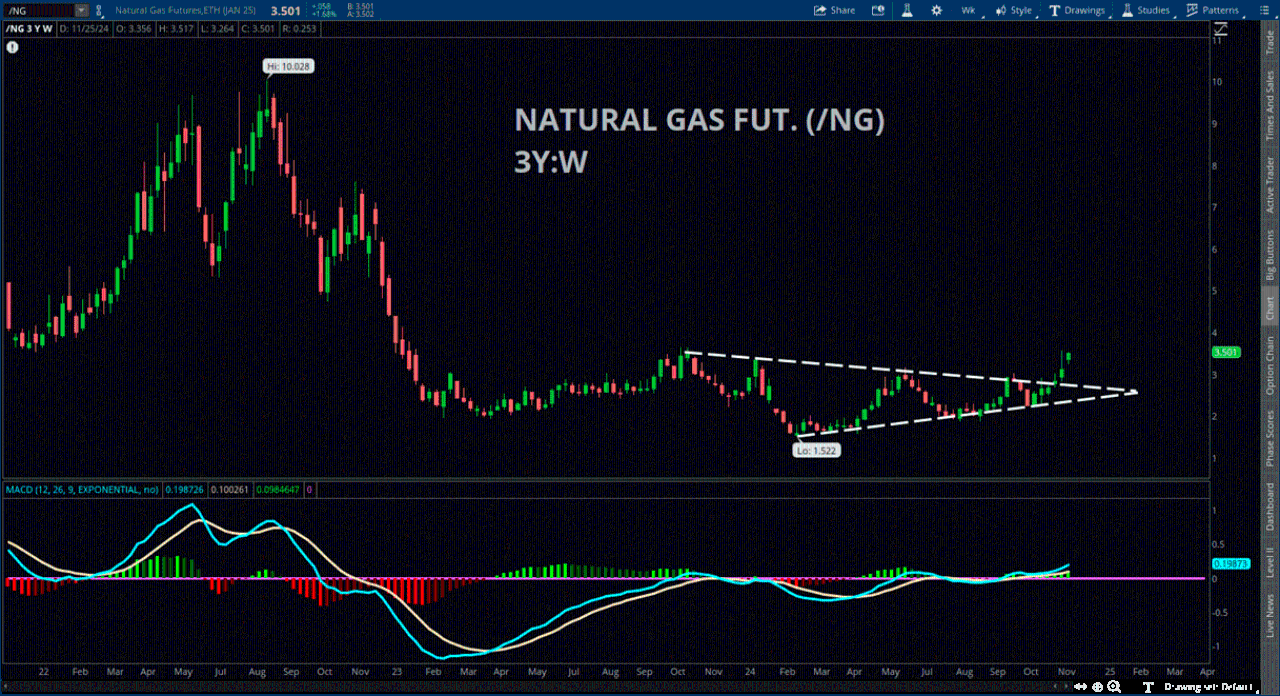

Market Minute: Natural Gas Continues to Push Higher

Natural gas, often overlooked due to oversupply in the United States, continues its upward trajectory as geopolitical factors remain in focus and natural gas inventories in the European Union deplete faster than expected due to a cold snap. This energy product may be poised for further gains if current conditions persist and short positions continue to be covered.

European gas inventories currently sit at around 88% of capacity, according to Celsius Energy, mirroring levels last seen in 2020, which marked the beginning of a tightening supply that lingered throughout the winter. Since the onset of the Russia-Ukraine conflict in 2022, many European nations have realigned their supply chains, reducing reliance on Russia and increasing liquefied natural gas (LNG) imports from the U.S. and Middle Eastern countries.

While Russia continues to supply Europe with natural gas through a major pipeline passing through Ukraine—untouched by both sides during the conflict—market skepticism remains. There is concern that Russia could halt flows at any time, one of its last significant levers of power against the West. A particularly harsh winter in the E.U. could exacerbate the situation, straining natural gas supplies and increasing demand for LNG, which faces structural shortages due to infrastructure limitations.

Liquefied natural gas has been at the forefront of the energy revolution in recent years. As demand surges in scenarios like this, domestic natural gas prices, as represented by the Henry Hub contract, tend to rise as well. While short-term price spikes and short-covering events are not uncommon, sustained price increases could eventually affect consumer costs, particularly utility bills. However, this trend may provide a tailwind for utility companies, which still possess pricing power to mitigate these impacts.

Featured clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.