Market Minute: Bitcoin Breaks 100K as Upside Surge Continues

Crypto bears have been routed once again after Bitcoin price broke through 100,000 for the first time at around 8:40pm CT yesterday evening, launching the Bitcoin futures contract (/BTC) up more than 4.5% on the day in early trading. The discrepancy between Bitcoin’s spot price and the /BTC futures derivative product has been interesting, as /BTC already broke the 100K level back on Nov. 29 – meanwhile, the spot price topped out around 99,330 on Nov. 22 and then made a lower high at around 98K near the same time the /BTC futures were breaking above the 100K threshold.

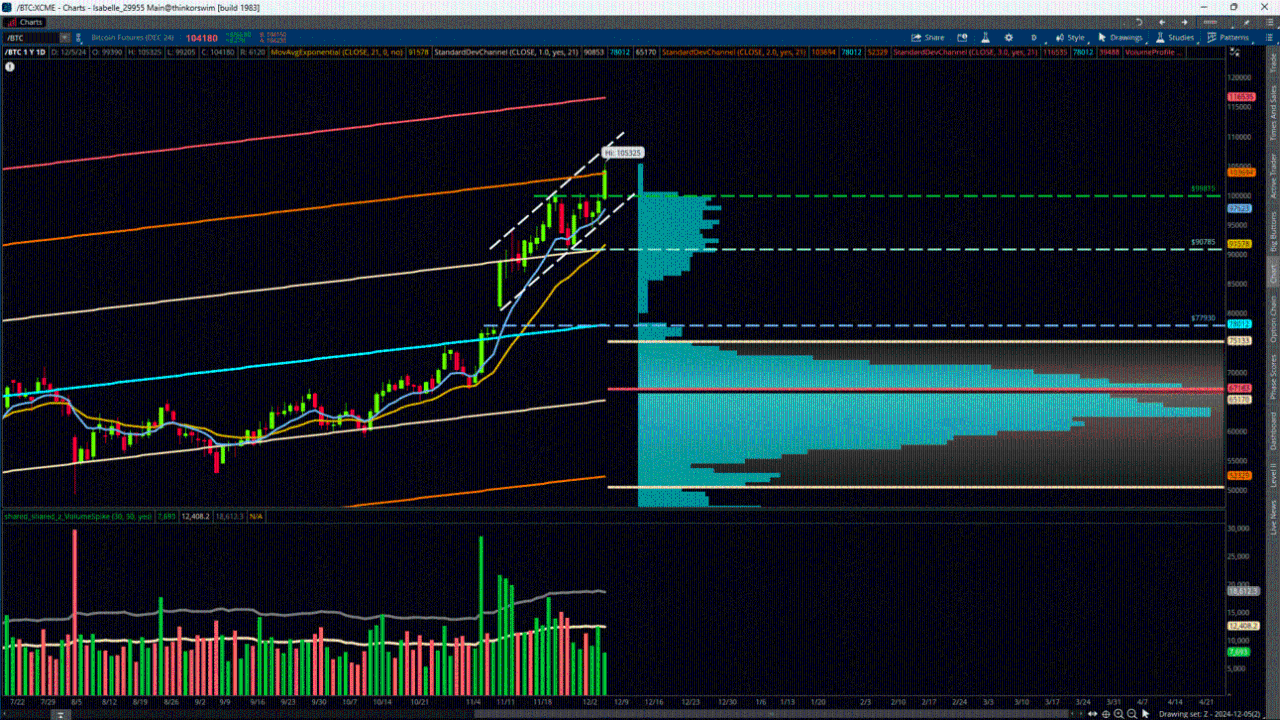

Examining the /BTC futures contract, the very short-term price action looks like it has formed a bull pennant pattern. While traders are edging beyond that downward sloping trendline that marks resistance they are still short of the highs of 105,325. But the bulls look to be driving the situation so far today, with price making new highs, the Relative Strength Index (RSI) making new relative highs and pushing into the overbought area, and the Moving Average Convergence Divergence (MACD) making a bullish crossover as well.

Bitcoin spot and the /BTC futures both have surged to the upside since Bitcoin broke 100K without looking back so far. Traders may consider that a break above a notable resistance level can result in an initial surge to the upside, then a pullback and retest of that same level, so there may be some important downside support points to remember. For the /BTC futures, the 100K level is worth noting, but many traders also likely will be keeping an eye on the previous high close of 99,815. Beyond that, traders may be watching a shorter-term trendline beginning with the lows that were formed after the Nov. 11 gap up near 80,670, which could project potential support near 96K. Resistance is the tricky part now. Price is currently above a notable resistance point in the yearly +2 Standard Deviation Channel, which comes in near 103,694. Beyond that, the +3 Channel is near 116,535.

Featured clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.