Market Minute: High Yield Dividend Stocks Thrived Last Week

Last week, the S&P 500 experienced a marginal pullback of 1.5% on a relative basis. As we have seen before, the market is now questioning whether this marks the beginning of a major downturn.

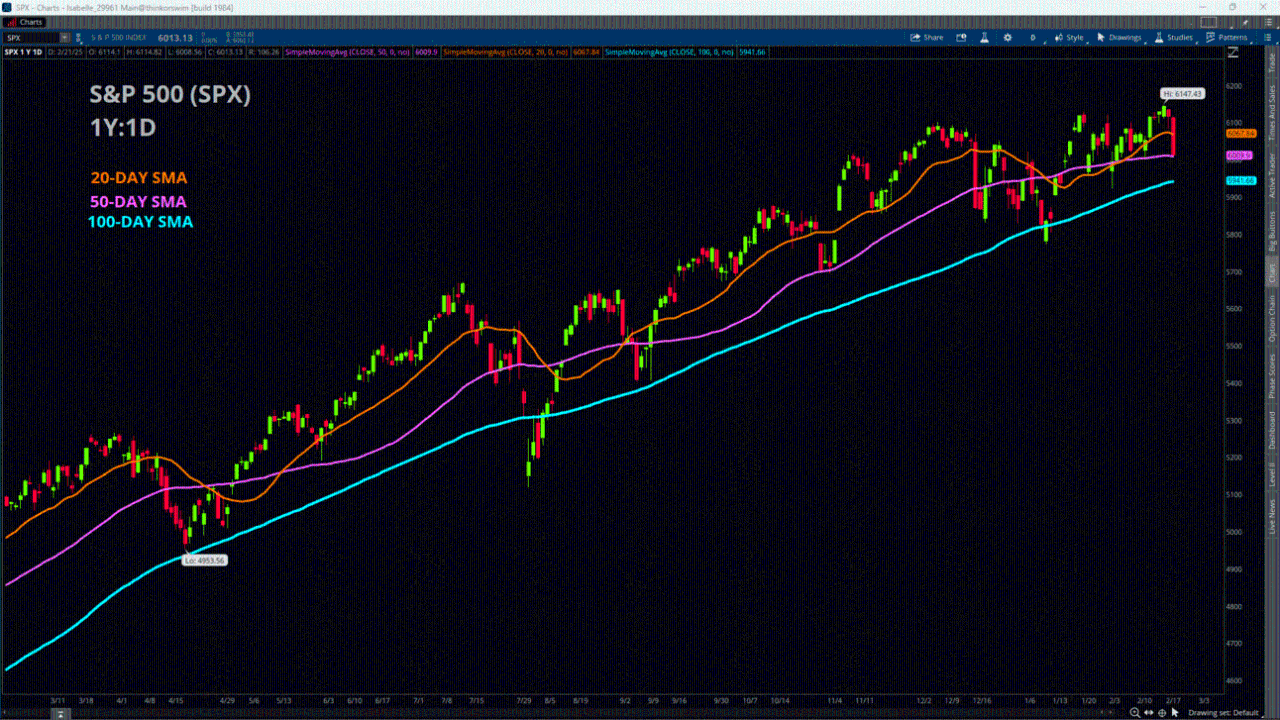

First and foremost, when analyzing the technical structure, did we see some damage on the daily charts? Yes. The 20-day SMA failed without hesitation, the market closed near its lows on Friday, and volume picked up during the selloff. However, we must also recognize that monthly options expirations generally bring increased volatility. In fact, during the Morning Trade Live segment on Friday, I mentioned that the volatility structure appeared to be at abnormally low levels, suggesting a potential rerating in volatility. That is precisely what we saw.

On the other hand, we closed right at the 50-day SMA, a critical level to hold this week. The hope is that buyers step in on Monday to defend that level, which is approximately 6,010. If that level fails, we can look to the 100-day SMA as the next area of support, which sits around 5,941 for the S&P 500.

Enough about the technicals—let’s consider the scenario in which the market fails to hold, and the headline stocks that dominate market attention begin to fade further. Last week, a group of stocks that have largely been overlooked actually performed well: high-yield dividend stocks, particularly those that have been in defined downtrends over the last several months.

High-yield dividend stocks are generally used as defensive positions, especially when fixed-income yields stabilize. While the expectation of outsized stock price appreciation is relatively low, their low volatility from a beta-weighted standpoint (meaning lower price variability compared to the S&P 500 as a benchmark) makes them attractive to portfolio managers searching for yield until other opportunities arise.

Several popular high-yield dividend stock ETFs, such as SPYD, which closed the week up approximately 0.8%, saw positive inflows as some of the underlying holdings attracted meaningful bids. For example, Hasbro, the toy maker, saw a 12% gain last week following its earnings report and currently has a dividend yield of approximately 4.1%. Even stocks outside of these ETFs, such as Hershey (HSY), Merck & Co. (MRK), and Kraft Heinz (KHC)—all with dividend yields above 3.1%—were up more than 6% last week.

Of course, dividend yields are never guaranteed, as companies can adjust their payouts based on their financial fundamentals. However, this shift in capital flows is something to be mindful of. If this trend continues into this week, we may be witnessing a shift from growth to value in the intermediate term.

Featured clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.