Tesla (TSLA) Losing First Mover Advantage – Can it Win on Tech Prowess?

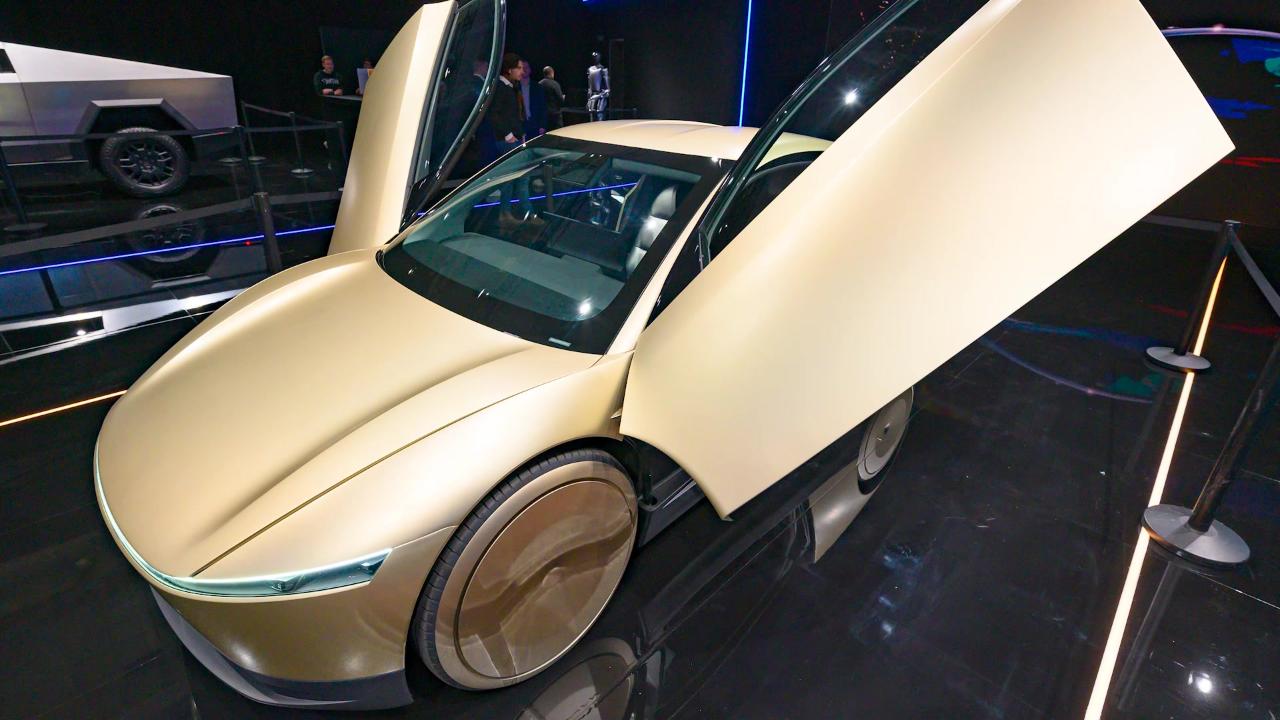

Tesla (TSLA) is one of this morning’s biggest premarket gainers as Elon Musk posted on X that it would ramp its Cybercab production in April.

This comes as Alphabet’s (GOOGL) Waymo announced approval to begin testing autonomous driving in Las Vegas – with a human at the wheel.

Tesla’s advantage has often been as a first mover. It made electric vehicles popular and built out significant charging infrastructure, leading eager investors to boost the stock price well above the usual carmaker multiples.

Then it lost market share as established carmakers pumped out cheaper alternatives, from China’s BYD to homegrown players like General Motors (GM). Due to a combination of factors, including the end of E.V. tax credits here, adoption hasn’t ramped the way analysts hoped.

Tesla was also a first mover on self-driving, advertising its FSD service for years and using customer data to help refine its systems – again, an advantage over any other competitor. However, as it comes time to launch driverless vehicles, Alphabet’s Waymo, with the full force of Google Maps data behind it, has already had working cars on the road for years.

Elon Musk is working on several AI projects, including the privately-held xAI. That could become useful for Tesla as it pivots towards AI, self-driving, and humanoid robotics. While there are other companies working on humanoid robots, particularly in China, no company is the standout winner yet. However, are humanoid robots as compelling a story as its original electric vehicle pitch?

Michael Burry doesn’t seem to think so, calling Tesla “ridiculously overvalued,” though he has denied shorting its shares. Car sales have struggled over the past year, and Tesla will either have to build new factories or repurpose existing ones to focus on robotics, potentially pulling resources away from the core business that already needs a revamp.

Tesla needs to get its narrative and its timing right. Investors are clearly excited about this new vision of the company, though it hasn’t gained nearly as much as tech peers (up 12% year-to-date and 5% vs last year). It has a history of delaying or dropping rollouts, including a cheaper Model 3 and other technological advancements. However, it needs to prove itself as a player in the self-driving industry soon as Waymo establishes dominance. We’ll see what April brings.

Featured Clips