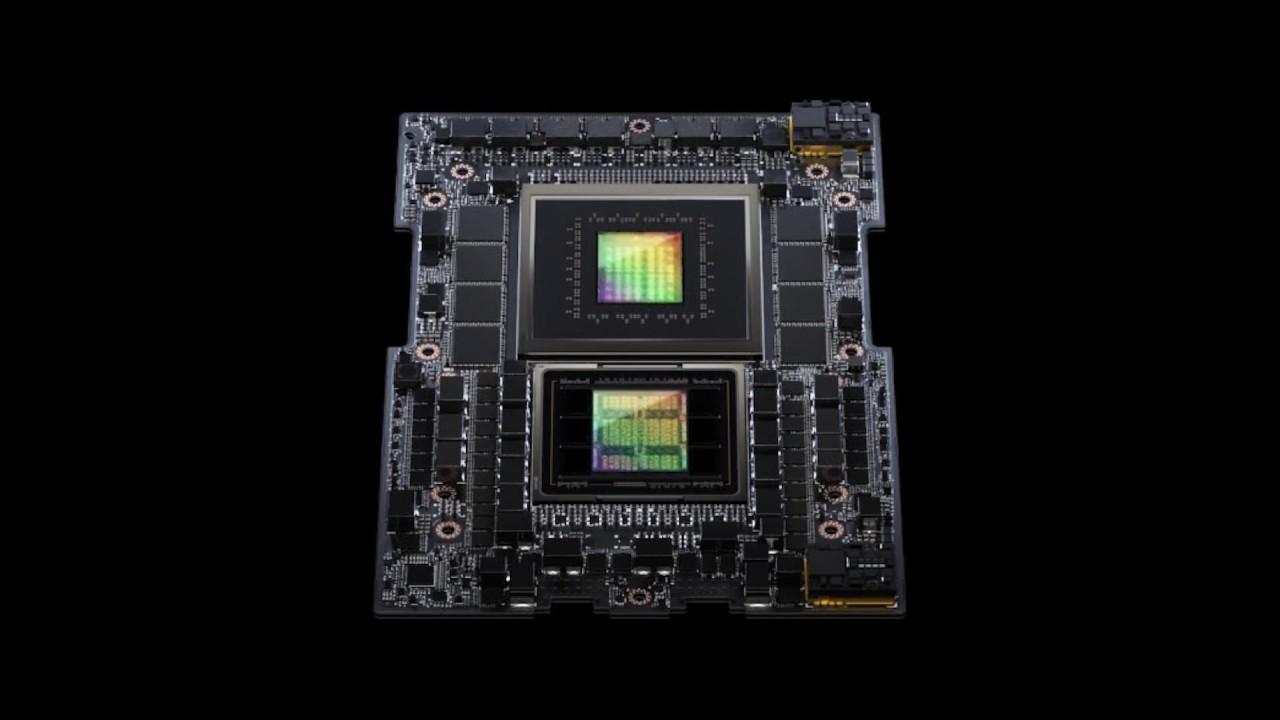

Semiconductor Stocks Rally After Taiwan Semiconductor’s Earnings Beat

U.S. stock futures are modestly higher in premarket trading and are attempting to correct from a two-day losing streak. Tech stocks are leading the gains this morning after Taiwan Semiconductor (TSM) reported another record quarter. Taiwan Semi is up 6% ahead of the opening bell, while Micron Technology (MU) popped 3% and Nvidia and gained more than 1%.

The moves also come after President Donald Trump on Wednesday signed a proclamation that imposes a 25% tariff on certain semiconductors. Banks underperformed on Wednesday after Wells Fargo (WFC), Citigroup (C) and Bank of America (BAC) fell following the release of their earnings reports. Investor focus remains on earnings this morning with more financial results along with data, including Jobless Claims and Retail Sales due.

Snapshot (as of 7 AM ET)

- Oil (/CL) – Oil prices are down over 3% near $59.80 a barrel after comments from U.S. President Donald Trump calmed fears that an American strike on Iran could be imminent. Speaking to reporters on Wednesday, Trump said he had been informed by “very important sources” in Iran that “the killing has stopped.” “There’s no plans for executions, I’ve been told that on good authority,” he said, adding that the White House would watch how the situation unfolds.

- Gold (/GC) – Gold prices are down 0.3% near $4620 following a record high in the previous session, as geopolitical and trade risks receded after U.S. President Donald Trump suggested he may pause military action against Iran and Washington held off on imposing tariffs on critical minerals.

- Bitcoin (/BTC) – The Crypto Future is down 1% near 97,000 in premarket trading.

- VIX – The CBOE Volatility Index was up 4.8% on Wednesday and settled at 16.75 as stocks fell.

- U.S. Dollar (/DX) – The U.S. Dollar Index is slightly positive up 0.12% at 99.173.

Biggest Premarket Movers (as of 7 AM ET)

- Broadcom (AVGO): +2.61%

- Advanced Micro Devices (AMD): +2.19%

- Nvidia (NVDA): +1.81%

- Emerson Electric Co (EMR): +1.25%

- Caterpillar (CAT): +1.14%

- Eli Lilly (LLY): -0.59%

- Exxon Mobil (XOM): -0.58%

- Abbott Labs (ABT): -0.49%

- Chevron (CVX): -0.44%

- Pfizer (PFE): -0.43%

Economic Data

- 8:30 AM ET: Unemployment Claims, Empire State Manufacturing Index, Philly Fed Manufacturing Index, Import Prices

- 8:35 AM ET: FOMC Member Bostic Speaks

- 9:15 AM ET: FOMC Member Barr Speaks

- 10:30 AM ET: Natural Gas Storage

- 12:40 PM ET: FOMC Member Barkin Speaks

- 1:30 PM ET: FOMC Member Schmid Speaks

Notable Earnings

- Premarket: BLK, FHN, GS, MS, TSM

- Postmarket: JBHT

- Premarket Tomorrow: MTB, PNC, RF, STT, WIT

- Postmarket Tomorrow: N/A

Upgrades/Downgrades

- Wells Fargo upgrades Broadcom (AVGO) to Overweight from Equal Weight

- Barclays upgrades Dell Technologies (DELL) to Overweight from Equal Weight

- Barclays upgrades Applied Materials (AMAT) to Overweight from Equal Weight

- Morgan Stanley downgrades Albertsons (ACI) to Underweight from Equal Weight

- Wells Fargo downgrades Flutter Entertainment (FLUT) to Equal Weight from Overweight

- KeyBanc downgrades Rocket Lab (RKLB) to Sector Weight from Overweight

Featured Clips