Market Minute: Geopolitical Risk Premium and Downward Revisions Crush Oil Prices

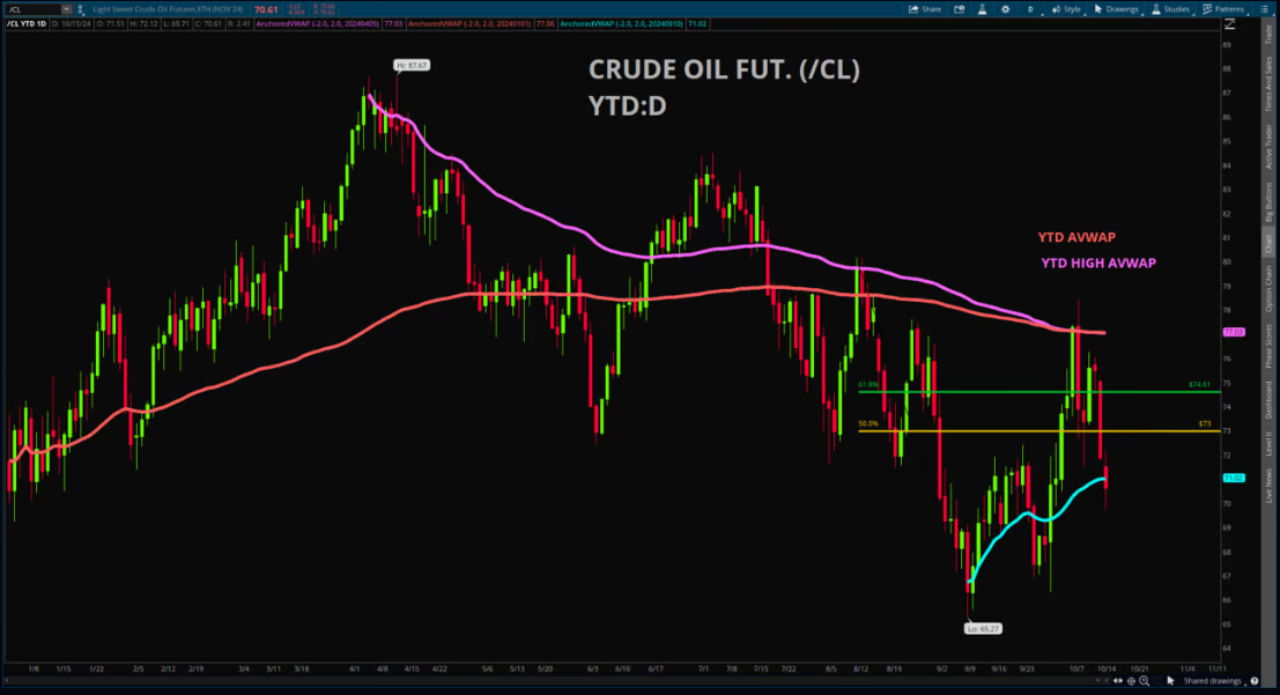

As of this morning, crude oil has dropped more than 6% since the close of U.S. equity markets yesterday. This decline followed news reports suggesting that Israel would target Iranian military infrastructure, rather than oil infrastructure and logistics lines, in response to an Iranian ballistic missile strike on Israeli territory earlier this month. While this has not yet been confirmed by Israeli or U.S. government officials, the market reacted swiftly, selling off crude oil in response to the news. The focus has now shifted back to the global demand outlook, which worsened overnight due to a downward revision from the International Energy Agency (IEA) and weaker-than-expected data from China.

Earlier this morning, the IEA reduced its oil demand growth forecast for 2024 by 40,000 barrels per day, citing China's underwhelming demand for petroleum products and excessive global stockpiles relative to demand. The IEA also noted that potential disruptions to Iranian oil infrastructure and logistics could be offset by spare capacity from OPEC+ and strong production levels in the United States. The IEA is not the only organization lowering its global demand outlook—on Monday, OPEC also cut its global oil demand forecasts for 2024 and 2025, highlighting similar concerns.

The final blow to energy prices overnight came from disappointing economic data out of China. September’s year-over-year imports grew by just 0.3%, well below the market’s expectation of 0.9%. Exports also underperformed, increasing by only 2.4%, compared to the market’s forecast of 6.0%. As a result, energy and industrial metal prices fell. However, investors should keep in mind that the recent stimulus measures announced over two weeks ago in China will take several months to be reflected in the "hard" economic data. For now, it seems traders are unwilling to wait for these developments to materialize.

Featured clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.