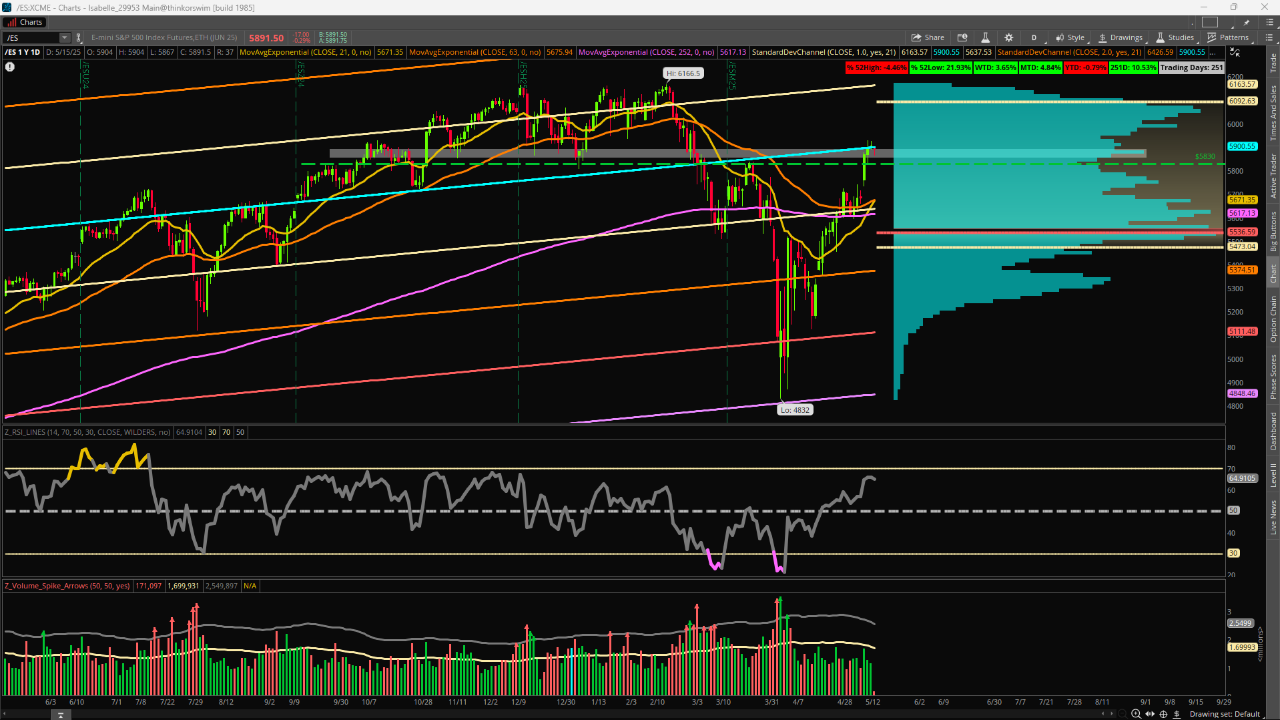

Market Minute: S&P Futures Holding Key Support Near 5,830

S&P 500 futures (/ES) are modestly down in early trading as the market seems to be taking a breather after a mixed session yesterday. Stocks have seen a sharp rally since the tariff news-related turbulence in early April sent major indices plummeting to new yearly lows. The /ES is now up about 22% after bottoming out at 4,832, and so far is hanging on above a key supportive area near 5,830 that represents a significant low from January and the recent relative highs from late March.

From a technical perspective, the /ES has paused near its yearly Linear Regression Line, which is the line of best fit based on closing prices and is often used as one way to assess the “fair value” for a product. This indicator lines up right at the 5,900 level and corresponds with a volume node on the yearly Volume Profile study. This confluence provides traders with another noteworthy potentially supportive point to watch.

To the upside, Volume Profile shows a spike near 5,990 and generally heavy trading activity between 6,050 to 6,070. This lines up with a period of sideways price action during late 2024 to early 2025 and will be an important area for the bulls to overcome if price is to test the all-time highs of 6,166.50. There’s another source of resistance that lines up with these highs as well, which is the +1 yearly Standard Deviation Channel. This is +1 standard deviation above the Linear Regression Line (“fair value”) and is another possible resistance measure to consider.

Featured Clips

NVDA & AMD Price Target Raises, SMCI Soaring Shows A.I. Retaking Leadership

MORNING TRADE LIVE

► Play video