Market Minute: Nvidia’s (NVDA) Earnings Triumph

Nvidia (NVDA) is higher before the bell after its 3Q25 earnings beat. It nearly doubled revenue year-over-year as demand for its cutting-edge chips remains strong. Dan Ives called it a “press release that should be framed and hung in the Louvre.” Many analysts raised their price target on NVDA this morning, many holding Overweight or Outperform ratings on shares.

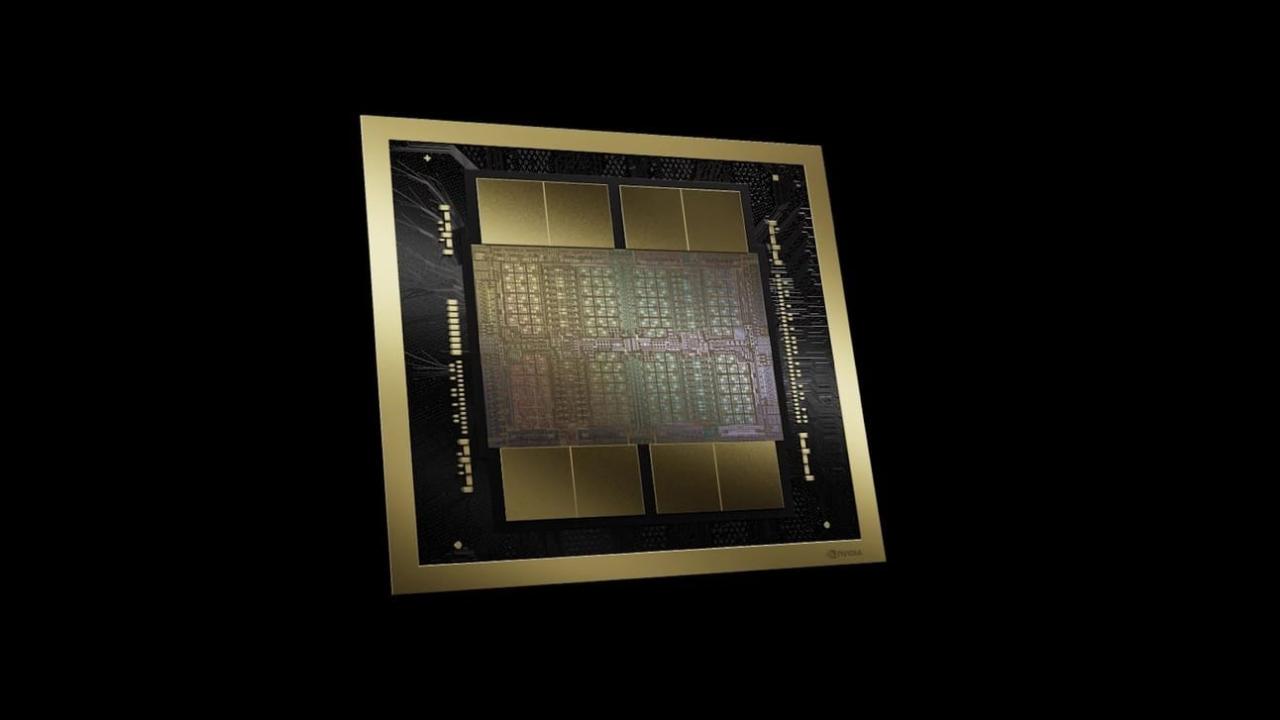

Clearly, Nvidia is a heavyweight A.I. leader, with new generations of chips planned each year – and it can’t keep up with demand even at max production capacity. Its CFO said the demand for its Blackwell chips are “staggering.” Despite some reports of overheating, Nvidia says they’ve fixed the issue. If NVDA continues to struggle with meeting demand, it could be an opportunity for competitors to step in – but they’ve got to have the hardware first.

This morning on Futures, Ali Mogharabi said we’re still “in the early innings” of Nvidia’s boom, pointing to client stickiness for Nvidia: despite the wait, once companies are in its ecosystem, it’s costly and hard to switch over to another provider.

Companies have been in technological arms races since the beginning, and it’s only intensified in the Internet Age. Stronger performance, even by a slim margin, can make a huge difference to a company’s success, and much of that is on the shoulders of the chips and hardware. It remains to be seen if Intel (INTC) or AMD (AMD) can catch up and grab any market share, or if Nvidia can ramp production and keep the gold mine to themselves.

Featured clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.