Shutdown Deal Steps, CRWV, DIS & More Earnings Ahead

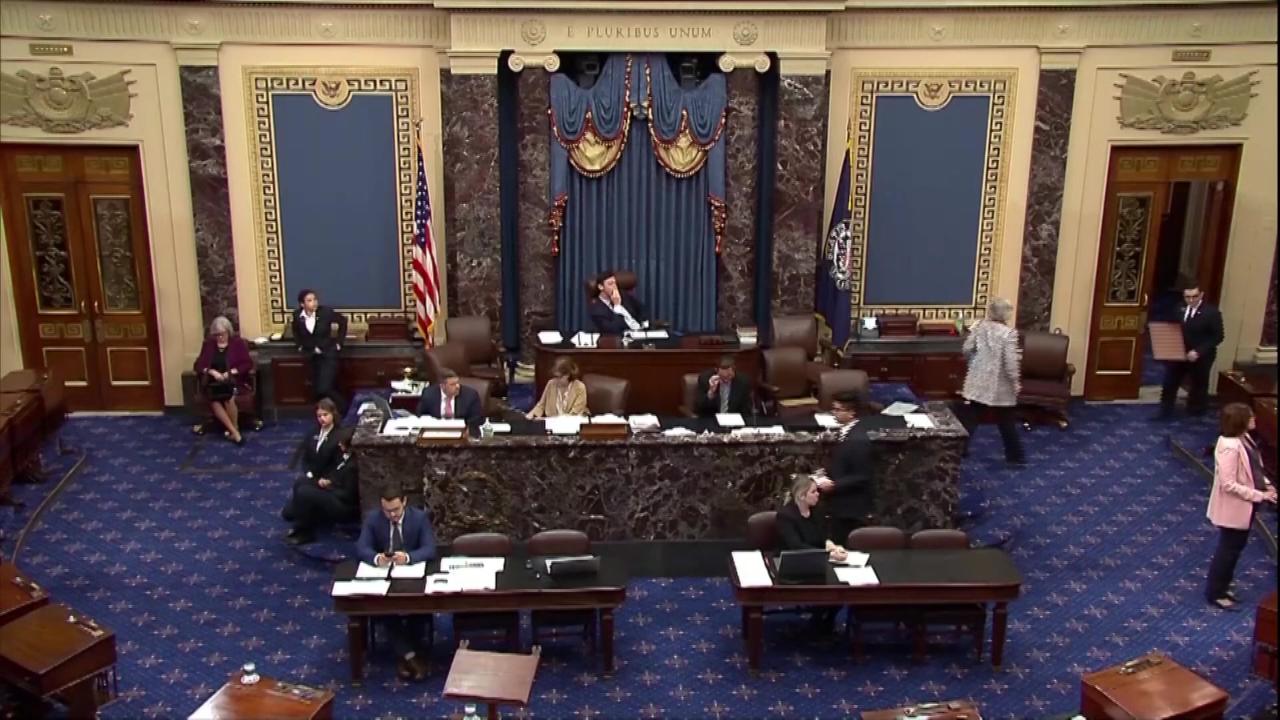

U.S. stock futures are sharply higher after Senate lawmakers took a crucial step towards a potential deal to end the historic U.S. government shutdown.

A procedural measure that allows other votes on the agreement to be held on Monday was approved by a minimum of 60 yes votes, after eight senators in the Democratic caucus broke with party leadership to support the deal.

The shutdown is in its 41st day, the longest on record, and caused stocks to fall last week amid increased volatility. Investor focus remains on the shutdown, tariff news and more earnings this week including results due from CoreWeave (CRWV), Cisco (CSCO) and Disney (DIS).

Snapshot (as of 7 AM ET)

- Oil (/CL) – Oil prices are up 0.5% near $60 a barrel after a second consecutive weekly loss on worries about excess supply and slowing U.S. demand.

- Gold (/GC) – Gold prices are up over 2% and broke $4,100 buoyed by expectations of another Federal Reserve interest rate cut in December and a slew of weak economic data that raised global slowdown worries.

- Bitcoin (/BTC) – The Crypto Future is up over 2% near 106,300 in premarket trading.

- VIX – The CBOE Volatility Index fell over 2% on Friday and settled at 19.08 as stocks rallied from an initial sell-off.

- U.S. Dollar (/DX) – The dollar is flat at 99.4.

Biggest Premarket Movers (Mark % Change as of 7 AM ET)

- Micron (MU): +4.93%

- Super Micro Computer (SMCI): +4.50%

- Seagate Technology (STX): +4.19%

- Centene (CNC): -6.87%

- HCA Healthcare (HCA): -4.53%

- Molina Healthcare (MOH): -3.99%

Economic Data

- 11:30 AM ET: 3-Month Bill Auction, 6-Month Bill Auction

- 1:00 PM ET: 3-Year Note Auction

Notable Earnings

- Premarket: B, DOLE, HHH, CART, BEKE, MNDY, RDNT, WULF, TSEM, TSN, WHF

- Postmarket: BBAI, CHGG, CRWV, IHRT, OXY, PSKY, REAL, RRGB, RGTI, RKLB

- Premarket Tomorrow: DAVA, HSAI, SE

- Postmarket Tomorrow: DOX, BYND, CAE, OKLO

Upgrades/Downgrades

- CICC upgrades Expedia (EXPE) to Outperform from Market Perform

- Leerink upgrades Eli Lilly (LLY) to Outperform from Market Perform

- Deutsche Bank upgrades MP Materials (MP) to Buy from Hold

- Morgan Stanley downgrades CarMax (KMX) to Equal Weight from Overweight

- Morgan Stanley downgrades JD.com (JD) to Underweight from Equal Weight

- Rothschild & Co. Redburn downgrades HubSpot (HUBS) to Neutral from Buy