Market Minute: Market Braces for Apple Earnings After Turbulent Week for Tech

Apple (AAPL) reports earnings after today’s close, joining other major companies like Visa (V), KLA (KLAC), Intel (INTC), and Atlassian (TEAM) in presenting quarterly results. The megacap giant seems to have largely sidestepped the rout in technology stocks earlier this week as the upstart artificial intelligence app DeepSeek took the sector by storm, with Apple up more than +7% this week as of yesterday’s close while the SPDR Technology Sector ETF (XLK) is down -3.1% during the same period.

Consensus estimates for AAPL point to EPS of $2.36 for this quarter vs. $2.18 last year, and to revenue of about $124.0B vs. $119.6B last year. For specific business segments, iPhone revenue is projected at $69.189B with net sales for Products and for Services coming in at $97.64B and $26.17B, respectively. (All estimates from Zacks.)

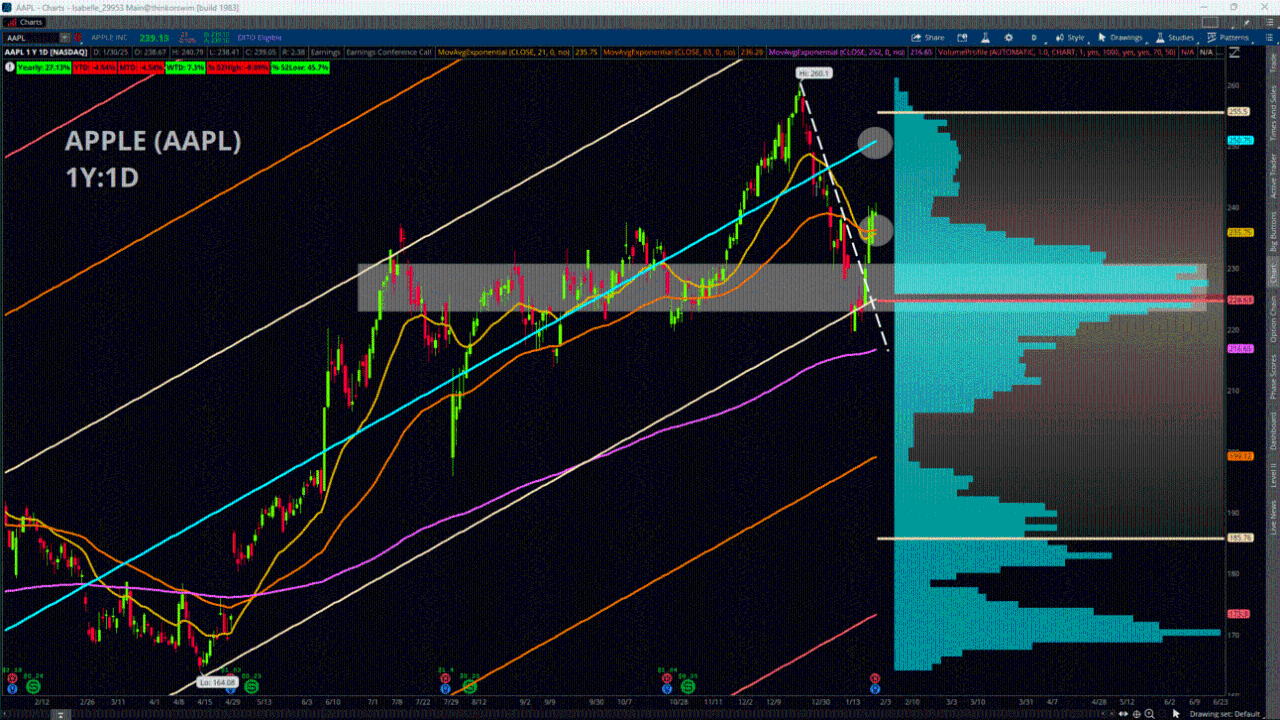

From a technical perspective, Apple’s push to the upside this week broke above a downward-sloping trendline beginning with the all-time highs of 260.10, as well as its 21-day and 63-day Exponential Moving Averages, which lie clustered together around 235 and present a potential support confluence to consider. Another notable area of possible support is near 225, as this represents the yearly -1 Standard Deviation Channel and the yearly Volume Profile Point of Control. To the upside, the area near 250 represents the yearly Linear Regression Line as well as another volume node area – one that is both much smaller and less well-defined than the Point of Control, but still enough to note.

Examining the options market, Friday’s Jan. 31 expiration series reveals a notable outlier in terms of open interest with more than 25,400 contracts at the 240 Calls while the largest amount on the Put side is the 220 strike at 20,960. In the broader picture, the Feb. 21 250 strike (39,981) and the May 16 255 strike (39,027) are the most notable overall open interest levels on the Call side; meanwhile, the Puts with the highest overall open interest are the Jun. 20 200 contract (32,433) and the Mar. 21 210 contract (30,185).

Featured clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.