Market Minute: Lose-Lose Response to Inflation Data Probably Back

This week began with some reversal in last week’s equity market action with a two-day bounce in the S&P 500, but not much else has changed. Bonds are still looking strong – I was surprised how meager the Treasury rally was on Friday following weak jobs data – as yields come down even further. Crude oil is extending its downtrend. Coins are bouncing around without a ton of direction, and the dollar is holding in. That part may get interesting if the dollar rises further, which would imply a gentle move from the Federal Reserve: 25bps, not 50

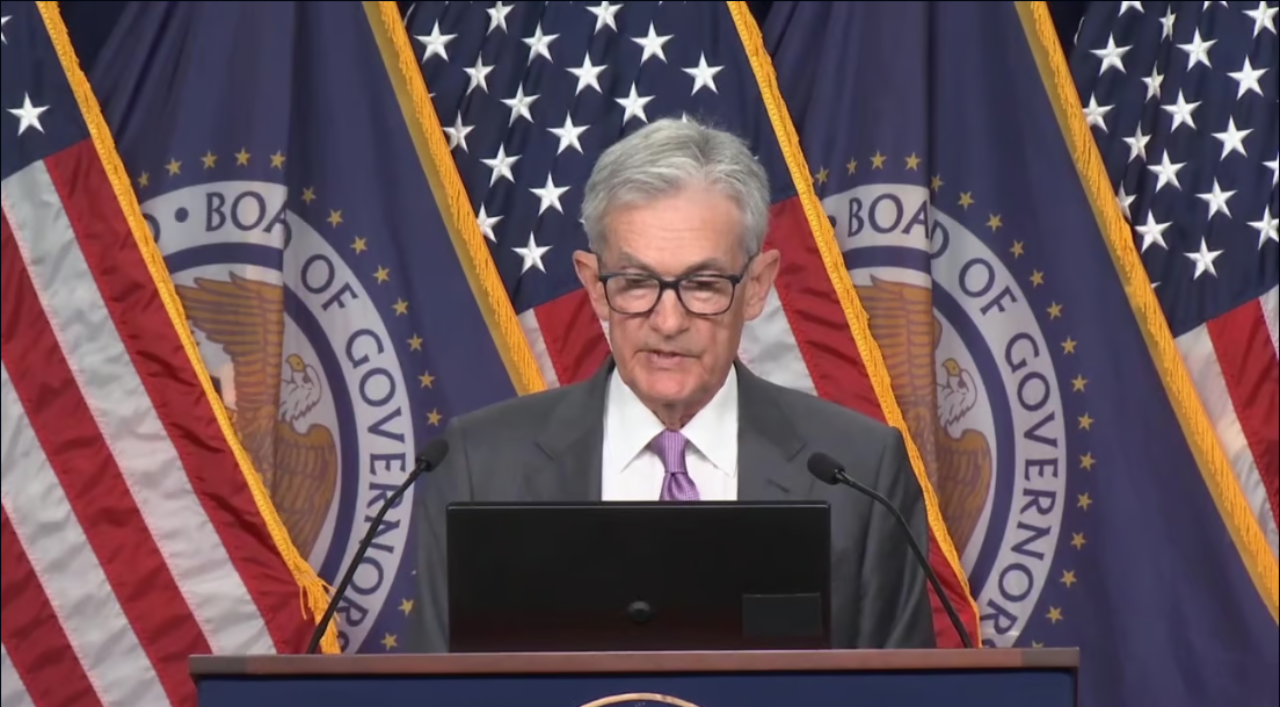

For now, the option of a 50bps-cut by Powell & Co does still seem live. Recent language from the Fed Chair and Treasury Secretary Janet Yellen shared tones of “Mission Accomplished,” and the data have indeed been weak. Powell specifically said he does not welcome further weakness. That’s why labor data, including weekly jobless claims, have as much potential to move the market as inflation data like today’s CPI.

Consensus for today’s print is for more of the same, with a tick down on the annual basis to 2.6%. It’s tempting to say a lower number would be good for stocks, but recent trading relationships suggest otherwise. Cooling inflation actually hasn’t been good for the market since July, when CPI came in shockingly light and the whole market rotated out of tech. That was the tick high for the Nasdaq, and as yields have fallen with inflation, the S&P has too.

So, I’m sorry to say it – it’s been a good 16 months – but it seems like we’re back to a lose-lose scenario when it comes to inflation. Disinflation has been one of the main catalysts for the bull market since October 2022, but now it seems we’re at the turning point when surprisingly light numbers make the market worried about deflation and recession. And too high a number in the context of deteriorating labor data gets the stagflation narrative spinning again.

That said, the tradeoff looks much more asymmetric than it was a few years back when the market was being driven by inflation (2022). The trend in disinflation has been strong, and the Fed is obviously ready to cut, so the risk of meaningful reflation would likely be much more fleeting this time around – especially when you factor in the drop in crude oil. A hot print could be good for some bond selling or a stock pullback in the short term, but more important at this juncture will be each employment update.

Featured clips

"Perfect Storm" Caused by Capital Requirement Increase for Big Banks

Next Gen Investing

► Play video

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.