Closing Bell: Records Beckon as CES Buzz Meets Jobs Week Jitters

U.S. stocks climbed and hovered near record territory with gains broadening beyond the largest companies. The S&P 500 rose about 0.6%, the Dow added around 1%, and the Nasdaq gained about 0.65%, while the Russell 2000 advanced roughly 1.37%. Leadership leaned toward Energy, Financials, and Consumer Discretionary, while Utilities trailed. The 10-year Treasury yield edged up to about 4.18%, the dollar firmed in the high 98s, and the VIX stayed calm in the mid-teens, a mix that cooled the most rate sensitive growth pockets without stopping the advance. Bitcoin slipped about 2% to the 93–94K area.

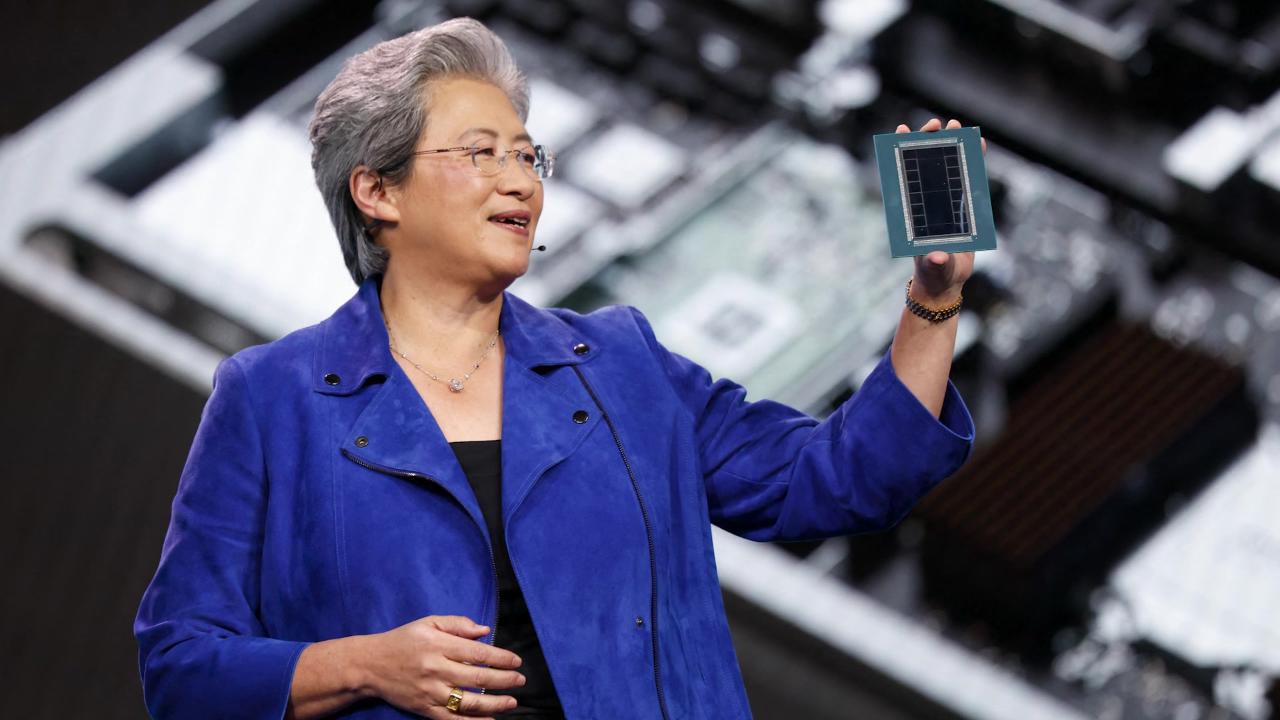

At CES, the AI story remained front and center and gave semiconductors another lift. NVIDIA previewed its next platform direction around Rubin, while AMD kept the focus on AI everywhere across data center and PC silicon. The backdrop kept the PHLX Semiconductor Index and SOXX bid and favored memory and storage suppliers such as Micron and SanDisk along with equipment leaders like Lam Research. Analog and power names also participated, with Texas Instruments and ON Semiconductor joining the move as investors leaned into a broader chips up cycle tied to data centers and AI PCs.

The metals trade echoed that investment drumbeat. Copper firmed on tight supply and expanding demand from data centers and electrification, while gold held steady despite slightly higher yields. It is a rare combination that points to strong physical markets and a touch of hedging ahead of a busy macro stretch. Through it all, volatility stayed tame, with the VIX lingering near the mid teens, consistent with a market that remains constructive while keeping some protection in place.

With indexes near highs, attention now shifts to a midweek run of labor and services data that will shape expectations for the late January Fed meeting. Traders want to see labor demand easing without breaking and services activity holding up as inflation drifts lower. That balance has supported multiples since autumn and it will be tested next.

What is next — Wednesday, Jan 7 (ET)

• 8:15 a.m. ADP private employment

• 10:00 a.m. ISM Services PMI

• 10:00 a.m. JOLTS job openings

Earnings, Wednesday

• After the close: AAR Corp. (AIR).

Featured Clips