Market Minute: Stocks Pushing Upward in Premarket After Fed’s Rate Cut

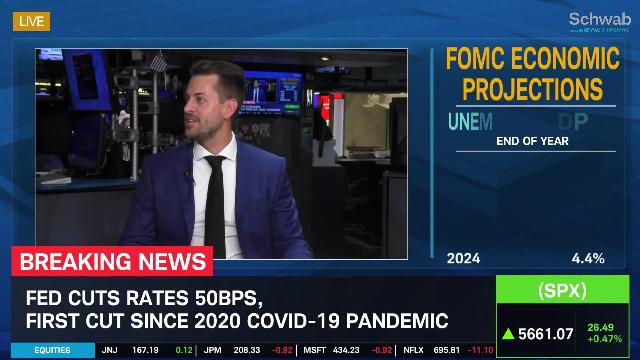

The Federal Reserve yesterday cut interest rates by 0.5%, a bigger-than-anticipated reduction that threw stocks into a tizzy after a choppy week of trading. Major equity indices, such as the S&P 500 (SPX), struggled to find a direction after this more aggressive move by the Fed, which was the first and biggest cut since the grim days of the early COVID-19 pandemic during March 2020. The SPX first made new all-time highs before eventually solidifying into a modest red day and finished down -0.28% as of yesterday’s close. However, equity index futures are ripping to the upside this morning, so traders could be in for an interesting session today.

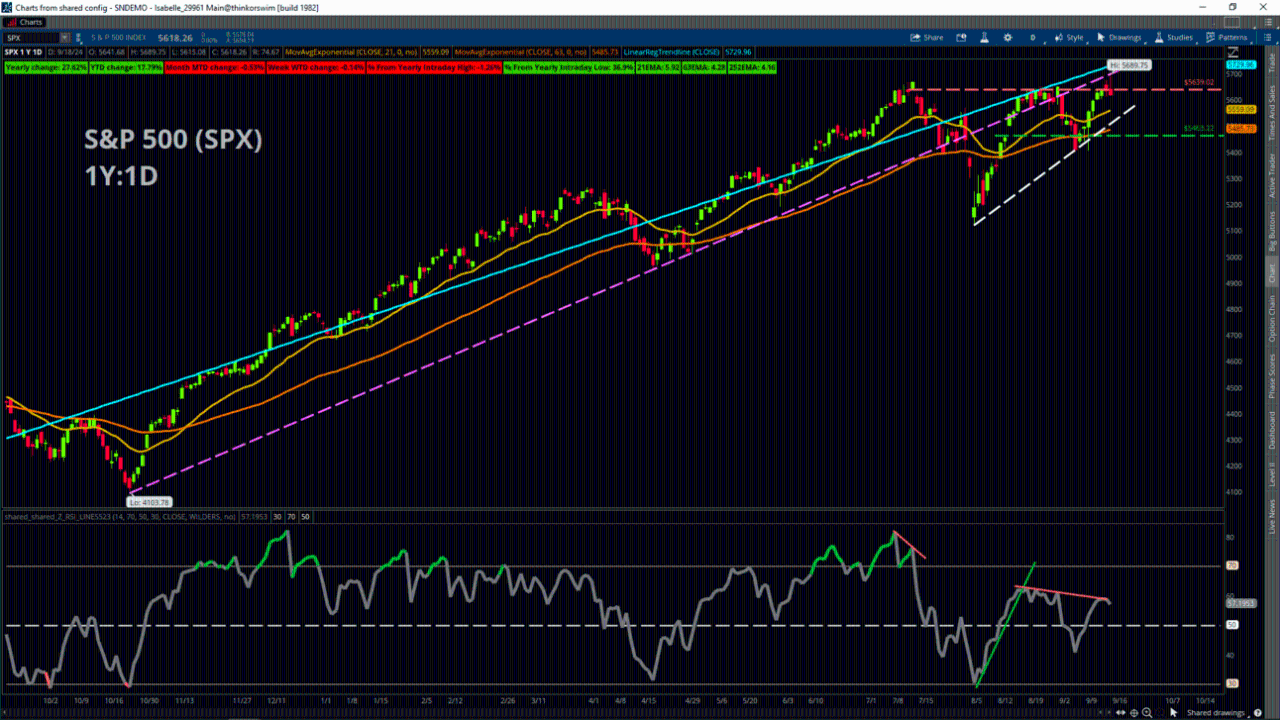

Despite making new all-time highs on an intraday basis, the SPX has made lower closing prices since its previous all-time highs in mid-July – though that situation seems likely to change given the strength of the associated futures contract in early trading. Price remains above most major moving averages, and a shorter-term upward trendline beginning with the Aug. 5 lows and connecting the subsequent lows from early September is still in play.

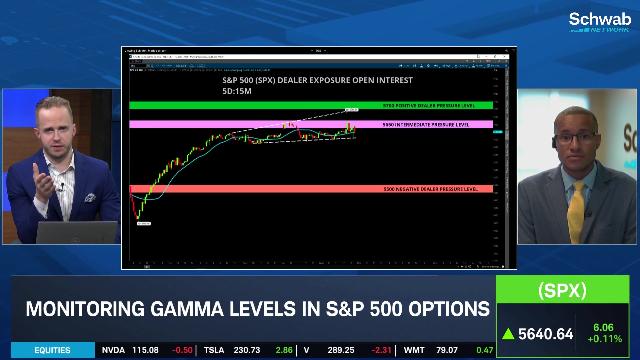

If price continues to rise, traders could potentially look for upside resistance on the SPX at the site of the yearly Linear Regression Line. This is a line of best fit based on closing prices and represents an idea of “fair value” for traders, and comes in near 5,730 under the current conditions in the premarket. For support, if futures do hold true to the upside and the SPX gaps up, look to the previous set of closing highs roughly around 5,640. Beyond that, consider the 21-day Exponential Moving Average at roughly 5,559 in the premarket.

Featured clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.