Coinbase (COIN) Earnings Preview

Bitcoin’s had a tough few months, with the futures plunging from a high of $127,240 in October to a low $60,005 on February 6. While some predict a crypto winter, a note from Bernstein earlier this week claims that it can climb back – and further – to $150K before year end.

Coinbase (COIN) reports earnings after the bell today. Zacks anticipates a tough quarter, estimating EPS of $0.61 (-82% year-over-year) and revenue of $1.82 billion (-20% year-over-year).

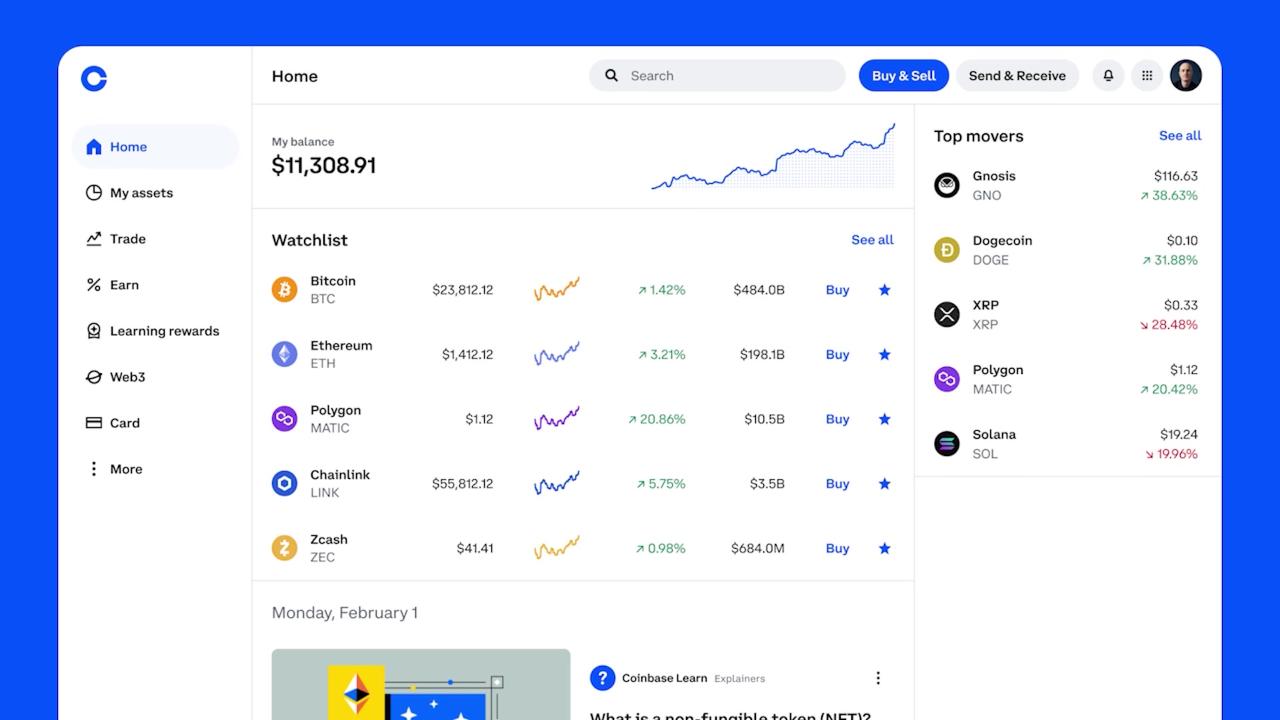

As a cryptocurrency exchange platform, Coinbase makes its revenue from transaction fees (around 50%), along with subscription and services (the other 50%). Unlike Strategy (MSTR), another well-known crypto-related name, it is also exposed to other cryptocurrencies, including Ethereum and Solana. Because it doesn’t primarily derive value from crypto holdings, it may actually benefit from the drop if it increases the number of transactions happening.

Last quarter, 3Q25, global crypto market spot trading volumes rose 38% quarter-over-quarter, and transaction revenue rose 37% vs last quarter. Total trading volume jumped to $295 billion, up 24% q/q, with both consumer and institutional showing double-digit gains. Comparing it to the year before, it saw strong gains in all revenue categories there as well.

Coinbase does make some money from “rewards,” aka the fees collected by minting new crypto coins. However, the way crypto works, average rewards should continue to decline with maturity, and it doesn’t make up a majority of their revenue stream.

The company is in the middle of building what it calls the ‘Everything Exchange’, working to offer more products, including spot assets, options, and perpetual futures. These could increase trading volume, but investors should also be watching regulatory action around these types of products.

As far as trading volume, Bitcoin remains the most popular at 24% of 3Q25 volumes, though Ethereum is close behind with 22%. Other, less well-known coins made up 42% collectively, meaning that interest is branching out within the ecosystem. This further diversification of product is a good sign for Coinbase, as long as it remains a trusted platform to do crypto business on. The stock itself is down 42% year-over-year, and over 30% since January 1. The options market anticipates a move of around +/- $12, or about an 8% move.

Overall, Coinbase needs further crypto adoption by retail and institutional investors and traders to continue to grow. The recent collapse of Bitcoin could hit it hard this quarter, or we will see if higher trading volumes help the company’s bottom line. If investors are scared out of Bitcoin, the most popular currency, they could either move to less well-known crypto or leave the sphere altogether. We’ll have to see which way the wind is blowing.

Featured Clips

Daniel Newman on Futurum's 'AI 15,' PLTR Upside Potential & 'Best Idea' in META

The Watch List

► Play video