Market Minute: Tariffs Add a Risk to The Global Economy

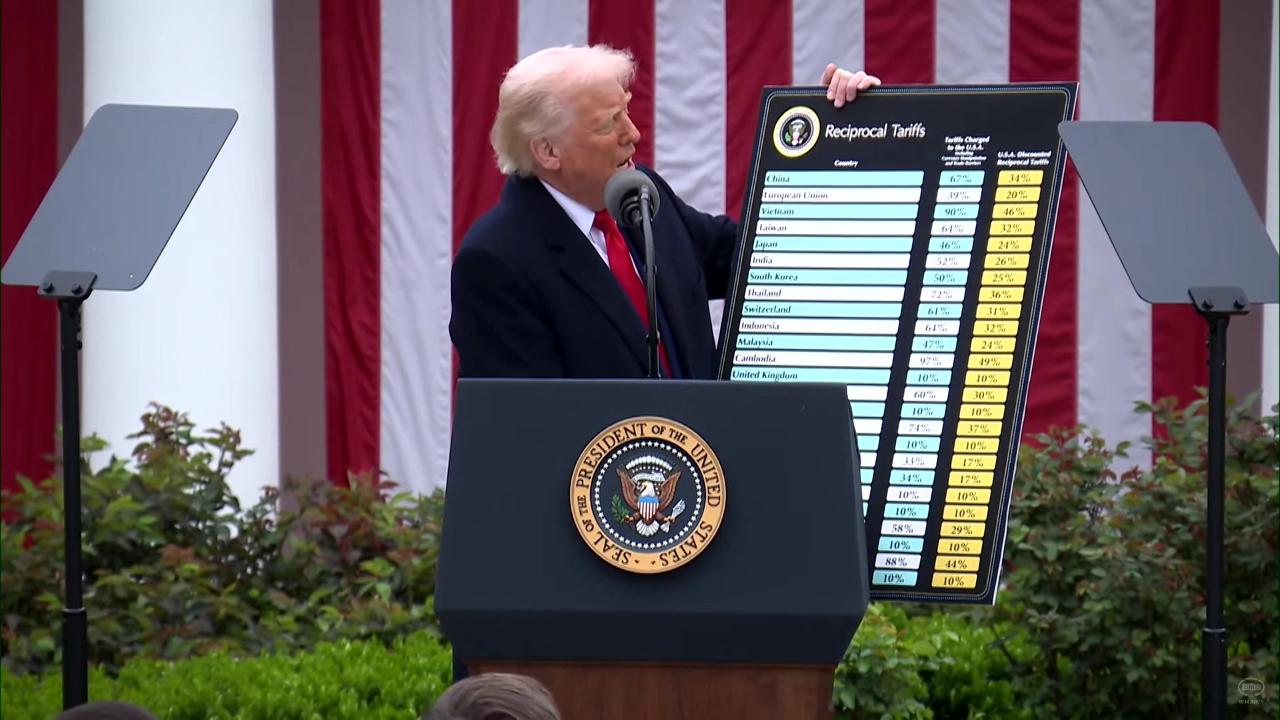

U.S. equity futures indicate another lower open as demand for the safety of U.S. Treasuries rises. China has indicated retaliatory countermeasures against the Trump administration’s recent round of new punitive tariff announcements. The market’s violent reaction underscores growing anxiety over the economic consequences of a controlled trade agenda that may backfire by raising consumer prices, disrupting supply chains, and continue to provoke retaliatory measures from trading partners.

Measures taken to bring manufacturing jobs back to the U.S. and reduce the trade deficit misunderstands modern trade dynamics. Around half of U.S. imports are intermediate goods used in American-made products. Making these inputs more expensive, tariffs hurt U.S. manufacturers’ competitiveness, potentially leading to job losses rather than gains. The U.S. economy is developed and is dominated by the services sector, which represents over 70% of GDP. Destabilizing the integrated nature of global supply chains and the complexity of commercial relationships is certainly enough to alter corporate profit expectations lower at a time when the economy has weakened.

International trade is not a zero-sum game. The gains from trade benefit both parties involved and serves to increase the wealth of nations. Tariffs function as obscure taxes, increasing costs for businesses that rely on imported materials. These added expenses are typically passed on to consumers in the form of higher prices, exacerbating already enduring inflation. If economic growth slows simultaneously in a stagflationary scenario, the Federal Reserve could find itself trapped between rising prices and weakening demand, limiting its ability to cut interest rates.

Featured Clips

Bear Market & Recession Probability, Investors Eye International Stocks

MORNING TRADE LIVE

► Play video

Demmert: 'Use This Dip as a Buying Opportunity,' AAPL & NVDA Options Trades

MORNING TRADE LIVE

► Play video

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.