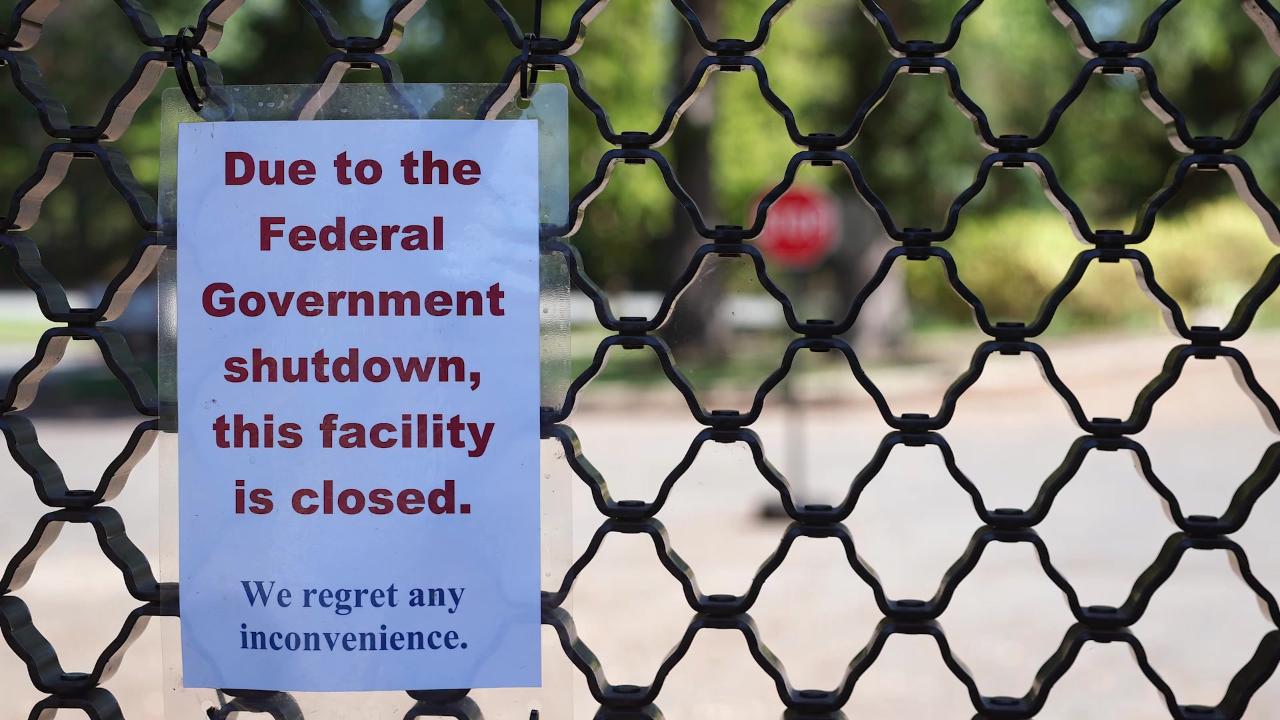

Risk-On Remains in Third Day of Shutdown

U.S. stock futures are extending this week’s gains in premarket trading after the market recorded new highs on Thursday.

The S&P 500, Nasdaq-100 (NDX) and Dow Industrial Index ($DJI) closed at another record high, driven by strength in the artificial intelligence trade that has pushed aside concerns about the U.S. government shutdown.

The shutdown, which entered its third day on Friday, continues to weigh on the mind of investors but not their bullish actions and appetite for risk-on trades in stocks.

With no September jobs report this morning due to the shutdown, investors will focus on services data and any progress on talks in Washington.

Snapshot (as of 7 AM ET)

- Oil (/CL) – Oil prices are up 0.3% near $60.70 a barrel ahead of the OPEC+ meeting over the weekend but is down over 6% this week. Speculation is that the group will boost output that has already been running high. If OPEC+ restores previous output even faster, it will only add to the projected supply overhang.

- Gold (/GC) – Gold prices are rebounding 0.5% near $3890 and are just below this week’s all-time highs.

- Bitcoin (/BTC) – The Crypto Future is down 0.3% near 121,600 in premarket trading.

- VIX – The CBOE Volatility Index was up 2% on Thursday and settled at 16.63 despite stocks at record levels.

- U.S. Dollar (/DX) – The dollar is down 0.1% to 97.4.

Biggest Premarket Movers (Mark % Change as of 7 AM ET)

- Occidental Petroleum (OXY): +1.56%

- Entergy (ETR): +1.53%

- Freeport-McMoRan (FCX): +1.49%

- Applied Materials (AMAT): -2.01%

- Apple (AAPL): -1.03%

- Philip Morris (PM): -0.93%

Economic Data

- 6:05AM ET: Fed’s Williams Speaks

- 9:45AM ET: PMI Composite - Final

- 10:00AM ET: ISM Services Index

- 1:30PM ET: Fed’s Logan Speaks, Fed’s Jefferson Speaks

- Delayed Data: September Jobs Report

Notable Earnings

- Premarket: None

- Postmarket: None

- Premarket Monday: None

- Postmarket Monday: STZ

Upgrades/Downgrades

- Rothschild & Co Redburn upgrades Coinbase (COIN) to Buy from Neutral

- Erste Group upgrades Bank of America (BAC) to Buy from Hold

- Erste Group upgrades Caterpillar (CAT) to Buy from Hold

- Wolfe Research downgrades PayPal (PYPL) to Peer Perform from Outperform

- Piper Sandler downgrades Instacart (CART) to Neutral from Overweight

- Jefferies downgrades Apple (AAPL) to Underperform from Hold