Market Minute: Equity Investors Remain Cautiously Optimistic

Investors are cautious of the uncertainty around the upcoming election, as well as core inflation data which remains elevated. Ambiguity behind the level of interest rates near the end of the year and moving into 2025, as well as 10-year Treasury rates topping above 4.1% in recent days marking a sharp increase from as low as 3.6% in late-September, has confounded long duration bond investors. As rates move lower, bond portfolio managers expect prices to rise as long-term yields fall following the path of the Fed navigating interest rates lower. This has not been the case since the Fed initiated the first policy cut last month.

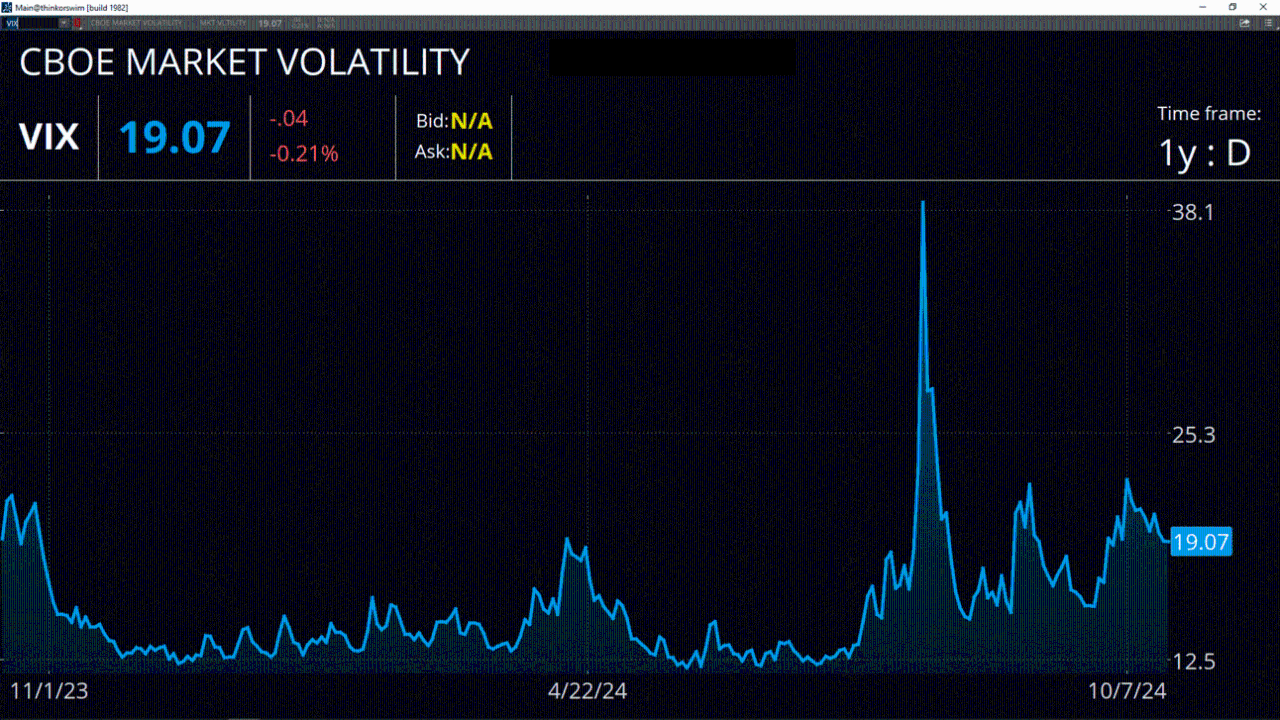

The S&P 500 keeps pushing into new all-time highs, while at the same time, the volatility index (VIX) is still around 20. This is highly unusual considering the VIX tends to trade in the mid-teens with the broad market trending near highs. This phenomenon suggests institutional investors may be hedging both long and short equity positions for election volatility. Even as the bull market climbs a wall of worry, evidence in favor of an end-of-year rally is getting higher by the day.

A narrow group of tech hardware stocks are on the move, along with software and banks which have benefited from higher lending rates. A drop in orders at chip equipment manufacturer ASML (ASML) hit the wider sector on Tuesday due to weaker end demand on products like smartphones, gaming consoles, and electric vehicles. Fast forward a couple of days, the global dominant chip manufacturer Taiwan Semiconductor (TSM) declared weakness is not A.I. related and most end markets remain firm. Enterprise software and semiconductor infrastructure names such as ServiceNow (NOW) and Broadcom (AVGO) are trading near all-time highs, which suggest enterprise capital investment remains strong.

With the stock market up and job creation strong, imminent recession worries seem a bit hasty. If there is a warning sign for our economy, it can be found in persistently high core inflation. The most recent University of Michigan survey shows consumer inflation expectations are rising, which is one variable that suggests moderating U.S. economic activity may be the central theme going into 2025.

Featured clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.