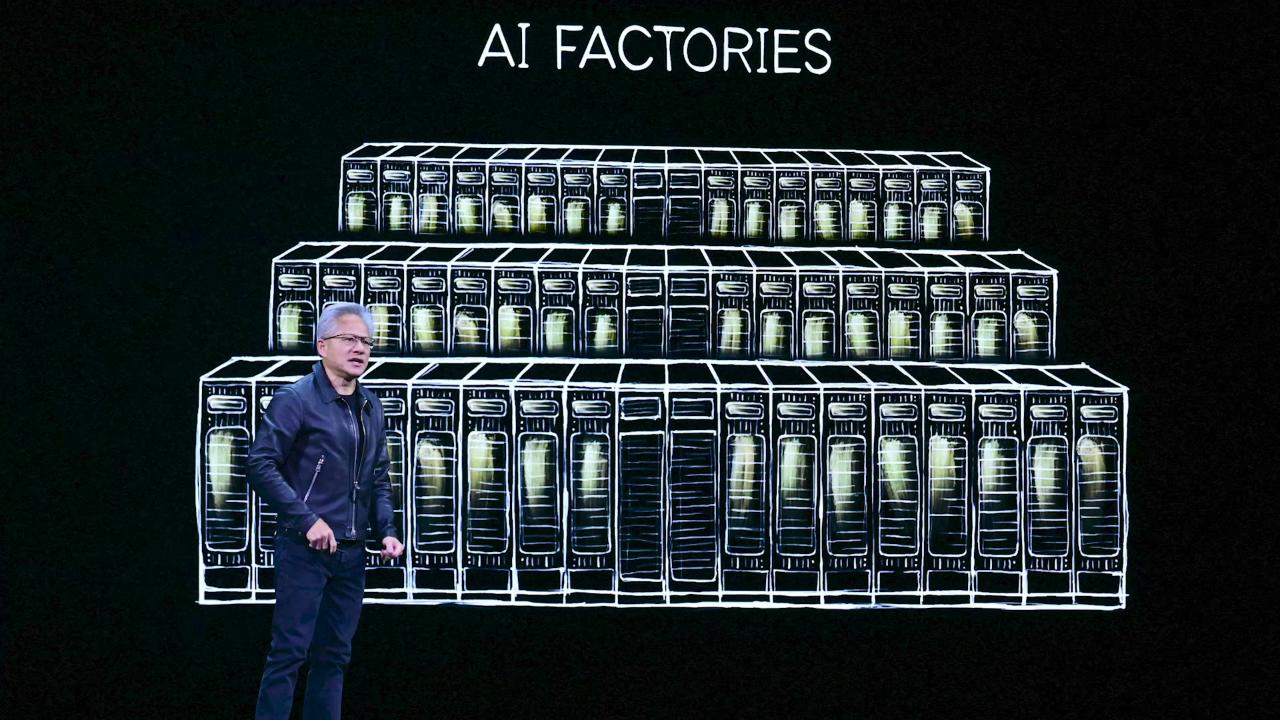

Nvidia Surpasses Forecasts, Projects Higher Q4 Revenue

Nvidia (NVDA) reported earnings after the close that exceeded market expectations. The company posted Q3 revenue of $57 billion compared to analyst estimates of $54.92 billion. Adjusted EPS came in at $1.30 versus the $1.25 estimate. Data center revenue totaled $51.2 billion. For Q4, the company expects revenue of $65 billion ±2%, compared to analyst consensus of $61.66 billion.

Target Earnings Disappoint as Consumer Spending Slows

Target reported lackluster earnings on Wednesday morning, with Q3 revenue of $25.27 billion versus analyst consensus estimates of $25.32 billion and adjusted EPS of $1.78 compared to Street estimates of $1.72. The company plans to increase CAPEX next year by 25%, but continues to see a slowdown in store traffic, putting pressure on topline growth. Target also announced a partnership with OpenAI to expand its sales distribution channels.

Key Market Events for Tomorrow

- 08:30 AM ET: Non-Farm Employment Change (September)

- 08:50 AM ET: FOMC Member Hammack Speaks

- 10:00 AM ET: Existing Home Sales

- 10:30 AM ET: Natural Gas Storage

- 11:00 AM ET: FOMC Member Cook Speaks

- 12:40 PM ET: FOMC Member Goolsbee Speaks

- 06:15 PM ET: FOMC Member Miran Speaks

- 06:45 PM ET: FOMC Member Paulson Speaks

Notable Earnings for Tomorrow

- Premarket: BBWI, WMT

- Postmarket: GAP, INTU, ROST

Featured Clips

Wednesday's Final Takeaways: No Full October Jobs Print & Bitcoin Selling Steepens

Market On Close

► Play video