Closing Bell: Stocks Rebound from Tuesday’s Losses

Key Points

- Markets rebounded on Wednesday, with gains in all four of the major indices.

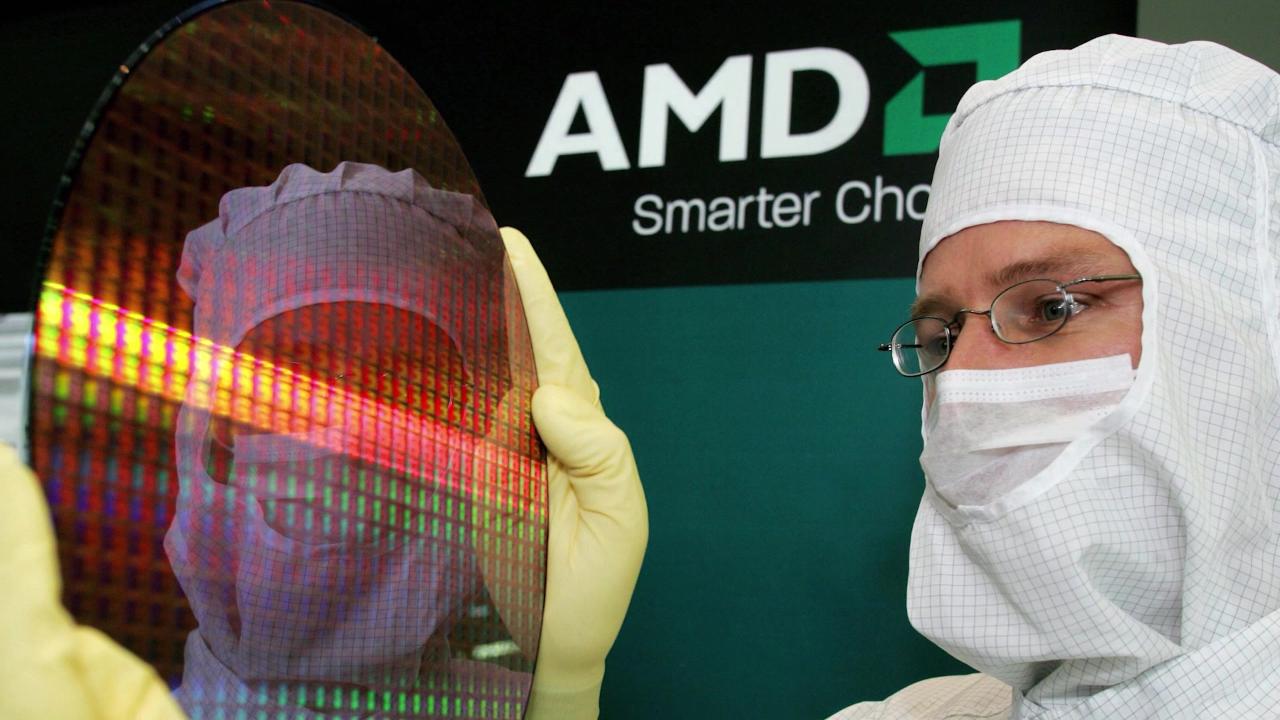

- AMD reverses early session losses and gains 2.3% post earnings

- SuperMicro shares fell 9% after missing earnings estimates

- ADP jobs data beats expectations

U.S. equities rose on Wednesday as the Supreme Court’s tough questions about President Donald Trump’s tariffs raised hopes that some of the duties may be rolled back. Chipmaker Advanced Micro Devices (AMD) and other names in the artificial intelligence trade also rebounded from valuation concerns that hit the market on Tuesday. The S&P 500 (SPX) was up 0.37% while the Nasdaq-100 (NDX) rallied 0.72%. The Dow Industrials Index ($DJI) was up 225 points or 0.48% on Wednesday while the small-cap RUT jumped 1.54%.

Along with AMD, tech names saw gains with Broadcom (AVGO) and Micron Technology (MU) reversing course from their losses in the previous session to jump 2% and 9%, respectively. Leading AI player Oracle (ORCL) recovered from Tuesday’s losses to rise Wednesday as well.

AMD earnings provide lift

The chipmaker posted third-quarter earnings and revenue that beat analyst expectations, though traders initially were worried about its margin outlook. AMD's data center revenue hit $4.3 billion (+22.8% year over year) with Analysts expecting $4.1 billion. The company saw $3.5 billion in revenue in the same quarter last year. The company says it foresees revenue of between $9.3 billion and $9.9 billion. Wall Street was anticipating revenue of $9.21 billion.

SuperMicro (SMCI) shares fall 11% post earnings

The AI server maker reported revenue and earnings for the first quarter of its 2026 fiscal year that fell below Wall Street's expectations. The company reported revenue of $5.02 billion for the first quarter, down from $5.94 billion during the year-ago period and less than the $6.09 billion expected by analysts. However, Supermicro lifted its full-year sales forecast to $36 billion from $33 billion, with executives noting recent "large-scale deals" for its Nvidia servers.

Finally, some Jobs Data

Equity investors received some encouraging data on the economy Wednesday with better-than-expected ADP payrolls data and a stronger-than-expected ISM services economy reading. U.S. ADP reported private payrolls rebounded 42k in October, better than forecast. And, the September drop was revised up to -29k (was -32k). U.S. ISM services gauge bounce back 2.4 points to 52.4 in October, recovering from the -2.0 point drop to 52.0 in September.

Key Market Events for Tomorrow

- 7:30 AM ET: Challenger Job-Cut Report

- 8:30 AM ET: Productivity and Costs

- 11:00 AM ET: Fed’s Barr and Williams Speak

- 12:00 PM ET: Fed’s Hammack Speaks

- 3:30 PM ET: Fed’s Waller Speaks

Notable Earnings for Tomorrow

- Premarket: AZN, BLMN, COP, QBTS, DDOG, H, KVUE, RL, TPR, VST

- Postmarket: AFRM, ABNB, AKAM, XYZ, DKNG, EXPE, MP, TTWO, TTD, WYNN

Featured Clips

Wednesday's Final Takeaways: Record Government Shutdown, Storage & Airlines Soar

Market On Close

► Play video