Closing Bell: Markets Rebound from Early Losses as Nvidia Earnings Loom

Key Points

- Markets were mixed during the session, with the S&P 500 (SPX) essentially flat, edging up 0.05%, while the Nasdaq-100 (NDX) slipped 0.06%.

- Nvidia faces selling pressure amid concerns over the A.I. trade and hyperscaler debt raises, with earnings due Nov. 19

- Strategy remained under pressure Friday as crypto sell-offs deepened, while CEO Michael Saylor reaffirmed strong Bitcoin conviction and dismissed liquidation rumors.

Markets were mixed during the session, with the S&P 500 (SPX) essentially flat, edging up 0.05%, while the Nasdaq-100 (NDX) slipped 0.06%. The Russell 2000 (RUT) outperformed, closing 0.22% higher. Energy, Information Technology, and Real Estate led the gains, while Materials and Financials were the two biggest laggards.

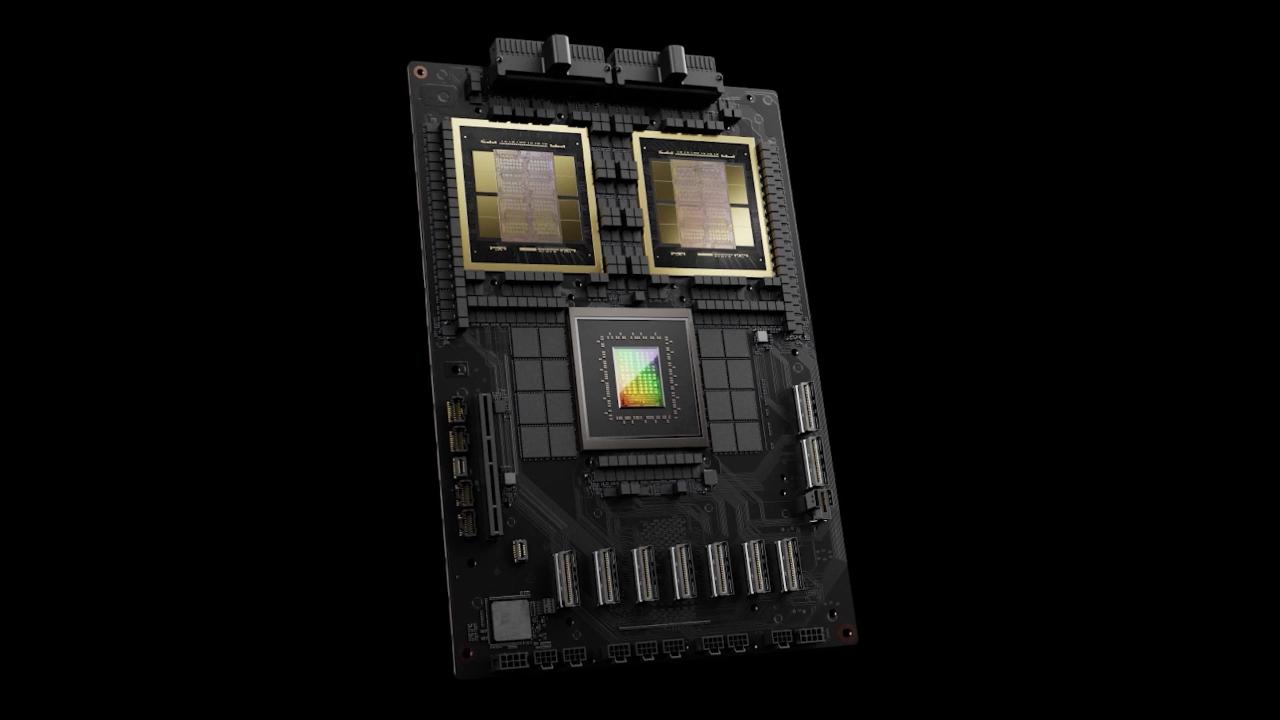

Nvidia’s Intraday Reversal Impresses Ahead of Earnings

Selling pressure plagued Nvidia (NVDA) for most of the week as traders and investors questioned the sustainability of the A.I. trade. Additionally, recent debt capital raises by several hyperscalers may signal potential overleveraging within the industry. Nvidia is scheduled to report earnings on Wednesday, November 19, after the market closes. Consensus estimates project revenue of $54 billion and adjusted earnings per share of $1.25.

Strategy Shares Drop Amid Bitcoin Pullback

Strategy (MSTR) faced continued downward pressure in Friday’s session as cryptocurrencies extended their sell-off. CEO Michael Saylor reiterated his strong conviction in Bitcoin in several statements today and dismissed rumors that the company had liquidated Bitcoin positions during early trading hours.

Key Market Events for Monday

- 08:30 AM ET: Empire State Manufacturing Index

- 09:00 AM ET: FOMC Member Williams Speaks

- 3:35 PM ET: FOMC Member Waller Speaks

Notable Earnings for Monday

- Premarket: XPEV

- Postmarket: TCOM

Featured Clips

Friday's Final Takeaways: Bitcoin Below $100K, WBD Bidding War & Fed Speak

Market On Close

► Play video