Market Minute: Nvidia (NVDA), Taiwan, and Export Controls

Nvidia (NVDA) reports earnings after the bell today – don’t miss Schwab Network’s extended coverage! Let’s prepare for the biggest report on the Street.

Zacks expects Nvidia to report 1Q26 EPS of $0.85 (+40% year-over-year) and revenue of $42.7 billion (+64% year-over-year). Data center revenue makes up most of its income: last quarter it reported $35.6 billion in that segment alone. Its second-biggest source of revenue, gaming, made up $2.5 billion.

China is its second-biggest source of revenue, and its share of the pie has been growing, doubling from $2.5 billion a year ago to $5.5 billion last quarter. U.S. revenue is more than triple Chinese revenue – $19.4 billion last quarter alone.

Taiwan sales were about equal to China sales last quarter. Taiwan is where the vast majority of advanced chip manufacturing actually takes place: Taiwan Semiconductor (TSMC) processes over 90% of the world’s most advanced chips.

Taiwan is in a delicate place geopolitically and geographically. China claims it as part of its territory, but Taiwan is self-governed and considers itself distinct. The takeaway for now is that there is a background threat of invasion, but more importantly, Taiwan does a lot of business with China. The Diplomat reported that in 2023, Taiwan exported $90.4 billion in chips to China, or about 54% of its total semiconductor exports (semiconductors made up almost 40% of all exports that year).

While Taiwan is complying with U.S. export restrictions, the New York Times reported last year that “it’s an open secret” private vendors are bypassing those restrictions to sell advanced chips directly to China. The U.S. blames part of DeepSeek’s success on ‘improperly obtained’ chips.

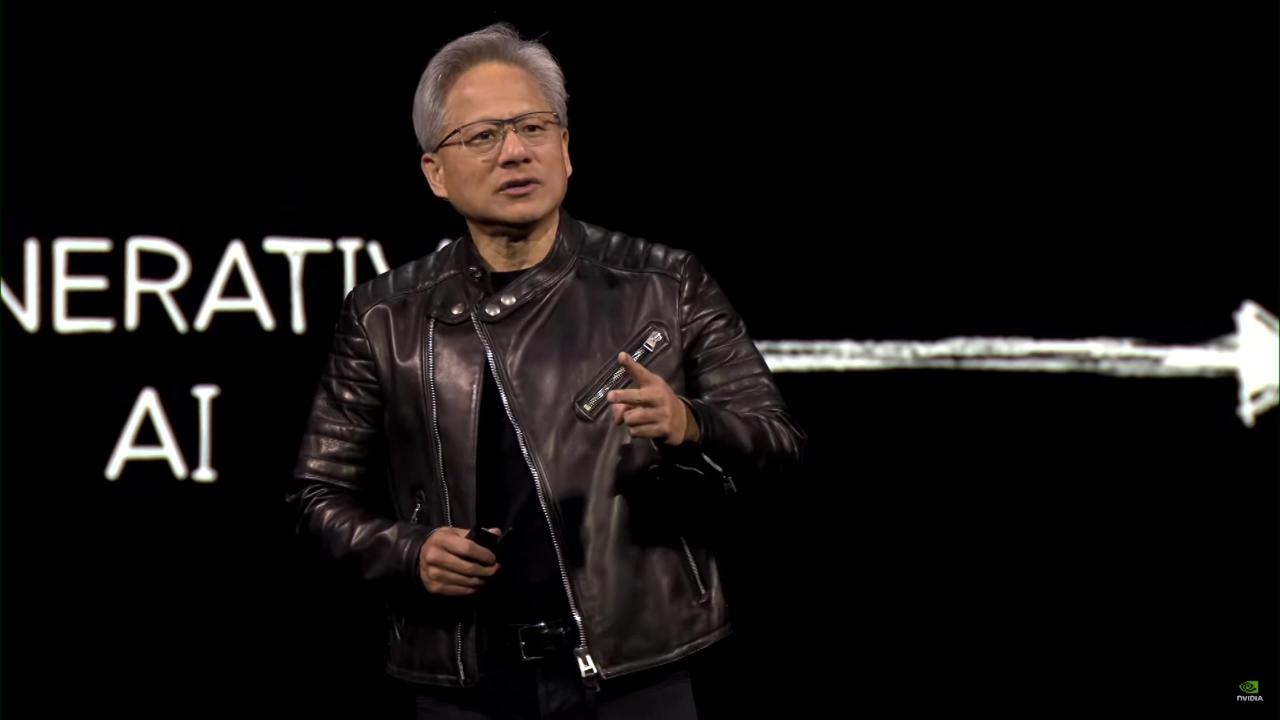

Nvidia’s CEO, Jensen Huang, argued earlier this month that export controls have been a “failure” that are hurting American companies. Huang said Nvidia’s GPU market share in China fell to 50% to(from) 95% over the last four years – the growing revenue from China in its quarterly reports reflects the enormous appetite for semiconductors even as NVDA loses share.

NVDA is clearly upset about missing out on the whole pie: on April 15, it announced a $5.5 billion charge it blamed on U.S. restrictions against selling its H20 graphics in China. Other arguments against the export controls include that it juices Chinese domestic innovation and competition, making the U.S.’s national security argument fragile.

Huang has some weight to throw around as NVDA remains the most valuable company in the world – and has an opportunity with the U.S. and China in trade negotiations. However, it can’t expect to regain all that market share. Look at dropping Tesla (TSLA) sales in China in favor of domestic companies like BYD. China is buying Made in China and recognizes the same national security risk around computing power that the U.S. does.

Regardless, if export controls were removed, it could mean a hefty chunk of revenue for Nvidia immediately. Investors will be watching for any comments around trade relations in the report or the conference call following. They will also be waiting for any forecasts on demand. The options market is currently pricing in around an +/- $8 move, or about 6%. Shares are currently up less than 1% year-to-date, though still up 30.5% since this time last year, meaning there could be room to run – or room to disappoint.

Featured Clips

Nano Nuclear Energy (NNE) President on Reactors "Coming to Life," A.I. Tailwinds

TRADING 360

► Play video