Is Palantir’s (PLTR) Long Rally Overheating?

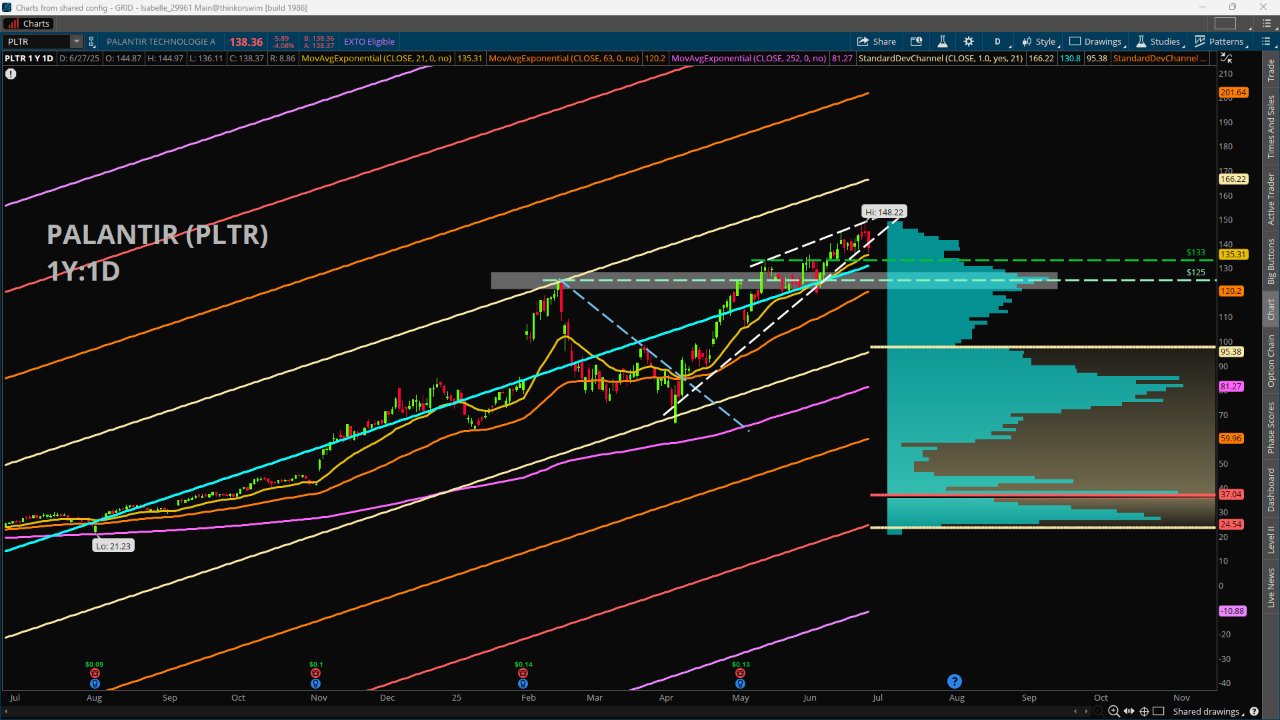

Palantir (PLTR) bulls have enjoyed a lengthy rally with the stock notching fresh all-time highs of 148.22 on Thursday after rocketing more than 550% off the 52-week lows of 21.23 on Aug. 5. Palantir, which builds and deploys software for intelligence organizations, continues to expand its role with the U.S. government and defense sector, which recently included a $795 million contract with the U.S. Army for its Maven Smart System that focuses on adoption of artificial intelligence and machine learning in the military.

The company has become one of the S&P 500’s most actively traded names, boasting an average daily volume of more than 91 million shares during the past 50 trading days, and often reaching more than a million options contracts traded per day. But no stock can go straight up forever no matter how enthusiasm surrounds it, and Friday’s session may have revealed some cracks starting to show in this technology sector powerhouse’s price action as shares slipped around 4%.

This downside move tested the lower boundary of a rising wedge-type pattern, characterized by a steeper line going up across the lows and more shallow sloping line across the highs. The rising wedge shape typically is regarded as a more bearish pattern; but for now, price held on above the shorter-term 21-day Exponential Moving Average near 135.50, which could be a notable downside level to watch this week.

Technicians also may have noted a more bearish read on momentum, such as the Relative Strength Index (RSI). Starting in mid-May, price has continued to log new closing highs while the RSI is trending lower. This mismatch is known as bearish divergence, and suggests the pace of the gains is slowing. This certainly does not translate to an impending collapse, but it is a notable development at this later stage of the rally.

If price were to move higher, traders face the tricky situation of relatively uncharted waters with no prior price action to work with. The +1 Standard Deviation Channel could be a source of potential resistance to watch, which represents one standard deviation above the yearly Linear Regression Line (line of best fit) and comes in near 166 as of Friday’s close. If price breaks to the downside, the 133 level represents recent old highs and then subsequent lows that could come back into focus if the previously mentioned 21-EMA is breached. Beyond that, the 125 level marks a significant old high from Feb. 18 and also a sizeable volume node, so price could also find footing near there.

Featured Clips

Disinflation or Stagflation? 3 Things Mish Schneider is Watching to Find Out

MORNING MOVERS

► Play video

TSLA Creates UBER & LYFT Bear Case, Baird Downgrades Banks, EL 'Lipstick Indicator'

MORNING TRADE LIVE

► Play video