U.S./China Lay Deal Groundwork, Mag 7 Reports

U.S. stock futures are sharply higher in premarket trading and extending last week’s record highs.

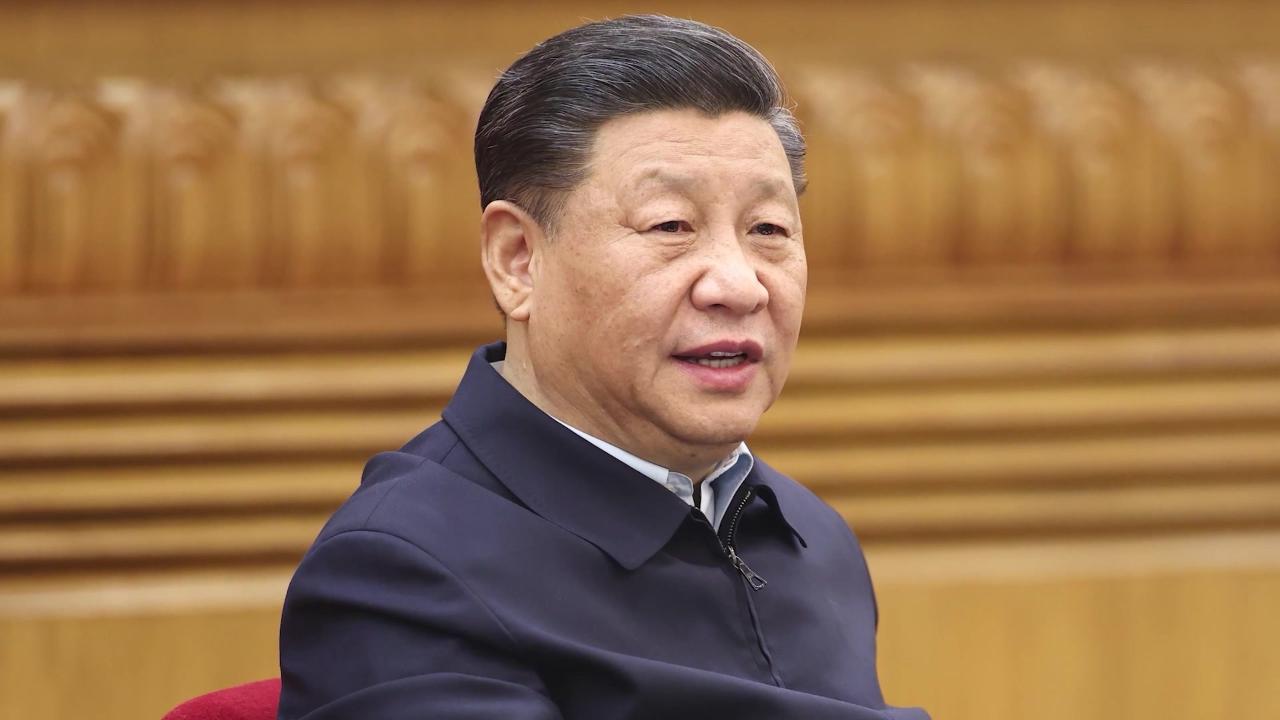

The bullish move comes after U.S. and China officials cooled tensions over the weekend, laying the groundwork for President Donald Trump and China President Xi Jinping to clinch a trade deal this week.

“I think we have a very successful framework for the leaders to discuss on Thursday,” said Treasury Secretary Scott Bessent from the ASEAN Summit in Kuala Lumpur.

“I have a lot of respect for President Xi, and we are going to come away with the deal,” Trump said on Monday from Air Force One.

Along with the trade talks this week, earnings ramp up with reports due from Mag 7 names Alphabet (GOOGL), Meta Platforms (META), Microsoft (MSFT), Amazon (AMZN) and Apple (AAPL).

Snapshot (as of 7 AM ET)

- Oil (/CL) – Oil prices are down 0.1% near $61.50 a barrel, giving up some of last week’s 7% gains as U.S. sanctions on Russia’s two biggest oil companies over the war in Ukraine spurred supply concerns.

- Gold (/GC) – Gold prices are down about 2.5% near $4050 after slightly softer-than-expected U.S. inflation data reinforced expectations that the Federal Reserve will cut interest rates this week. The metal had its first weekly loss in 10 weeks.

- Bitcoin (/BTC) – The Crypto Future is up over 4% near 115,500 in premarket trading.

- VIX – The CBOE Volatility Index fell 5% on Friday and settled at 16.37 as stocks rallied to record highs.

- U.S. Dollar (/DX) – The dollar is down around 0.2% to 98.6.

Biggest Premarket Movers (Mark % Change as of 7 AM ET)

- Keurig Dr. Pepper (KDP): +8.28%

- Micron (MU): +3.73%

- Robinhood (HOOD): +3.26%

- Newmont (NEM): -5.24%

- Huntington Bancshares (HBAN): -5.10%

- Revvity (RVTY): -2.92%

Economic Data

- 10:30 AM ET: Dallas Fed Mfg. Survey

- 11:30 AM ET: 2-Year Note Auction

- 1:00 PM ET: 5-Year Note Auction

Notable Earnings

- Premarket: CRI, KDP

- Postmarket: AMKR, CAR, BRO, CDNS, CR, FFIV, HIG, NOV, OLN, PFG, WELL, WHR, WM

- Premarket Tomorrow: AOS, ALKS, AMT, ATI, CARR, CX, GLW, DHI, GPI, HRI, HUBB, INCY, JBLU, NEE, NUE, PYPL, PII, REGN, RCL, SHW, SOFI, SYY, THC, UPS, UNH, VFC, W, ZBRA

- Postmarket Tomorrow: BE, BKNG, CZR, CWH, CAKE, CSGP, EA, ENPH, EXE, FLS, LOGI, MDLZ, OKE, PPG, RRC, STX, TER, V

Upgrades/Downgrades

- Guggenheim upgrades Microsoft (MSFT) to Buy from Neutral

- RBC Capital upgrades Honeywell (HON) to Outperform from Sector Perform

- Vertical Research upgrades General Dynamics (GD) to Buy from Hold

- Morgan Stanley downgrades Harley-Davidson (HOG) to Underweight from Equal Weight

- Keefe Bruyette downgrades Berkshire Hathaway (BRK/A) to Underperform from Market Perform

- Jefferies downgrades Keysight (KEYS) to Hold from Buy