Apple Earnings This Afternoon To Shed Light on iPhone Demand, A.I. Efforts

Apple (AAPL) will report earnings in today’s postmarket, with the tech giant showing relatively muted performance during the past year (+7.1%) against not only the broader market in the S&P 500 (+15.5%) but also its peers in the lauded Magnificent 7 group (+13.3%). Analyst expectations for earnings results come in at $2.65 against last year’s figure of $2.40 (+10.4%) for EPS and at $137.81B compared to $124.30B year-over-year (+10.8%).

As always, iPhone demand is the meat of the report. CEO Tim Cook recently said they anticipate this quarter’s revenue to be the best ever for the iPhone. However, rising computer chip prices due to insatiable demand may present a headwind for the company. Traders also are likely to be eager for any updates about Apple’s artificial intelligence efforts with recent news including that the company is revamping Siri after choosing Google’s (GOOGL) Gemini to back the updated version.

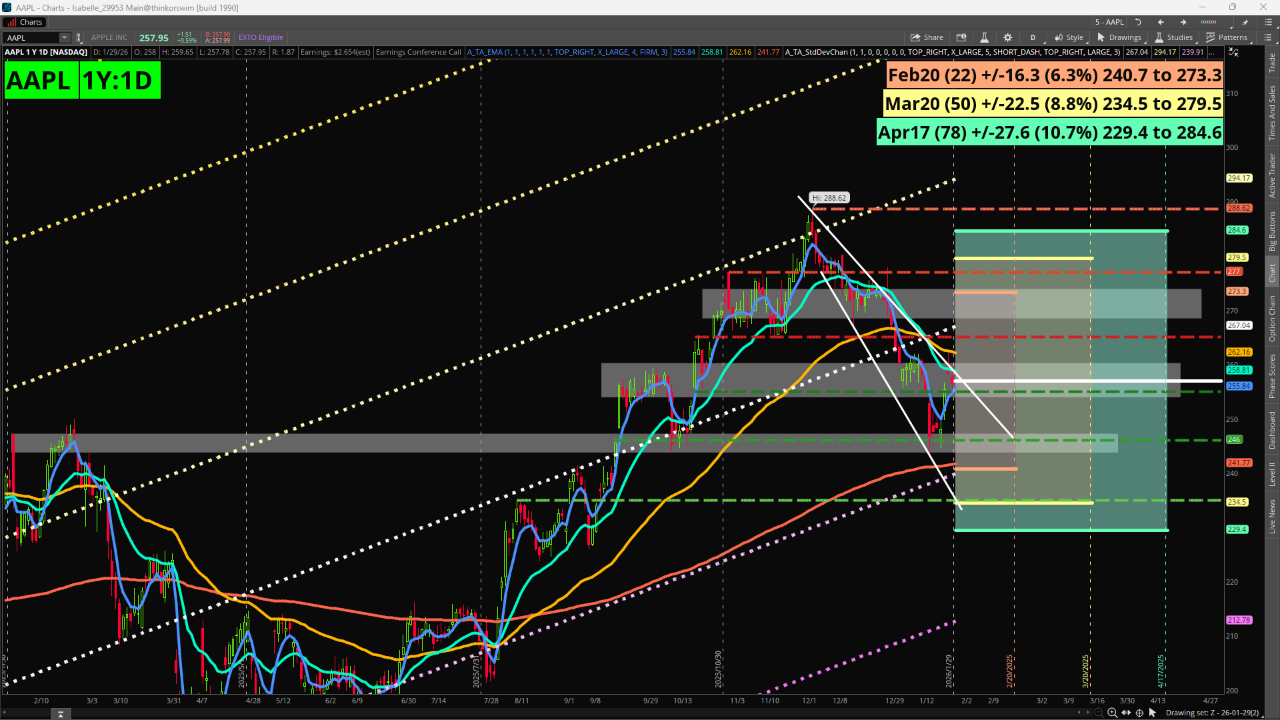

From a technical perspective, Apple held a critical support area near 246 recently which marked a pre-gap high point and subsequent low from late September to mid-October. However, the bulls for now have stopped short ahead of the next horizontal resistance level, which is near 265 and marks a series of lows from early November. This area is also quite close to the yearly Linear Regression Line, a line of berst fit that traders may use as an idea of fair value. Meanwhile, the options market shows a potential expected move of +/- 10.05 (3.9%) for this Friday’s expiration.

Featured Clips