Physical Squeeze in Silver — Will It Last?

It seems that only a handful of times each year silver captures the full attention of traders and investors — and this time, the metal is experiencing a historic surge. Silver is up nearly 95% year-to-date, fueled earlier this year by tariff concerns that prompted the physical movement of monetary metals like gold across borders to avoid tariff risk. At the same time, global central banks aggressively ramped up precious-metal purchases to strengthen their balance sheets.

Now, silver is rallying on a broader set of catalysts. For newer traders entering the metals space, caution is warranted. Silver is a higher beta commodity, meaning significantly more volatility, than other metals like gold.

To understand the current move, it’s important to remember silver’s dual identity. Silver is first an industrial metal and then a precious metal. From solar panels to circuit boards, it appears in some capacity in nearly every consumer and industrial electronics device. That means physical demand for industrial use is critical.

As a precious metal, silver has historically been viewed as “second best” to gold due to its similar properties but greater abundance and lower price. Yet the structural backdrop is shifting. Silver is currently in a supply deficit, with industrial demand outpacing mining and processing capacity. This tightening has been years in the making, but recent price action suggests the deficit is beginning to matter more to traders.

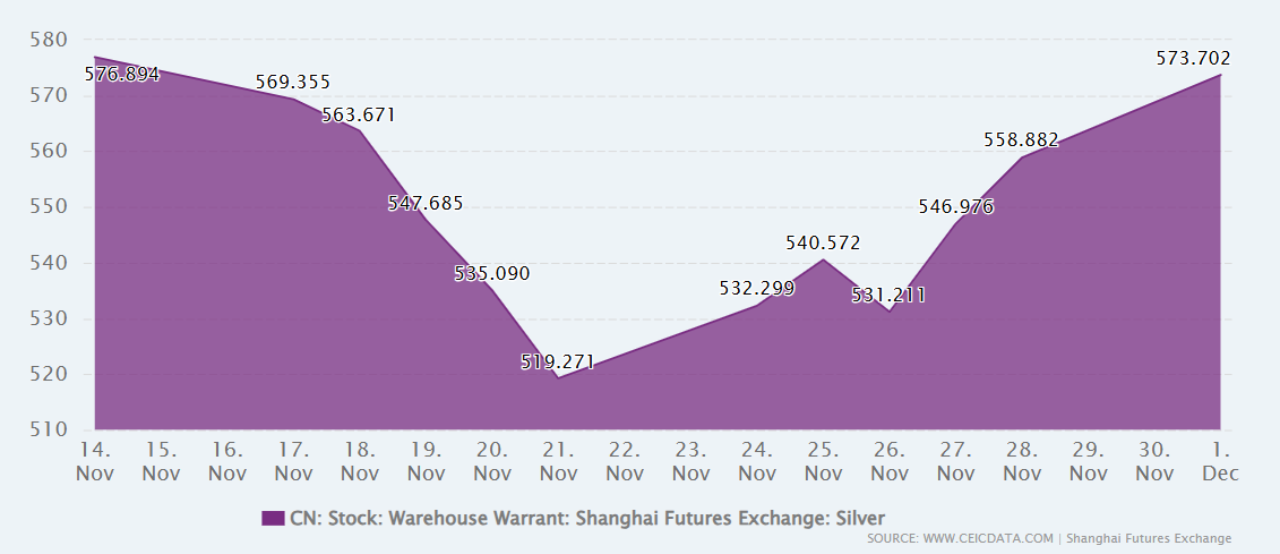

The latest leg higher in silver can be attributed to several factors, but one event that stood out is a sharp, but brief, decline in silver inventories at the Shanghai Futures Exchange between November 14 and November 25. The rapid drawdown raised concerns about near-term supply tightness.

Although inventory levels have since backfilled as of the December 1st update, the market reacted swiftly. A technical breakout followed, and traders took full advantage as short positions came under pressure. Yesterday’s 4.5% intraday surge coincided with a drop in open interest in COMEX Silver futures, indicating that shorts were covering on a net basis rather than new longs entering the market. While the squeeze may continue, sustained upside ultimately requires fresh long positions to replace short-covering as the primary driver.

Silver’s explosive rally reflects a combination of structural deficits, industrial demand strength, and short-term supply stress, amplified by a technical breakout, and an ongoing short squeeze. While short-covering can propel prices sharply higher in the near term, a durable continuation of the uptrend will require meaningful participation from new buyers, not just squeezed sellers. For bullish investors, the key question now is whether real long-term demand will step in to support silver once the squeeze exhausts itself.

Featured Clips

Arora: Yen Carry Trade Holds 10%-20% A.I. Correction Risk, Silver to Hit $70

Market On Close

► Play video