Alphabet Lower Despite Favorable DOJ Antitrust News

Alphabet (GOOGL) shares are down this morning in early trading, despite breaking news that the Department of Justice will not make the company to sell off its investments in artificial intelligence companies in a pending antitrust lawsuit. However, the DOJ and 38 states attorneys general are still looking to require Google to divest its Chrome browser among other measures to address concerns about its monopoly on internet search traffic.

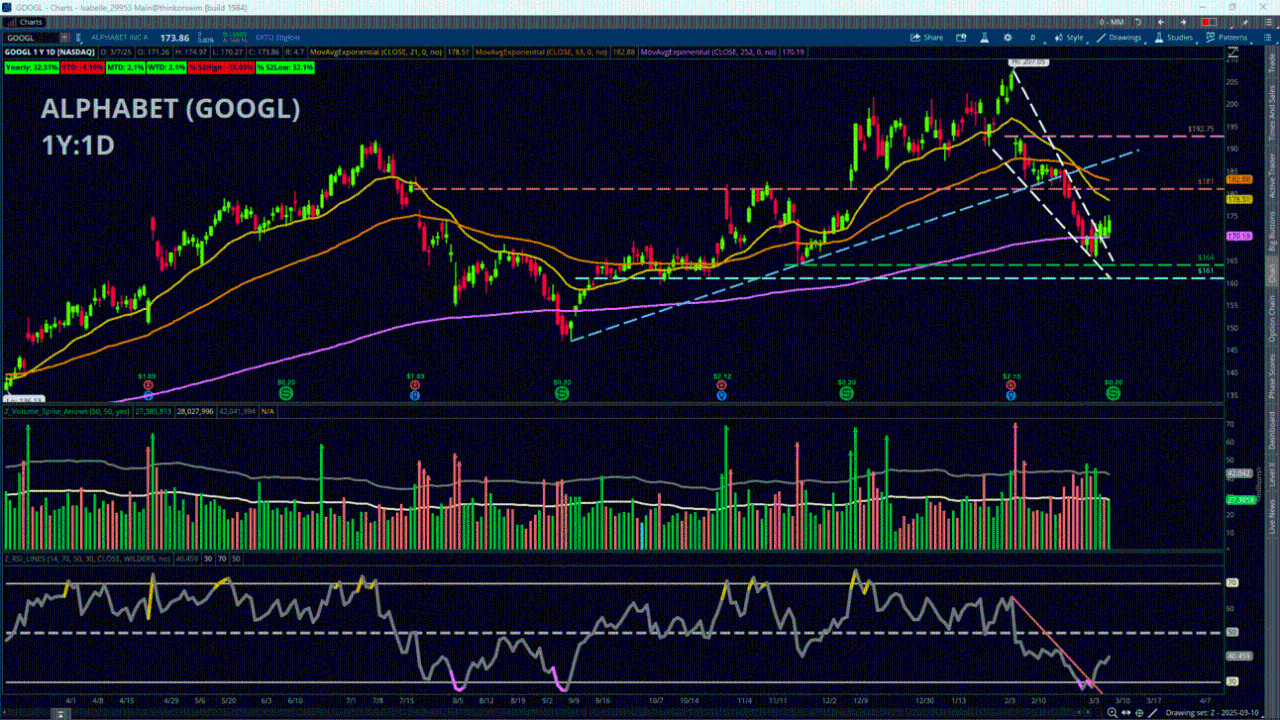

Shares of the tech and communications giant have stumbled recently after logging all-time highs of 207.05 on Feb. 4 heading into its last earnings report. From there, price has fallen about -16% as of Friday’s close, with more weakness on the horizon today as broader equity index futures point to a notably lower open. Price has so far stayed above a notable technical range, which is the lows from Nov. 21 and 22 near 164 and then another series of lows from September to October near about 161, and last week pushed above the boundary of a downward trendline beginning with those highs near 207 with a corresponding bullish RSI breakout out of the oversold area. But the splash of cold water on that bullish outlook could be that price also has so far failed to make any serious upside progress after the breakout, and that price is poised to open below a key technical indicator, the 252-day Exponential Moving Average which sits near 170 based on Friday’s close. Upside resistance could be found near 181 based on old gaps and high/low levels, as well as the 63-day EMA near about 183.

Looking at the options market, the Mar. 21 monthly contract is the most active in terms of open interest with 289,476 calls and 241,154 puts, while the June and January monthlies also show heavy activity. On the call side for March, the range between 180 to 220 shows the highest activity, while the most notable area for the put side is between 150 to 185.

Featured clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.