Market Minute: NVDA Slumps Despite Earnings Beat

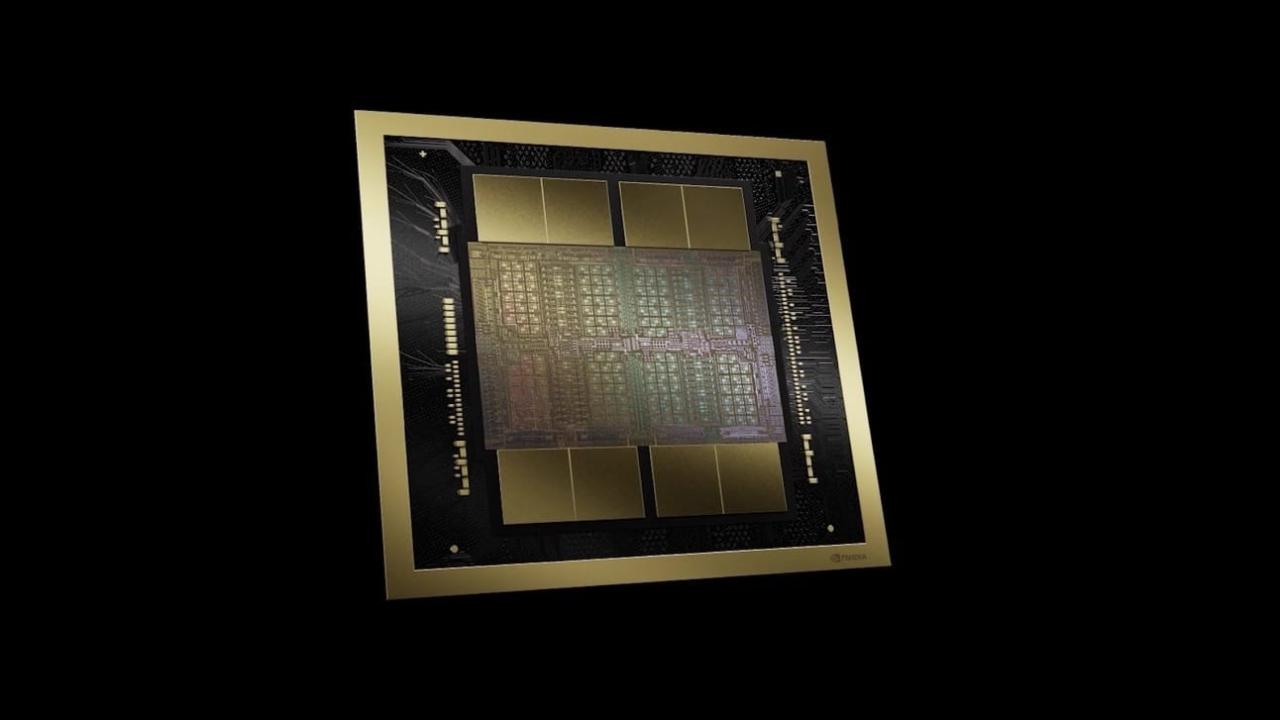

Nvidia (NVDA) shares were up a modest 2% in early trading after the tech behemoth reported earnings in yesterday’s postmarket, despite the much-lauded Magnificent 7 member beating on both the top and bottom line. But now the computer chip and graphics card manufacturer’s sluggish initial reaction has turned into a decline after the market opened. This move may be a disappointment for traders, who have had to contend with months of relatively rangebound trading that marks a notable departure from the dizzying gains traders saw during the past two years. In terms of the numbers, Nvidia’s earnings per share of $0.89 and revenue of $39.3 billion topped estimates, while Nvidia’s Blackwell A.I. graphics processing units (GPU) accounted for $11 billion of quarterly revenue.

The technical picture is little changed for this stock as we approach the end of the trading week, with a downward-sloping trendline that began with the 52-week highs of 153.13 and connecting subsequent peaks from January and mid-February still intact. Price recently made an attempt to break above the confluence of its 21-day and 63-day Exponential Moving Averages near 132-133. Technical traders also may have their eye on the 130 level as potential support, as it represents old highs from mid-August as well as a low point several times since the autumn months. To the upside, the recent highs near 142 seem worth watching as they line up with the low point that price hit before its severe gap down from the DeepSeek A.I. news on Jan. 27.

The options market for Nvidia’s Feb. 28 weekly expiration shows heavy outlier open interest on the call side near the 140, 145, and 150 strikes with most of the activity between 105 and 165. On the put side, the strikes of 140, 105, and 120 show the highest numbers with the open interest activity more widely dispersed over a larger range, so these could all be noteworthy options to follow.

Featured clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.