Market Minute: Crude Oil Plummets After Israel's Retaliatory Strikes on Iran

Late Friday, Israel launched retaliatory strikes on Iran, a move long anticipated by geopolitical analysts. However, the strikes, which targeted military assets such as missile defense systems and ballistic missile manufacturing facilities, avoided oil infrastructure and logistics sites. This omission has provided relief to energy traders, who initially feared potential supply disruptions that could have sent oil prices soaring.

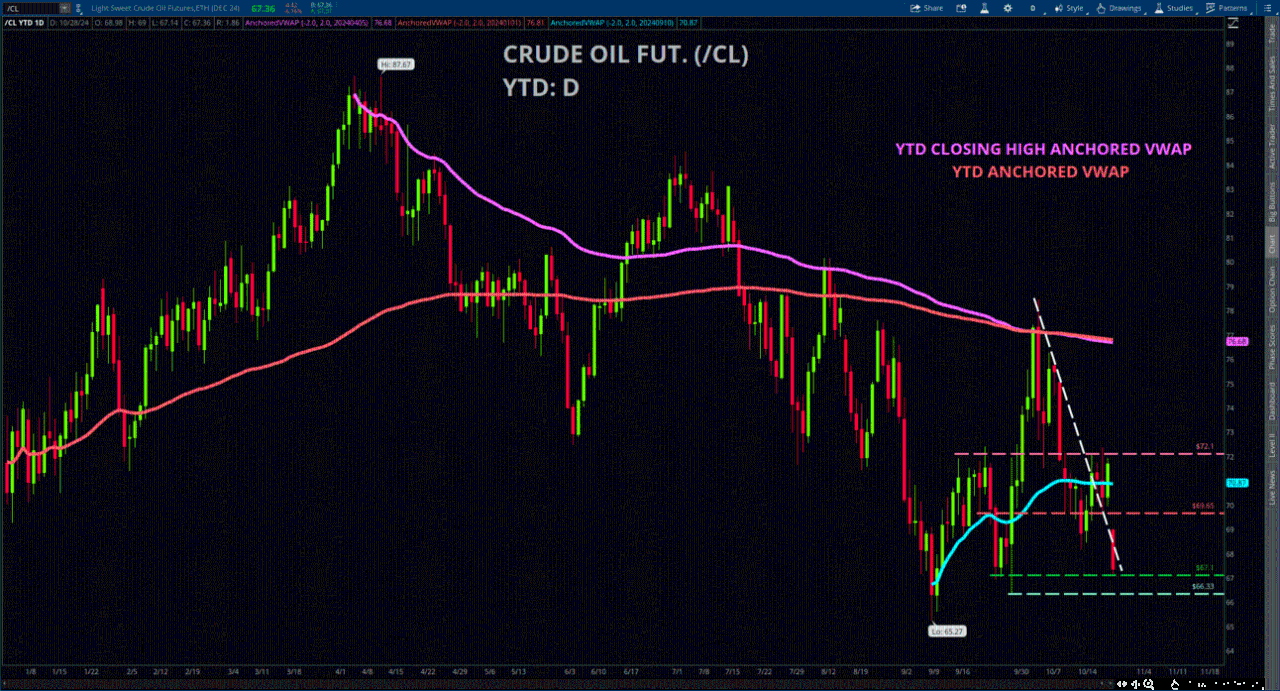

The geopolitical risk premium—a factor often driving sudden oil price increases—appears to have been largely priced out of the market for now. This is evidenced by a $4.00 drop in Brent Crude, the global benchmark for oil prices. With this risk premium diminished, downward pressure on oil prices has been driven by several additional factors: economic concerns stemming from China, potential production increases by OPEC+ set for December, and strong petroleum output in the United States.

Without a clear catalyst for significant economic growth, and with supply-side pressures mounting, the technical outlook for oil prices remains bearish. Analysts suggest that Brent may continue its downward trajectory, with a near-term support range identified between $65.75 and $66.50 per barrel.

In corporate earnings reports, several energy companies have already confirmed the anticipated squeeze on profit margins. The upcoming earnings and guidance reports from Chevron (CVX) and ExxonMobil (XOM) will provide a clearer gauge of whether this margin compression has been fully accounted for in stock valuations.

Featured clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.