Market Minute: Previewing Nvidia (NVDA) Earnings

It’s the event the Street’s been waiting for all week – Nvidia (NVDA) reports 4Q earnings after the bell. Zacks expects it to report EPS of $0.84 (+62% year-over-year) and revenue of $37.72 billion (+71% year-over-year). Great growth numbers – but starting to slow a little bit from the triple-digits we saw at the initial A.I. boom.

And, of course, there’s DeepSeek – a Chinese LLM A.I. model able to compete with OpenAI using less chips, slower chips, and less energy is a potential threat to Nvidia’s boom times. Remember that the day DeepSeek was announced, NVDA lost around $600 billion in market value. Despite that fall, the stock is still up 60% over the last year, though looking year-to-date it’s down -5%. The options market is implying a move of around $12 up or down after the report.

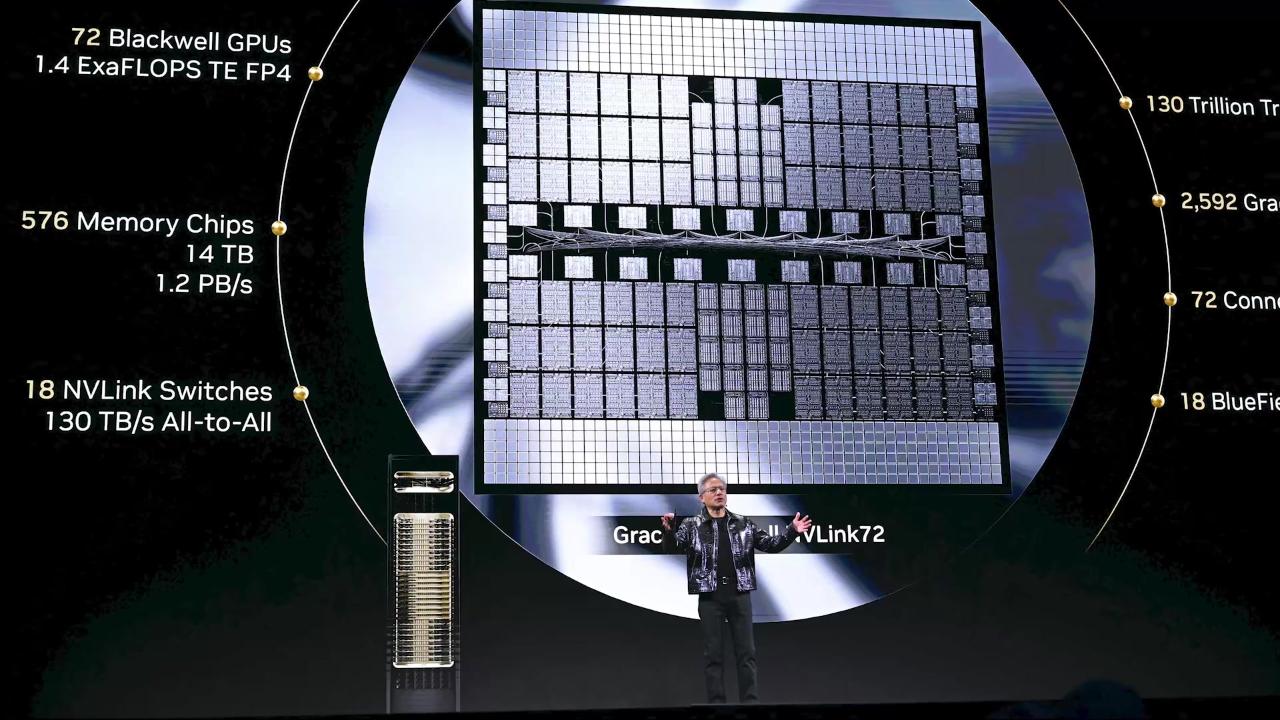

Part of the bull case for NVDA is that they’re the only competitive source of the cutting-edge A.I. chips that everyone wants, giving them years-long waitlists and the incentive to spend to expand their manufacturing capabilities. While some of that demand will almost certainly remain, any plans to scale may be trimmed or deferred. Also, Bloomberg reports that Trump’s admin could tighten export restrictions on the company.

Investors should watch closely for any language around demand forecasts and growth. If NVDA disappoints, the whole A.I. ecosystem could be punished, like the tallest tree in the forest taking dozens down with it when it topples. However, analysts are remaining positive on the stock, with Wedbush’s Dan Ives writing recently that “we expect another strong performance…that should ease investor concerns,” adding that, “About 70% of customers we have spoken with have increased their A.I. budgets.”

Tune into Schwab Network’s extended coverage of NVDA earnings this afternoon!

Featured clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.