Market Minute: CrowdStrike Earnings – What Outage?!

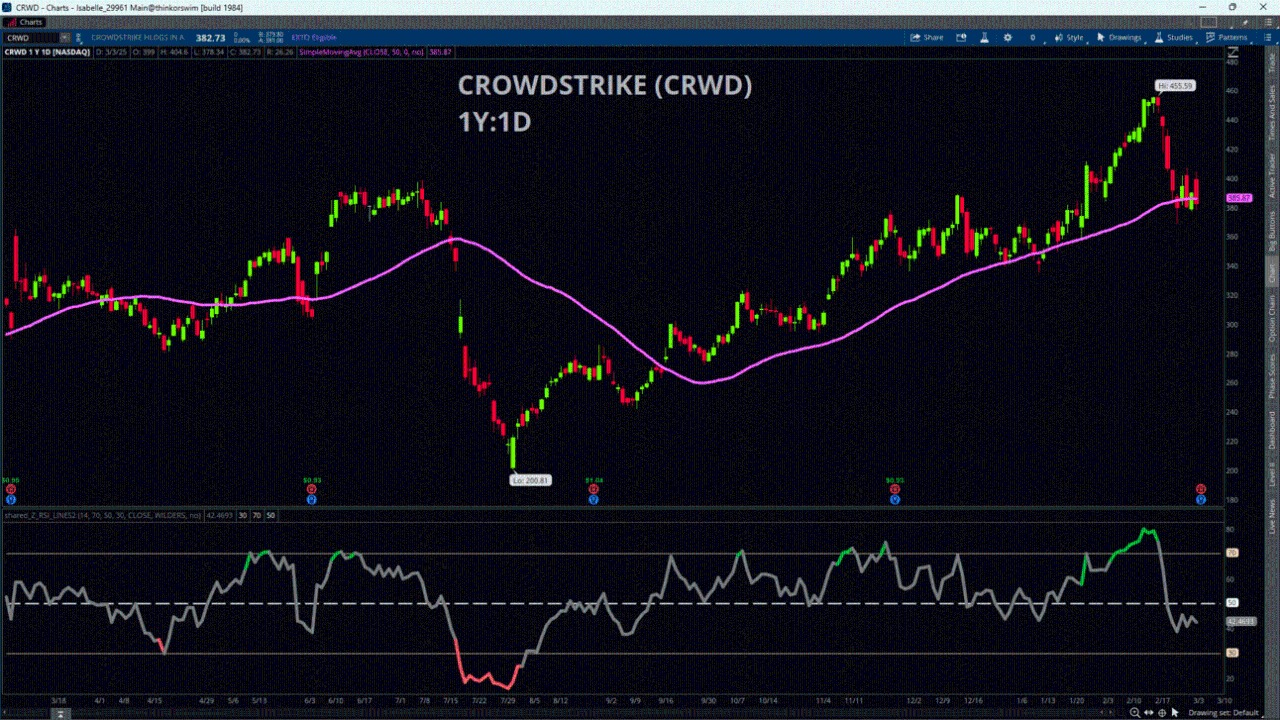

Cybersecurity company CrowdStrike (CRWD) reports earnings after the close today. This quarter, analysts are expecting CrowdStrike’s revenue to grow 22% year on year to $1.03 billion, slowing from the 32.6% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.86 per share. Last quarter, the company beat on EPS and revenue, but the stock fell on softer full-year 2025 guidance. The stock recovered quickly and rose to all-time highs of $455 in mid-February. Remember last summer that the stock fell sharply after the company pushed out an update to their software that caused a massive outage, but the stock has recovered above those levels.

The company operates it’s A.I.-powered Falcon platform that helps organizations protect their digital property. Crucially, CrowdStrike sells its products in modular form, allowing organizations to buy whatever add-ons best fit their needs. "CrowdStrike surpassed $4 billion in ending annual recurring revenue (ARR) in the quarter – the fastest and only pure play cybersecurity software company to reach this reported milestone – as our single platform approach and trailblazing innovation continue to resonate at-scale," said George Kurtz, Founder and CEO, after last quarter.

The shares have pulled back 16% from those all-time highs over the last three weeks as markets have come under pressure. The stock settled just below its 50-day Simple Moving average on Monday, which has been an area of support over the last six months. The relative strength index (RSI) was overbought at the 80 level last month but has fallen to the low 40’s, so not quite to the oversold area of a 30 RSI. The Option market is pricing in a +/- 8% move ($30) post earnings as of yesterday’s close. The Current IV Percentile level is 72% so Implied Volatility has risen to nearly the top 25% of volatility levels over the last 52 weeks into the report. The question for investors may be guidance moving forward and the impact the overall market weakness is having on companies, especially in the tech sector.

Featured clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.