Market Minute: Bitcoin Breaking Upward As Election Looms

Bitcoin futures (/BTC) have been on the move to the upside in recent weeks, as cryptocurrency traders must ponder the possible implications of either a Donald Trump or a Kamala Harris presidency for the industry. Based on the price action, traders seem to be feeling bullish heading into the election as the /BTC contract is up about 38.5% as of yesterday’s close since the lows of 49,365 on Aug. 5.

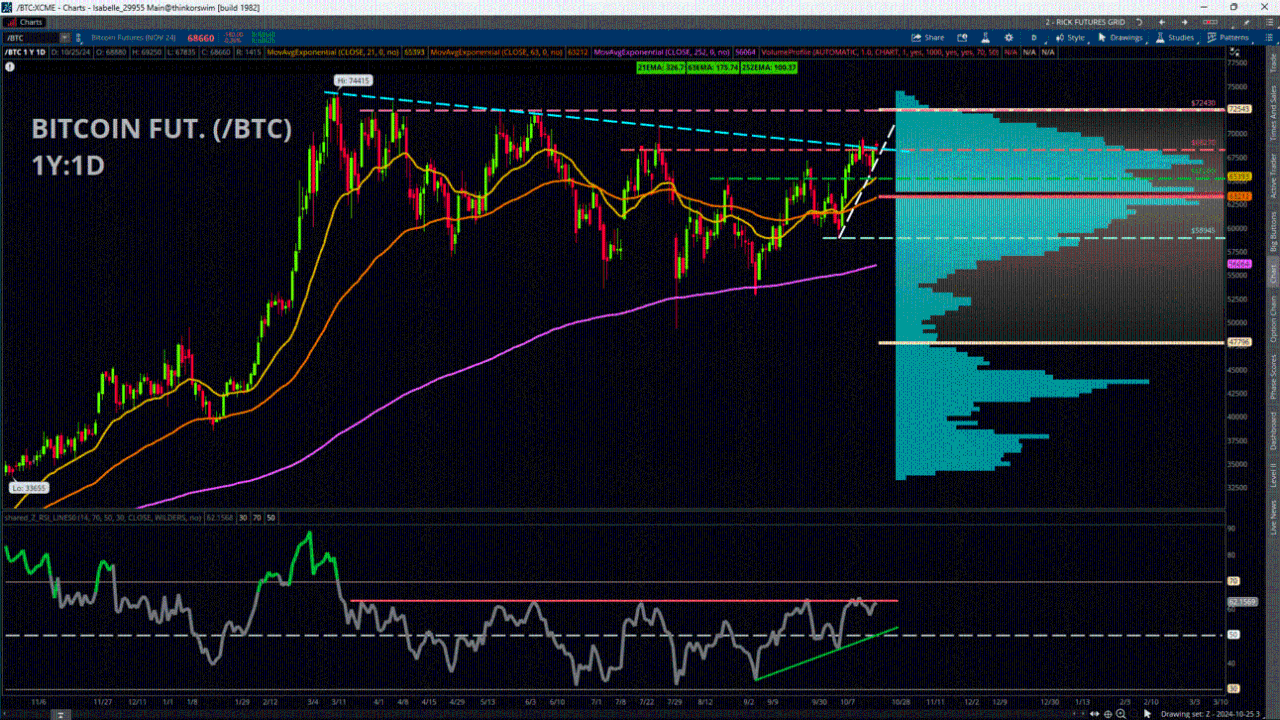

Traders may find themselves at an important potential turning point today, as /BTC seems to be breaking above some noteworthy technical points. Today’s premarket action puts price above the 68,270 level, which was the contract’s best close near the end of a rally that culminated in late July. Price repeatedly struggled to break above this level in recent weeks, which additionally is the general site of a longer-term trendline beginning with the 52-week highs in March and connecting subsequent lower highs in April, June, July, and again during the past couple of weeks.

Looking at the broader picture, the trend has improved significantly in recent weeks. Even though price on Sept. 6 made a new closing low vs. Aug. 5, price seemed to find support near the 252-day Exponential Moving Average and made a significant rally the next day. Technical traders also may have noted bullish divergence on the Relative Strength Index (RSI) at the same time, which made a higher low despite price making a lower low. The RSI’s behavior since April has been rather curious as well in the form of a persistent ceiling near the 63 level, which has often been the harbinger of a decline. The RSI currently gives a reading near this level, so be on the lookout for either breakout or rejection.

If price keeps trending upward, the next major resistance area for many traders likely would be around 72,430, as price repeatedly failed to make a strong close above this level during the spring and summer months. From there, the next stop is the all-time highs of 74,415. For downside points to watch, look for the old resistance level of 68,270 to now become potential support. After that, the 65,200 level was another level that seemed to serve as both support/resistance, and also presently lines up very close to the 21-day EMA.

Featured clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.