Winter Storm Puts Natural Gas Back in the Spotlight

Occasionally, natural gas captures headlines, especially during major weather event – and rightfully so. The primary fundamental catalyst for sharp movements higher in natural gas, particularly in winter, is the expectation that heating demand will surge as severe storms develop.

When demand spikes, inventories are drawn down, and concerns about pipeline disruptions or slower flows can push near-term prices higher. That is exactly what we saw this week. The February natural gas contract surged more than 81% from last week’s close to this week’s high of $5.65.

Will this storm have a meaningful impact on the U.S.? Yes. But this weather event also hit the natural gas market at the “perfect” time to trigger such aggressive price reaction. So, let’s break down what happened and what could come next.

First and foremost, it is no secret that Henry Hub is one of the more heavily shorted futures products among institutional traders and producers. Natural gas is abundant in the United States, largely because it is a byproduct of shale oil production. Until liquefied natural gas (LNG) export capacity meaningfully ramps up over the next 2–5 years, this structural oversupply may keep prices depressed for an extended period. That imbalance set the stage for an explosive move when a credible demand shock emerged.

Several key factors explain the magnitude of the rally. Most of the price action was concentrated in the front-month contract—specifically the February contract.

The last day to trade the February contract is January 28th. Because natural gas futures are physically delivered, traders typically begin rolling positions into the next active contract well before expiration to avoid delivery risk and maintain liquidity. As contracts approach expiration, bid-ask spreads often widen, particularly in physically delivered markets.

This dynamic played a major role in last week’s surge. A large amount of volume was concentrated in a contract nearing expiration, while open interest was rapidly declining. In other words, intraday trading activity, not long-term positioning, was driving much of the price action in February contract, rather than in the March contract, which will become the active contract next week.

For example, on Thursday, February open interest stood at 34,942 contracts, while total daily volume reached 310,947 contracts. This disparity suggests that most trades were opened and closed within the same session, indicating limited new structural positioning.

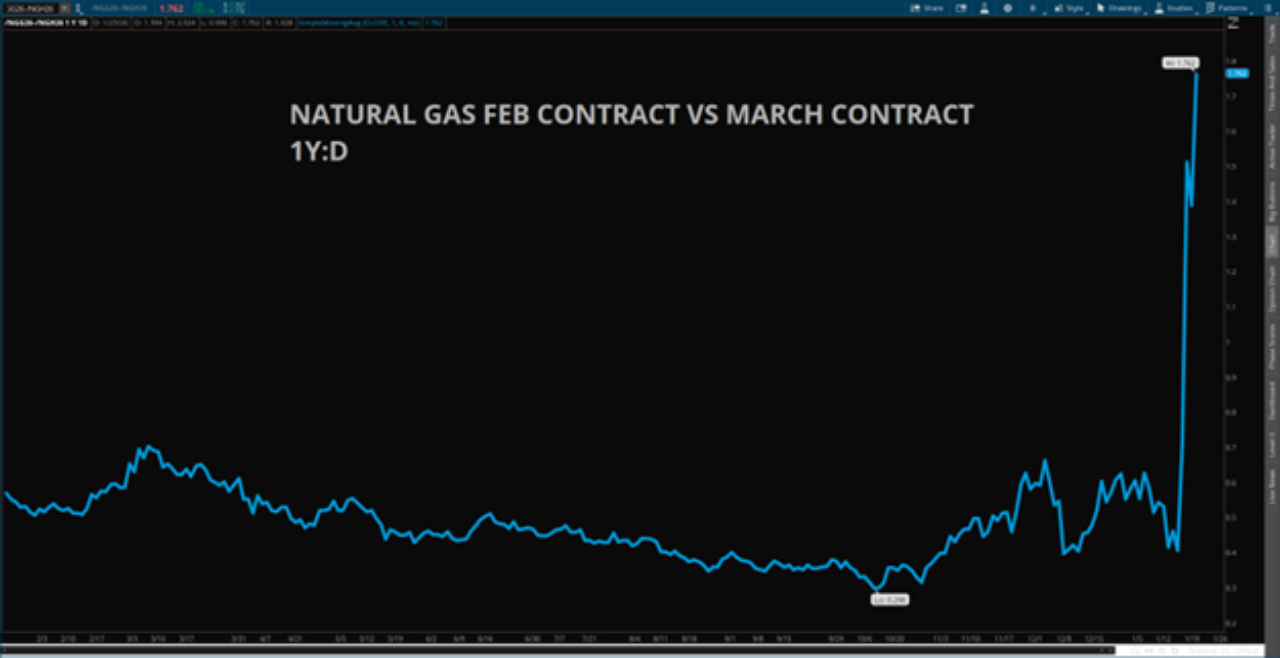

The rally also pushed natural gas futures into significant backwardation—where the front-month contract trades at a premium to later-dated contracts. In this case, the February–March spread widened to unusually elevated levels.

This abnormal spread reflects near-term event risk, specifically weather risk, being priced into the market, rather than longer-term demand expectations. Typically, as contracts approach expiration, front-month prices converge toward the next month’s price. Wide spreads like this rarely persist for long.

As the weather outlook stabilizes and event risk fades, the spread tends to normalize in one of two ways:

• The front-month contract declines relative to later-dated contracts, or

• Later-dated contracts rise faster than the front month.

Either outcome reflects the market’s attempt to re-establish an equilibrium as the expiring contract rolls off and the next contract becomes the front month.

Natural gas remains one of the most volatile commodities and trading it carries significant risk relative to other asset classes. This winter storm represents a near-term catalyst, not a structural shift.

Featured Clips