Closing Bell: Markets Pull Back to Kick Off Another Shortened Trading Week

Key Points

- Stocks pulled back in light trading, with the S&P 500 (-0.35%), Nasdaq-100 (-0.46%), and Russell 2000 (-0.57%) all finishing lower.

- Nvidia purchased $5 billion of Intel shares at $23.28, providing a capital boost as Intel works to advance its 18A fabrication process.

- Nvidia signed a non-exclusive licensing deal with Groq to enhance its AI ecosystem and access top talent.

Markets pulled back to start the week as low trading volume persisted due to the holiday schedule. The S&P 500 (SPX) closed down 0.35%, while the Nasdaq-100 (NDX) declined 0.46%. Small-cap stocks also moved lower, with the Russell 2000 (RUT) finishing down 0.57%. Energy, Real Estate, and Utilities led the advance, while Materials and Consumer Discretionary lagged.

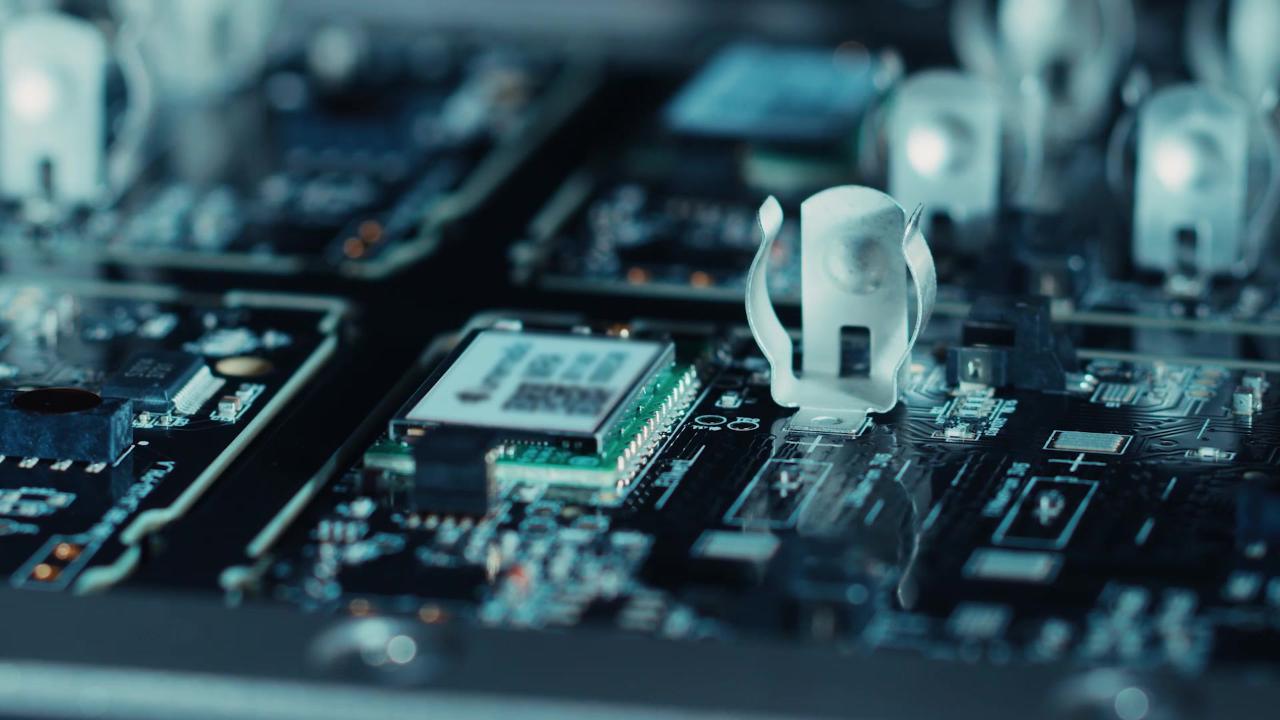

Nvidia Takes $5B Stake in Intel, Signs Groq Licensing Deal

Nvidia (NVDA) has officially taken a $5 billion stake in Intel, purchasing shares at $23.28 per share. The investment provides a much-needed cash infusion for Intel as it continues working to improve its 18A fabrication process.

In addition, Nvidia has entered into a licensing agreement with Groq, allowing it to gain access to top-tier AI talent while expanding its broader AI ecosystem. Groq will continue operating as an independent company, though the non-exclusive inference licensing agreement has drawn scrutiny from industry experts, with some suggesting the structure resembles a de facto acquisition.

Key Market Events for Tomorrow

- 09:00 AM ET: S&P/CS Composite-20 HPI

- 09:45 AM ET: Chicago PMI

- 02:00 PM ET: FOMC Meeting Minutes

- 04:30 PM ET: API Weekly Statistical Bulletin

Notable Earnings for Tomorrow

- Premarket: N/A

- Postmarket: N/A

Featured Clips