Market Minute: Tesla Charges Up as Trump Vows to End 'EV Mandate'

Elon Musk is in an interesting position as the second presidential administration of Donald Trump dawns. The CEO of electric vehicle maker Tesla (TSLA) and the world’s richest person made headlines during the campaign season as he threw his support behind Trump and even spoke at the inauguration ceremony last night – even as Trump himself yesterday issued an executive order that declared an “energy emergency” and vowed to end what he refers to as the “electric vehicle mandate.” Among other things, the order revoked a previous 2021 executive order that sought to require automakers to sell more electric vehicles, halted distribution of unspent government funds to build vehicle charging stations, and said the administration would consider ending electric vehicle tax credits.

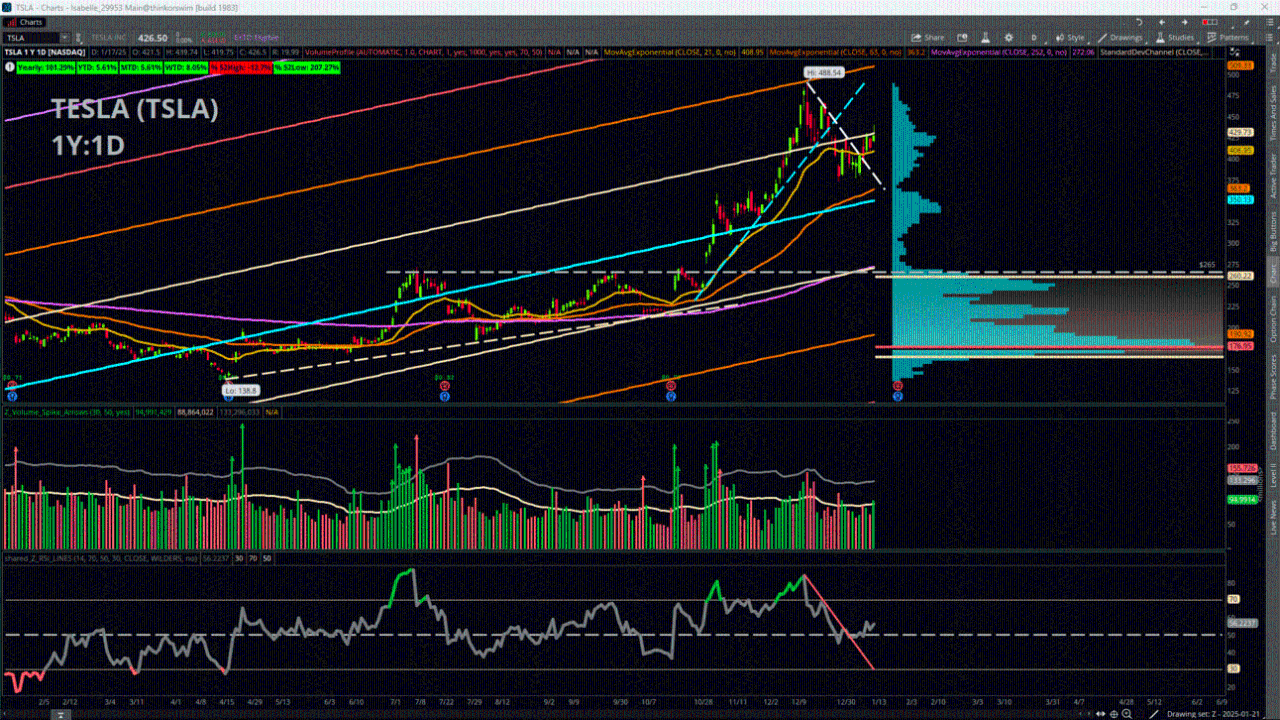

Regardless, TSLA shares are up in premarket trading. The stock price has pulled back about -13% from the all-time highs of 488.54 on Dec. 18, but held the previous lows near 377 and rallied during the past week to close just below the yearly +1 Standard Deviation Channel near 430 on Friday. The price action broke through a shorter-term downward sloping trendline that began with those all-time highs and also held on above the 21-day Exponential Moving Average, now sitting in the thick of the most notable volume node until all the way back down to near 345. Momentum is also improving along with price, as the Relative Strength Index (RSI) broke its own short-term downward trendline and is holding on above the 50 midline.

If price keeps moving to the upside, the old highs are the obvious spot to beat if traders can clear that +1 SDC mentioned previously. But just beyond that, the yearly +2 Standard Deviation Channel is currently near about 509, so this could be another area to watch. To the downside, the first foothold for bulls could be found near the 21-day EMA near about 409, then the 50-day Simple Moving Average sits a bit lower near 381.

Featured clips

Grant Cardone: LA Fires 'Devastating' for Insurance, Tying Crypto to Real Estate

Market On Close

► Play video

Tuchman: 'Reactive' Market Hinges Too Much on Fed, Now Buying Back What it Sold

Trading 360

► Play video

AAPL Bull's 'Stronger for Longer' iPhone Cycle Bet, TikTok Ban Looms

Morning Trade Live

► Play videoCharles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.