Will China Be Enough for Nvidia (NVDA)?

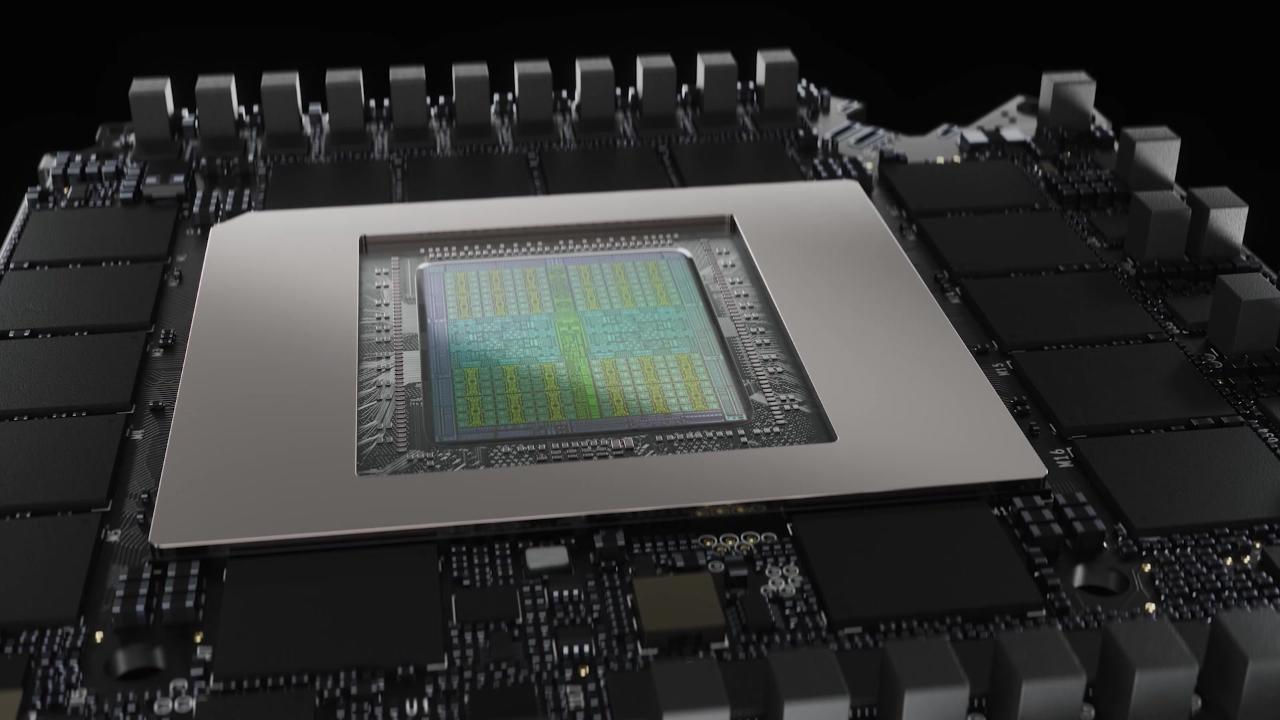

Nvidia (NVDA) is reportedly evaluating adding production capacity for its H200 AI chips after President Trump allowed Nvidia to export them to China again. However, Nvidia must pay a 25% fee on its sales. The same rule may apply to other chipmakers, including Intel (INTC) and Broadcom (AVGO). Bloomberg estimates potential annual H200 revenue from China at $10 billion, while CEO Jensen Huang sees a $50 billion opportunity this year.

The U.S. is still restricting the most advanced chips as it tries to keep its lead in the AI race. However, China is still obtaining them through countries where the sales are not prohibited. The DOJ announced a week ago that it seized more than $50 million in advanced GPUs meant to be smuggled into China. The Information reports that DeepSeek is using banned chips to develop an upcoming AI model.

Some companies undoubtedly will take advantage of the new legality to obtain H200 chips. However, traders must wonder how much of a revenue bump Nvidia will see if demand was already coming circuitously from China.

Another conflicting report comes from the White House, where AI czar David Sacks said China is “rejecting our chips.” He added, “Apparently, they don’t want them, and I think the reason for that is they want semiconductor independence.” China’s dominance in the rare earth markets could assist them with that.

NVDA shares are up 30% year-to-date and 25% vs last year and are up over 1% in premarket trading today. However, it is down around 17% from the all-time high of $212.19 it made in November. Nvidia still dominates the chip market, but investors are beginning to fret about AI capex. Foreign purchases could help ease some concerns around circular investments within the U.S., proving demand and transformation worldwide. Still, will reopening exports to China push Nvidia to the growth levels the market wants?

Join Schwab Network for the latest on AI, China and more.

Featured Clips

Johnson: ORCL Long-Term Bull Case, NVDA Not Expensive & Brace for 5-Year A.I. Buildout

The Watch List

► Play video