Market Breadth Has Been the Key to This Rally

Markets have experienced a relatively healthy rally off the November 21st lows, with broad participation emerging as the key driver behind the rebound. Technically, the E-mini S&P 500 is approaching a make-or-break point, and continued breadth will be essential for institutional bulls to keep stepping off the sidelines and pressuring the bears.

From a week-to-date perspective, several key sectors have posted solid gains. Communication Services is up more than 5.5%, Consumer Discretionary has gained 3.8%, and Health Care is higher by 2.6% as of premarket trading today.

Notably, only one sector is in the red this week: Energy. The sector is being dragged lower by improved sentiment around a possible Russia-Ukraine resolution, which has sparked expectations that additional Russian oil supplies may return to the market if sanctions are lifted or eased.

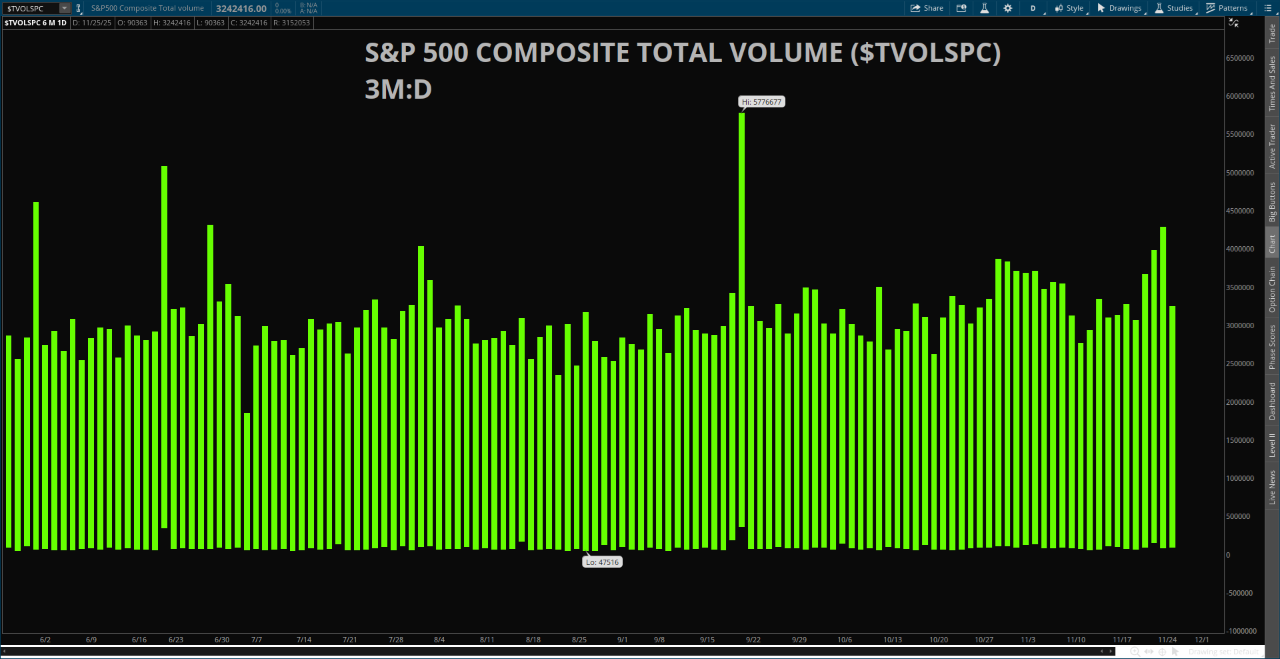

While some argue that this holiday week is producing “low-volume markets,” the data tells a different story. Volume in both the E-mini S&P 500 (/ES) and the SPDR S&P 500 ETF (SPY) remain near their 60-day volume averages. Moreover, market breadth strength is reflected in the S&P 500 Total Composite Volume ($TVOLSPC)—an aggregate of all component trading volume. Over the past three sessions, composite volume has increased and has now reached its highest level since June 27 (excluding the September quarterly options-expiration spike).

This shows that positive inflows are still entering the market and that capital is being deployed beyond the “Mag 7.” Value stocks and high-yield dividend names have served as a relative haven throughout the recent pullback, reinforcing the broadening participation theme. This dynamic is a constructive sign for overall market health.

The expansion in market breadth, combined with steady inflows and rising composite volume, suggests the rally has durable support beyond a handful of mega-cap leaders – at least for now. If this trend persists, concentration risk may ease in the near term and broadened participation could unlock meaningful opportunities for investors across multiple sectors.

Featured Clips