Market Minute: This Week Is All About Recovery

Last week, the market experienced some de-risking as economic data—particularly sentiment data—came in relatively weak. Additionally, commentary from the White House continued to create uncertainty regarding tariff policy and geopolitical posture. However, this week is all about recovering from the technical damage. For the bullish camp, economic data should be in their favor as we begin to receive more hard data rather than sentiment-based metrics. Over the past several months, hard data has generally supported positive price advances at the index level. This week, the market will also focus on labor market conditions.

Starting on Wednesday, job market data will begin to roll in with the ADP Nonfarm Employment Change report. Market consensus currently anticipates 114,000 jobs added in February, down from 183,000 in January. On Thursday, Initial Jobless Claims, a key high-frequency data point, will take center stage, with expectations of 230,000 claims for the previous week. Estimates have started to tick higher following last week's unexpected 242,000 print and the anticipated fallout from DOGE job cuts, which could immediately impact private contractors who rely on government contracts.

Friday’s Jobs Report will be another focal point for the market. Nonfarm Payrolls are expected to show 156,000 jobs added in February, a modest increase from 143,000 in January, with most job gains coming from the private sector. Additionally, Average Hourly Earnings, a key inflation gauge, is projected to rise 0.3% month-over-month—still elevated compared to historical trends but a notable decline from the 0.5% m/m increase reported in January.

While a relief bounce is underway, sustained upward momentum will depend on market participation and confirmation through volume. Investors will be closely watching whether labor market resilience supports continued economic growth or signals potential headwinds in the coming months.

Featured clips

DeepSeek ‘Shot a Hole in the Heart of U.S. Exceptionalism’; Exodus to International Equities

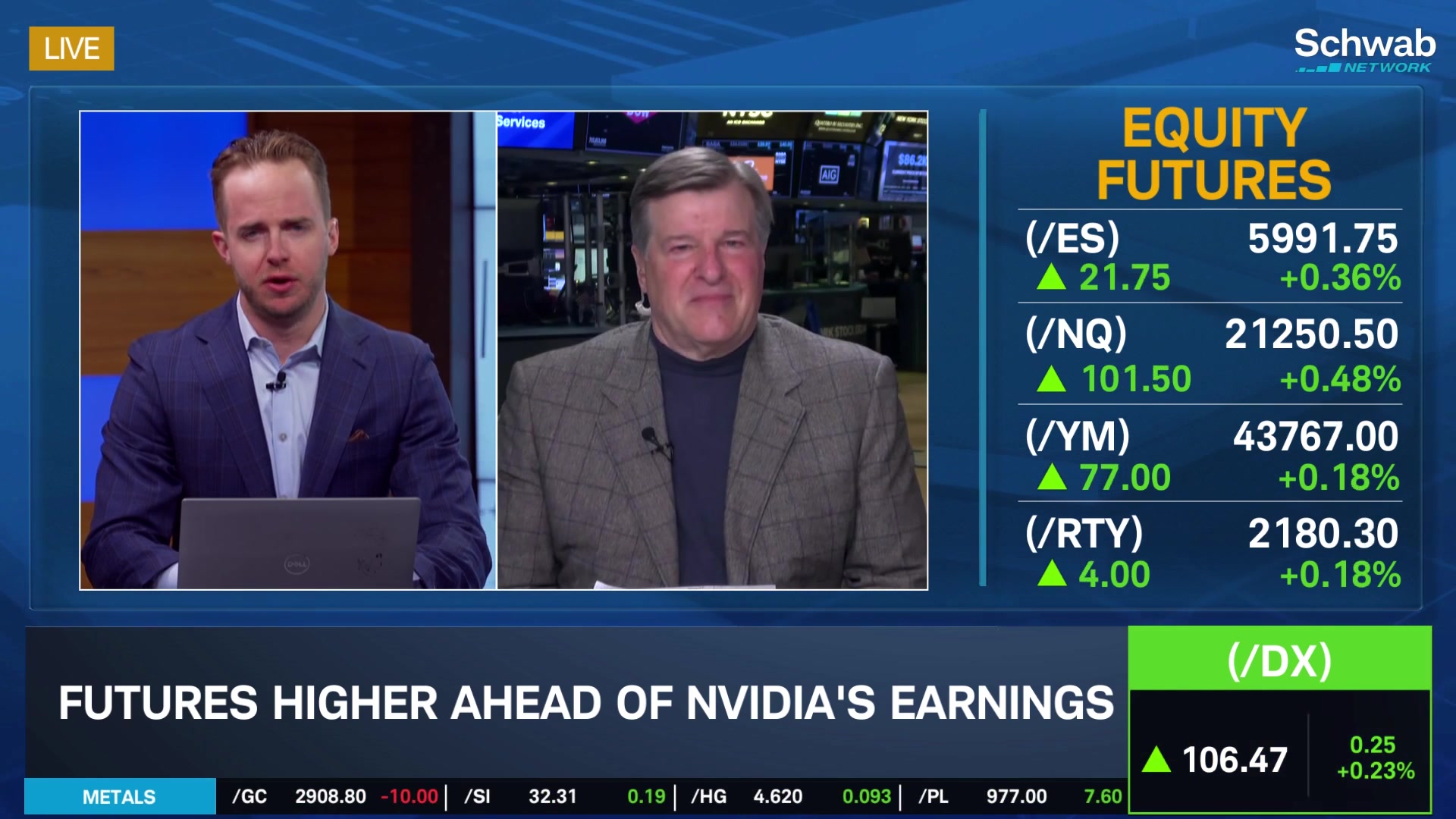

Morning Trade Live

► Play videoCharles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.