Markets Hit Records Tuesday, Fresh Highs Ahead?

PUBLISHED | 2 min read

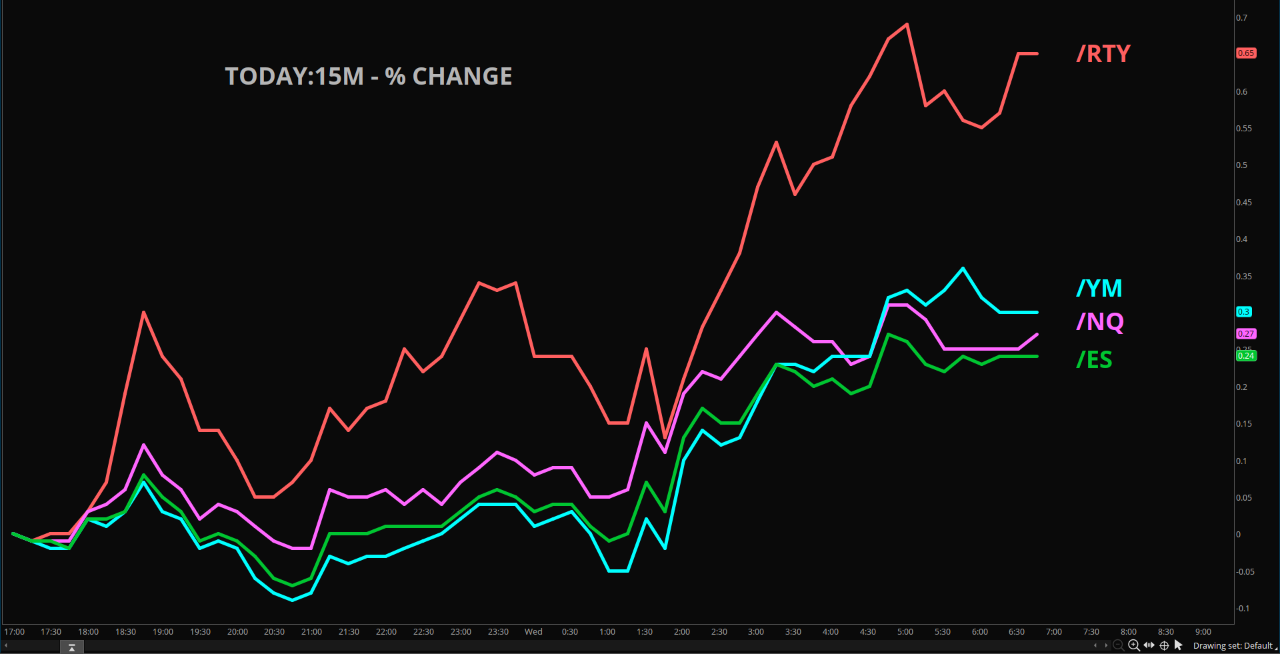

U.S. stock futures are slightly higher in premarket trading after the S&P 500 (SPX) and Nasdaq-100 (NDX) settled at fresh record highs on Tuesday. Stocks rallied as headline inflation data was tamer than expected, soothing investor fears that tariffs are not spiking prices.

The Year-over-Year CPI came in at 2.7%, below expectations of a 2.8% gain but Core prices were up 3.1% versus expectations of 3.0%. Traders are now pricing in a 96% chance of a rate cut at the Federal Reserve’s September meeting, per the CME’s FedWatch Tool.

Snapshot (as of 7 AM ET)

- Oil (/CL) – Oil prices are down 0.6% near $62.80 a barrel after the IEA noted supply overtaking demand this year, while investors awaited Friday’s meeting between U.S. President Donald Trump and Russian President Vladimir Putin. The International Energy Agency on Wednesday raised its forecast for oil supply growth this year following OPEC+’s decision but lowered its demand forecast due to lackluster demand across the major economies.

- Gold (/GC) – Gold Futures are up 0.4% near $3415 as expectations of a U.S. Federal Reserve interest rate cut in September gained traction following mild inflation data, while a weaker dollar bolstered bullion’s demand.

- Bitcoin (/BTC) – The Crypto Future is up 0.8% near 121,000 in the premarket.

- VIX – The CBOE Volatility Index was down 9.3% on Tuesday and settled at 14.73 as stocks rallied. It was the lowest closing price for the VIX since December 26th of 2024.

- U.S. Dollar (/DX) – The dollar is down 0.4% to 97.6.

Biggest Premarket Movers (Mark % Change as of 7 AM ET)

- Albemarle (ALB): +3.42%

- Palo Alto Networks (PANW): +1.64%

- Advanced Micro Devices (AMD): +1.46%

- Target (TGT): -1.67%

- Brown & Brown (BRO): -0.65%

- Intel (INTC): -0.64%

Economic Data

- 7:00AM ET: MBA Mortgage Applications

- 8:00AM ET: Fed’s Barkin Speaks

- 10:30AM ET: Oil Inventories

- 1:00PM ET: Fed’s Goolsbee Speaks

- 1:30PM ET: Fed’s Bostic Speaks

Notable Earnings

- Premarket: EAT, CAE, PFGC, TCEHY, VG

- Postmarket: CSCO, COHR, RRGB

- Premarket Tomorrow: AAP, AMCR, AIT, BIRK, DE, JD, NTES, SPTN, TPR, VIPS, WB

- Postmarket Tomorrow: AMAT, NU, QUBT, SNDK

Upgrades/Downgrades

- Deutsche Bank upgrades Palo Alto Network (PANW) to Buy from Hold

- BNP Paribas Exane upgrades Novo Nordisk (NVO) to Neutral from Underperform

- BofA upgrades Lumentum (LITE) to Neutral from Underperform

- Edgewater Research downgrades Target (TGT) to Underperform from Neutral

- Jefferies downgrades On Holding (ONON) to Underperform from Hold

- Oppenheimer downgrades C3.AI (AI) to Perform from Outperform