Market Minute: Reddit Plunges Despite Earnings Beat

Reddit (RDDT) fell as much as -19.7% during extended hours, with traders downvoting shares in spite of the social media company beating estimates for both earnings and revenue in yesterday afternoon’s quarterly report. Earnings per share came in at $0.36 vs. expectations of $0.25 (+44% surprise) while revenue was $427.71 million vs. estimates of $409.04 million (+4.5% surprise). Ad Revenue increased to $394.5 million (+60%) since the same time last year, but even though Daily Active Unique Users rose to 101.7 million (+39%) it missed the consensus expectations of 103.1 million. (Figures from Zacks and Barron’s.)

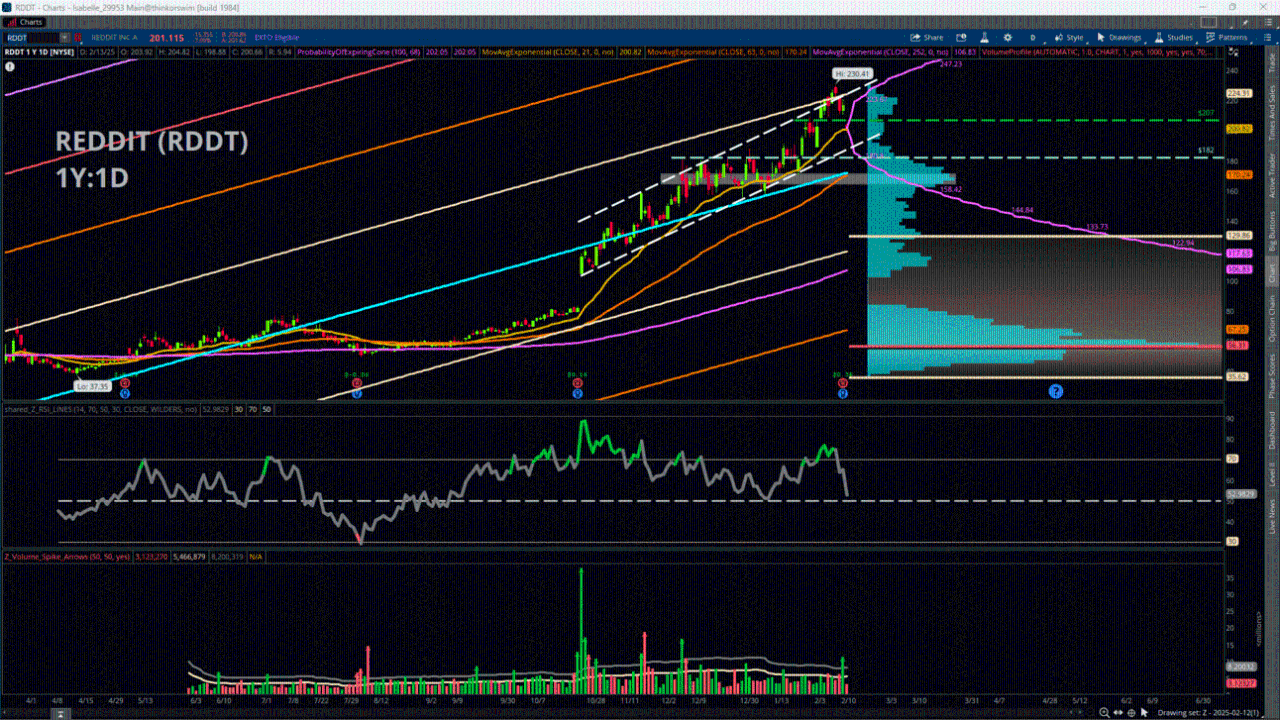

From a technical perspective, Reddit shares look much improved off the overnight lows of 173.73 and are poised to open around their 21-day Exponential Moving Average, which is near 201. However, price remains above a key area, which is the series of highs that were established around 182 during the past quarter. There’s also another notable potential support confluence just below, with the yearly Linear Regression Line and the 63-day Exponential Moving Average lining up with a sizeable volume node near about 170. Additionally, price at this point looks like it will open within the boundaries of a longer-term upward channel that began with lows established after last quarter’s post-earnings gap up near 104.

For this Friday’s Feb. 14 options expiration, open interest on Reddit is higher on the put side with 47.4K total contracts and heightened activity at the 200 (6.5K) and 150 (5.4K) strikes. The call side comes in at about 37K total contracts with the highest O.I. at the 305 strike (3.7K), but the 250 (3.2K) and 230 (2.3K) strikes are also noteworthy.

Featured clips

Future of A.I. Chips on Employment, QCOM Undervalued, 'Don't Bet Against' INTC

Market On Close

► Play video

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.