Market Minute: Bitcoin’s Rally Nears Resistance

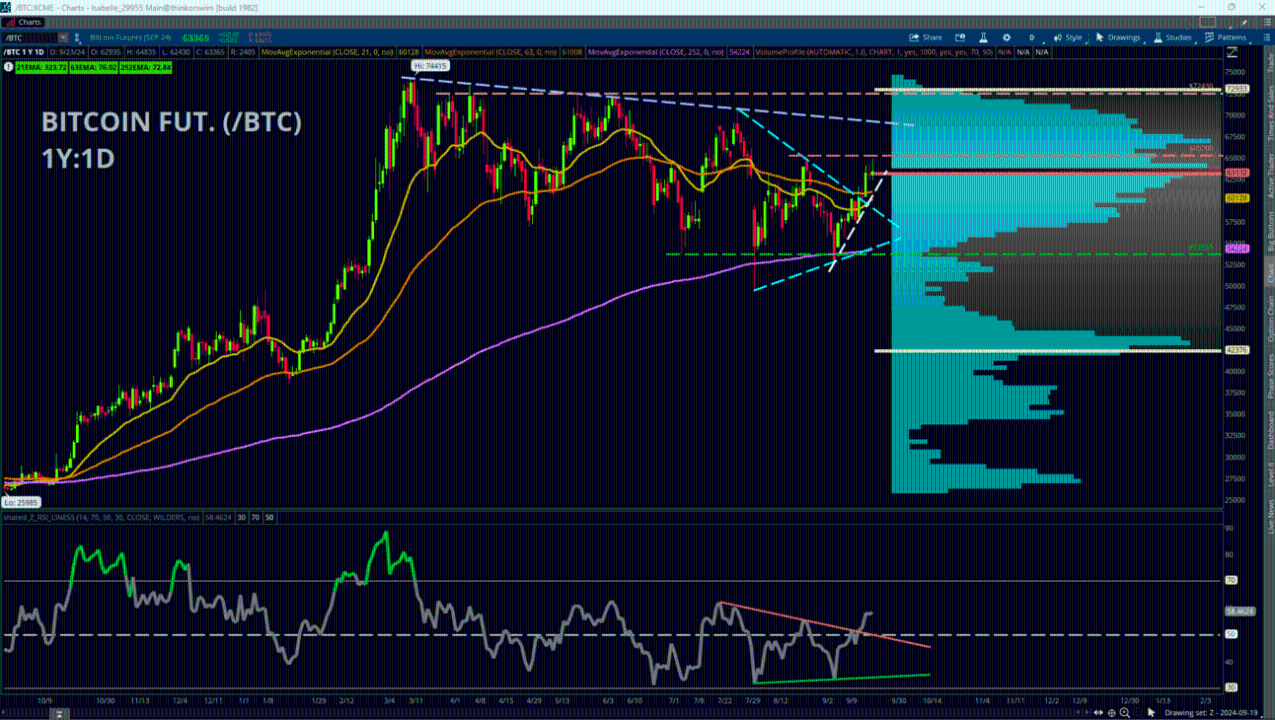

Bitcoin futures (/BTC) have been on the move to the upside in recent weeks, rising more than 19% from the recent lows of 52,820 on Sept. 6 to Friday’s close of 62,940. The rally has driven price upward to surpass several key technical points, but the cryptocurrency is still short of its previous highs on 65,200 on Aug. 26.

Looking more closely at the recent price action, traders may note that /BTC has crossed above several major moving averages during its rally, including the 21-day and 63-day Exponential Moving Averages, both of which are now trending upward which is a sign of potential trend change. Price also took out some of the most important Simple Moving Averages as well, namely the 20-day, 50-day, and 200-day.

There are other developments to note as well. In addition to establishing a new, shorter-term uptrend, price also broke above a downward trendline that began with the highs from July 29. The Relative Strength Index also shows a matching upside breach of a downward trendline, which helps provide further credence to this upside move. Additionally, the RSI also broke above the 50-midline that separates bullish and bearish momentum, which is a further bullish sign.

However, price is now getting close to a bigger test, as premarket trading currently sits very close to the yearly Volume Profile Point of Control, which is the area of heaviest trading during the past year and comes in around 63,132. This is a potentially important resistance area to watch, and the previously mentioned highs of 62,500 on Aug. 26 present the next significant price hurdle. Beyond that, traders could consider a shallow-sloped downward trendline beginning with the all-time highs to present the next source of resistance, which would presently come in around 69,200. To the downside, watch for support at the previously discussed moving averages, most notably the 50-day SMA due to being the closest to current price and comes in at 61,260.

Featured clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.