Keep Calm — Volatility Mechanics You Should Know

Markets continue to experience heightened volatility following Nvidia’s (NVDA) earnings, as we saw yesterday with a classic “buy the rumor, sell the news” reaction. The CBOE Volatility Index (VIX) remains elevated and is climbing in a slow, methodical manner, a trend that’s relatively rare compared with past volatility episodes.

Should the market be concerned? To a degree, yes. Key narratives remain murky with the sustainability of AI-related financing trends, shifting Fed rate-cut expectations, and stress in global sovereign credit markets. But volatility is inherently mean-reverting in nature. As long as these narratives linger, markets may continue to deleverage in pockets, yet volatility typically comes back down once positioning resets.

Importantly, the VIX has not breached a 2-standard-deviation move from its 1-year mean. That suggests we may face additional turbulence in the next couple of days, but the setup is more mechanical than structural, especially with November monthly options expiration today. Roughly $3.1 trillion in notional value will expire, which should relieve some pressure on the volatility complex as institutions roll and reset positions heading into the December quarterly expiration.

Of today’s expiration, about $1.3 trillion in notional value expires this morning with SPX AM-settled options. That leaves roughly $1.7 trillion expiring at the close, which could drive intraday swings and set up an interesting trading environment into the final hour. Once positions are rolled out in time, both delta and gamma pressure tends to dampen, which can help pull volatility lower barring any unforeseen news events.

Keep an eye on the VIX options market for large blocks of call-credit-spread activity. As we approach “peak” volatility — on a relative basis — traders often look to sell out-of-the-money call spreads to capture premium, anticipating a reversal lower in vol – once again volatility is mean-reverting.

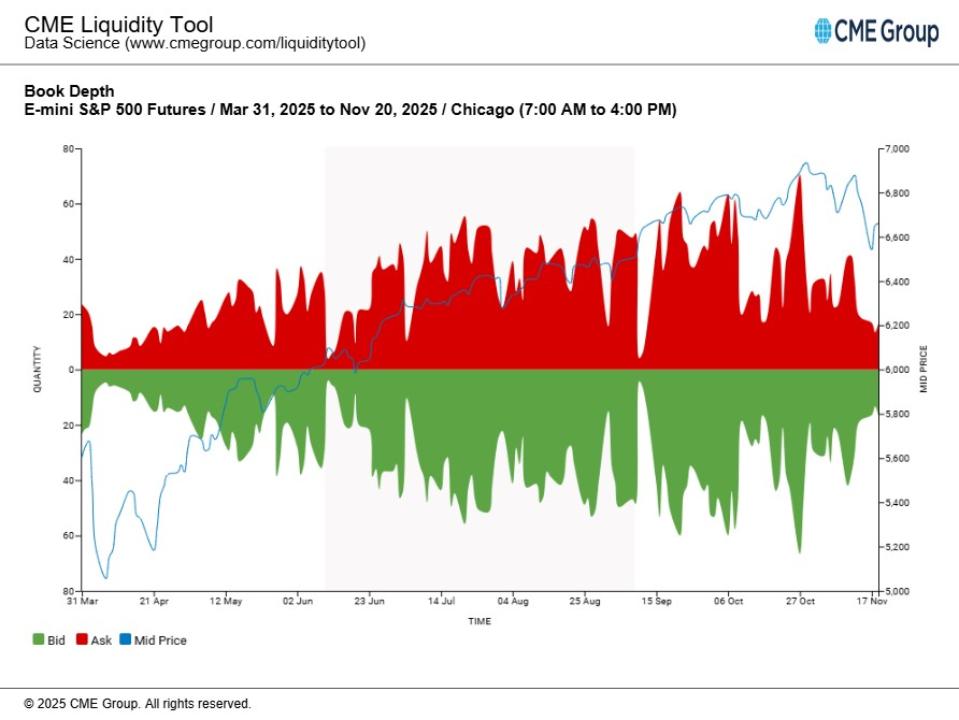

Lastly, liquidity is critical for volatility to compress. At the moment, liquidity remains exceptionally thin when measured by E-Mini S&P 500 book depth. When depth begins to expand — meaning larger sizes reappear on both the bid and the ask — it typically signals improving liquidity conditions, which in turn helps push volatility lower. The chart above from CME Group illustrates this relationship clearly: book depth is shown in red and green, while the blue line represents the E-Mini S&P 500 price. As you can see, there is a strong correlation between book depth and overall equity market performance.

Trading through volatile periods can be challenging; risk management and internal market-structure metrics can help navigate these conditions. For now, the technical trend has shifted to neutral-to-bearish, as discussed in the November 15th article “S&P 500 Weekly Chart Shows Bearish Setup.” However, history shows that markets can reverse sharply when the right conditions emerge.

Featured Clips

Rezolve AI (RZLV) CEO on Reaching $500M ARR, "Misguided" A.I. Bubble Views

Market On Close

► Play video