Dec. Rate Cut Chance Falls, Oil Spikes, AMAT Sinks

U.S. stock futures are lower and extending yesterday’s sell-off despite the ending of the Government shutdown.

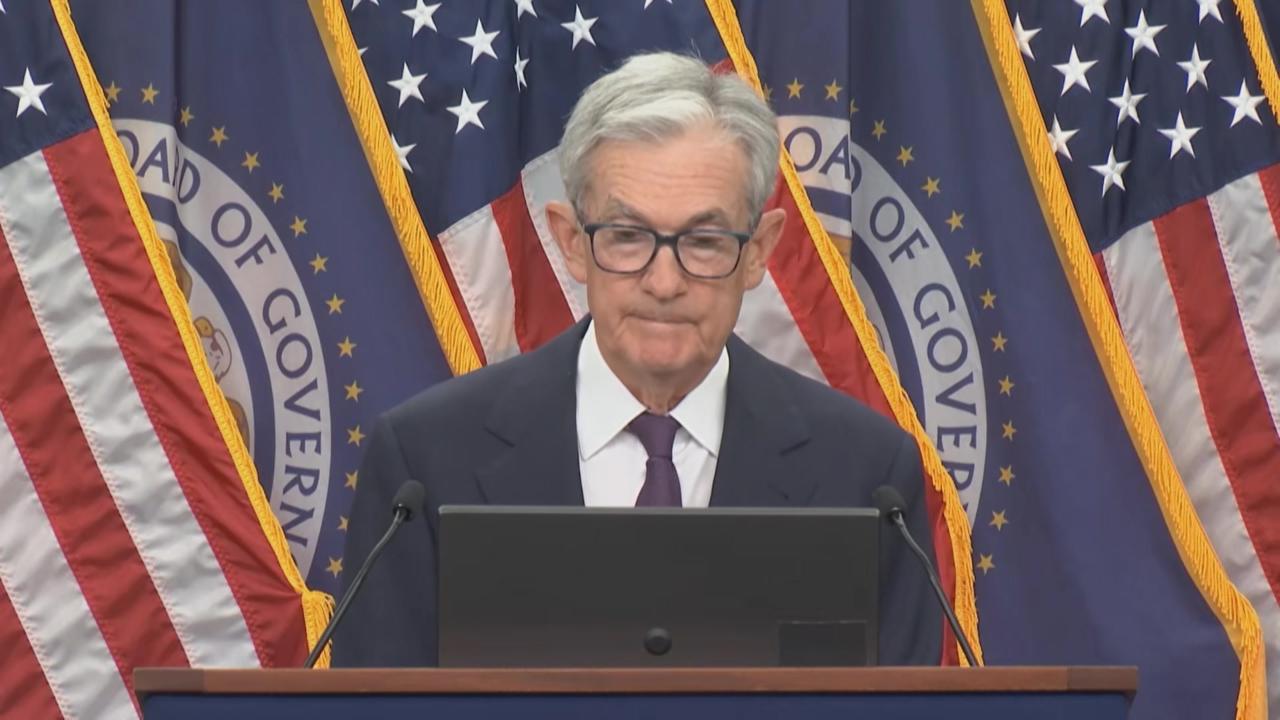

Growing concern about the Federal Reserve’s December interest rate decision added pressure to the market on Thursday. Traders are now pricing in a 50% probability that the central bank will cut its benchmark overnight borrowing rate by a quarter percentage point during their December meeting. This is down from over a 90% chance of a cut just last month according to the CME FedWatch Tool.

With little economic data today, investor focus remains on Fedspeak and rising uncertainty with the CBOE Volatility Index (VIX) above the 22 level and rising this week.

Snapshot (as of 7 AM ET)

- Oil (/CL) – Oil prices are spiking up 1.6% near $60 a barrel, reversing from recent weakness, as investors weighed concerns about global oversupply with looming sanctions against Russia’s Lukoil. Crude is also bid on reports of a Ukraine Strike on a major Russian export hub.

- Gold (/GC) – Gold prices are down 1.8% near $4120, pulling back from a three-week high yesterday amid a broad market sell-off following the reopening of the U.S. government.

- Bitcoin (/BTC) – The Crypto Future is down over 2.5% near 95,400 in premarket trading and is at 6-month lows.

- VIX – The CBOE Volatility Index jumped 14.2% on Thursday and settled at 20.00 as stocks sold-off. The VIX is up another 10% near 22 this morning as stocks extend losses.

- U.S. Dollar (/DX) – The dollar is flat at 99.0.

Biggest Premarket Movers (Mark % Change as of 7 AM ET)

- Warner Bros. Discovery (WBD): +2.57%

- Baker-Hughes (BKR): +1.20%

- T-Mobile (TMUS): +1.04%

- Applied Materials (AMAT): -6.91%

- Robinhood (HOOD): -6.21%

- Coinbase (COIN): -5.96%

Economic Data

- 10:00 AM ET: Business Inventories

- 10:05 AM ET: Fed’s Schmid Speaks

- 10:30 AM ET: Natural Gas Inventories

- 2:30 PM ET: Fed’s Logan Speaks

- 3:20 PM ET: Fed’s Bostic Speaks

Notable Earnings

- Premarket: PIII, SR

- Postmarket: QUBT

- Premarket Tomorrow: ARMK, HP, JKS, XPEV, ZK

- Postmarket Tomorrow: TCOM

Upgrades/Downgrades

- Baird upgrades Circle (CRCL) to Outperform from Neutral

- Jefferies upgrades Gap (GPS) to Buy from Hold

- JPMorgan upgrades MP Materials (MP) to Overweight from Neutral

- Stifel downgrades Home Depot (HD) to Hold from Buy

- Craig-Hallum downgrades Applied Materials (AMAT) to Hold from Buy

- BofA downgrades StubHub (STUB) to Neutral from Buy