Market Minute: Nvidia Faces $5.5 Billion Charge

Nvidia (NVDA) disclosed in an SEC filing after market close yesterday that it may incur a charge of up to $5.5 billion in the current quarter due to the introduction of new U.S. export requirements. The company was notified on April 9 that it must now obtain a license to sell its China-focused H20 AI chips, part of a broader U.S. strategy to restrict China’s access to advanced semiconductor technology.

This move represents another escalation in the ongoing trade and technology conflict between the United States and China. The new rules apply indefinitely, further tightening the clampdown on AI-related hardware sales to Chinese companies. This could significantly impact major Chinese tech firms such as Alibaba (BABA) which are reported to have made substantial purchases of Nvidia’s H20 chips.

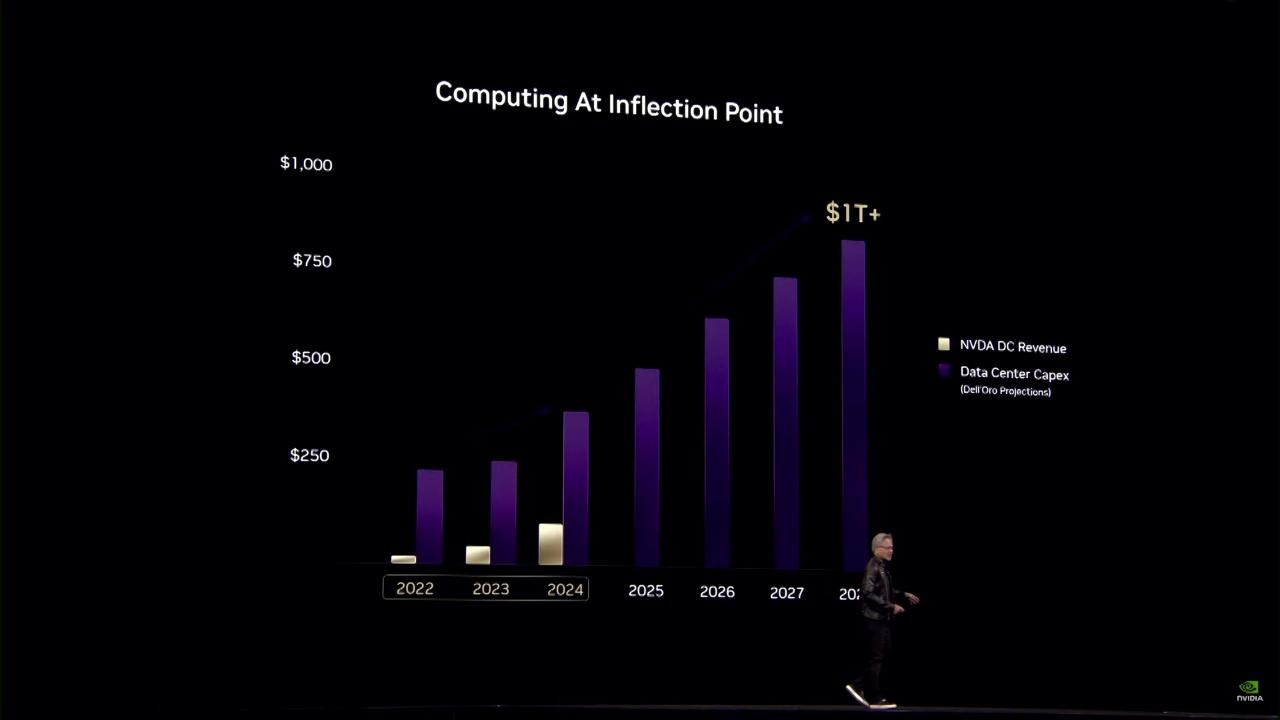

The H20 chip line has generated approximately $18 billion in orders since the start of 2025, underlining its importance to Nvidia’s current product lineup. Despite that figure, China still accounts for roughly 15% of Nvidia’s total revenue, meaning the financial impact, while material, may be manageable in the long-term relative to the company’s broader global business.

Adding to the controversy, Reuters reported that Nvidia did not inform some of its largest Chinese customers in advance of the new licensing requirements, potentially straining client relationships.

Nvidia is not alone in facing fallout from the policy change—AMD’s (AMD) MI308 AI chip is also affected by the new export licensing rules. This signals a broader impact across the U.S. semiconductor industry, especially for firms with exposure to China in their AI and data center product lines.

While Nvidia’s $5.5 billion potential charge reflects the immediate financial cost of shifting export policy, the longer-term implication is a deepening decoupling between the U.S. and China in high-tech sectors. AI chip war is not only about technology, but also about global influence – and Nvidia finds itself squarely at the center of it.

Featured Clips