Market Minute: Tariff Impact on Energy Markets

In the past, I lived in Arizona, a beautiful state with great weather. However, Arizona experiences a phenomenon known as a "Haboob"—massive dust storms that appear on the horizon like a towering wall of dust, flooding homes and covering everything in fine sand. Spectators often marvel at the sight, taking pictures as the storm approaches. Yet, no matter how awe-inspiring it may seem from a distance, you know it will eventually hit. While these storms rarely cause significant damage, they are an unavoidable nuisance.

The current energy market feels much the same due to the ongoing tariff battle. Energy traders see a storm forming on the horizon, but for now, they are simply observing the fallout from tariffs in other markets, waiting for the inevitable impact.

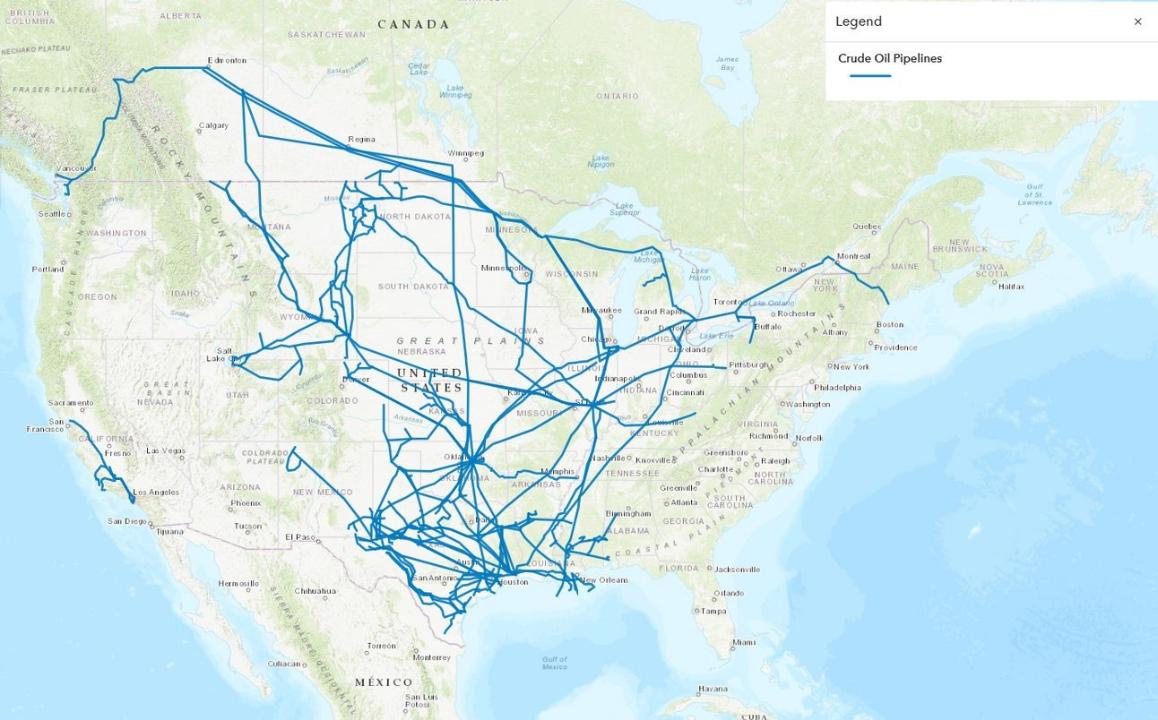

Over the weekend, the Trump administration announced a 25% tariff on imports from Mexico and Canada, with one key exception—Canadian energy products, which will be taxed at a lower rate of 10%. Canada exports approximately 4.5 million barrels of oil per day to the United States, playing a critical role in supplying refiners in the Midwest. These refiners focus not only on gasoline but also on diesel, fuel oil, and other heavier petroleum byproducts.

Although the United States is currently the world's largest oil producer, the majority of its production consists of light sweet crude, which is well-suited for gasoline refining but less ideal for producing heavier products like diesel. Any disruption in the flow of heavy or sour crude from Canada would have an immediate impact on diesel prices. Additionally, many Midwest refiners are not equipped to efficiently process lighter crude without significant investments in additional additives and chemicals, which would drive up costs.

Over the weekend, speculation arose that Venezuela could help offset a potential loss of heavy crude from Canada. However, there are several obstacles to this idea. Venezuela has not invested in its export infrastructure for over a decade, and while it might be able to supply an additional 250,000 to 500,000 barrels per day to the United States, that crude would likely go to Gulf Coast refiners, which currently have little spare capacity. This would result in a surplus of crude in the Gulf while leaving the Midwest still with a shortage.

For now, Canadian energy products are exempt from the steepest tariffs, but if Canada decided to leverage its "nuclear" option in the trade war—reducing or threatening to throttle heavy crude exports to the U.S.—the impact on consumers would be immediate and severe. However, such a move would also hurt the Canadian economy, making it a high-stakes decision. From an energy perspective, this trade war has placed both nations in a state of Mutually Assured Disruption—where any aggressive action would have serious consequences for both sides.

Featured clips

Feinseth: 'You Have to Hold' AAPL, Poised as 'Significant Leader in A.I.'

Morning Trade Live

► Play video

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.