Closing Bell: Selling Wave Hits Markets to Close Out 2025

Key Points

- Stocks fell across the board amid tax-loss harvesting and institutional rebalancing, with the S&P 500 (-0.74%), Nasdaq-100 (-0.84%), and Russell 2000 (-0.75%) all closing lower.

- Chinese tech firms have reportedly ordered ~2 million H200 chips for 2026, far exceeding current inventory estimates.

- Initial jobless claims fell to 199,000, well below expectations.

Markets finished lower to close out 2025 as tax-loss harvesting and institutional rebalancing took hold in a low-liquidity environment. The S&P 500 (SPX) fell 0.74%, while the Nasdaq-100 (NDX) declined 0.84%. Small-cap stocks also moved lower, breaking key short-term technical levels, with the Russell 2000 (RUT) down 0.75%. Every sector finished in the red, led to the downside by Real Estate, Materials, and Industrials.

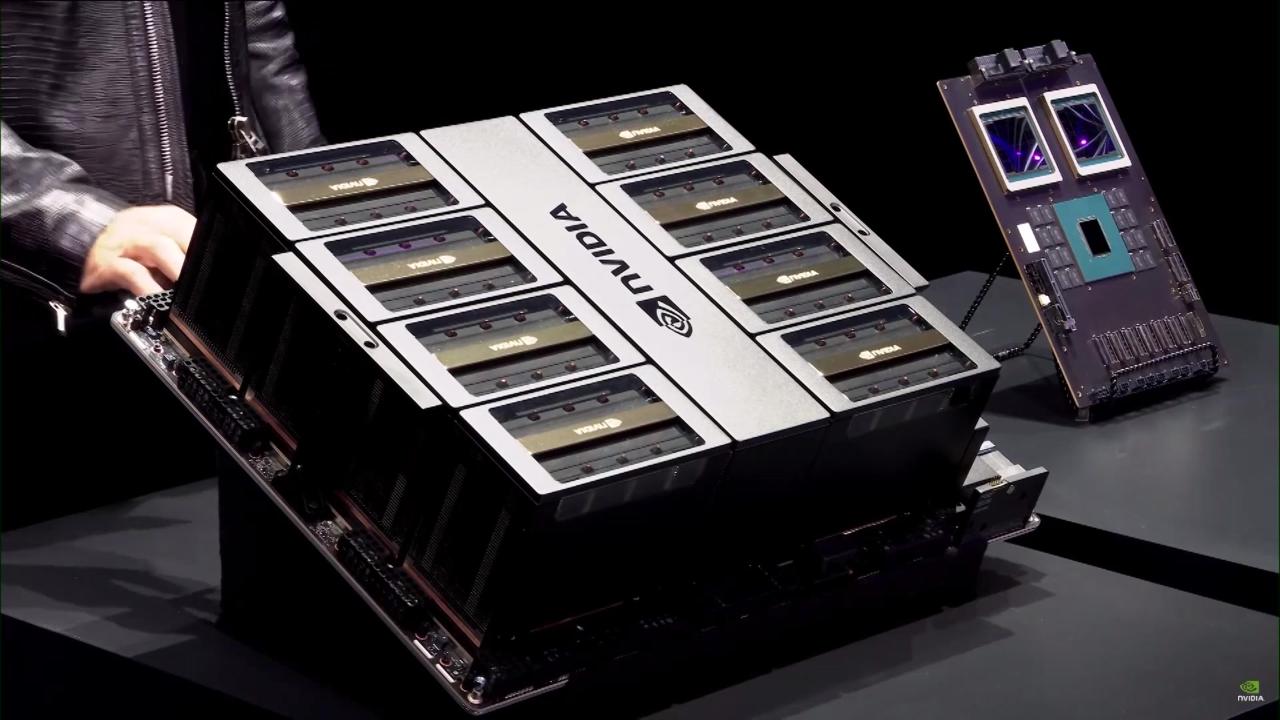

Nvidia Prepares for Major H200 Chip Ramp for China

Reuters reported early this morning that Chinese technology companies have ordered approximately 2 million H200 chips for 2026, significantly exceeding the currently assumed inventory of roughly 700,000 units. With the backlog continuing to grow, Nvidia is reportedly expecting Taiwan Semiconductor (TSMC) to ramp production in Q2 2026 in order to meet demand.

Initial Jobless Claims Come in Better Than Expected

Initial jobless claims came in below expectations last week, with 199,000 claims reported versus estimates of 219,000. Excluding the week of December 4th, this marks the lowest level of claims since January 2024. The bulk of the decline came from Texas, which saw claims fall roughly 49% week over week.

Key Market Events for Tomorrow

- Market Holiday

Notable Earnings for Tomorrow

Market Holiday

Featured Clips