Market Minute: Palantir – A.I. Darling Stumbles

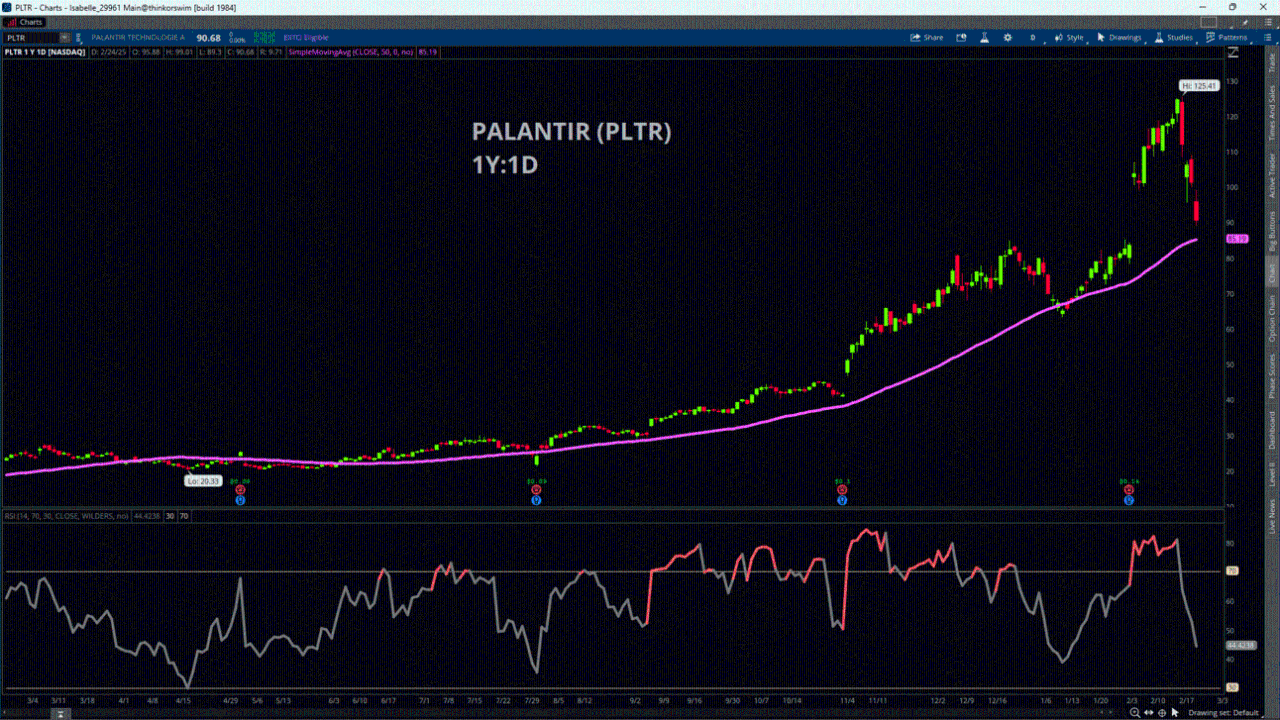

Palantir (PLTR) shares fell another 10% on Monday and are now down nearly 30% from its all-time highs from just last Wednesday. The A.I. platform stock has stumbled over the last four sessions in a sign that investors are taking profits or realizing that valuations are still stretched. Palantir shares are still up about 20% this year as of Monday’s closing price after jumping more than 340% in 2024 to lead gains in the S&P 500 (SPX).

After another solid earnings report on February 3rd when the stock jumped 24%, sentiment has come crashing down for the stock over the last week. The sharp decline comes as investors grow increasingly uneasy over potential U.S. defense spending cuts under the Trump administration. The Washington Post reported that U.S. Defense Secretary Pete Hegseth ordered senior leaders at the Pentagon and throughout the U.S. military to develop plans for cutting 8% from the defense budget in each of the next five years. This is a major concern for Palantir, which depends on government contracts for a significant portion of its revenue. Making matters worse, according to a regulatory filing from last week, CEO Alex Karp's new stock plan will allow him to sell nearly 10M shares of Palantir stock in the next six months.

Palantir stock went from technically overbought last week with an RSI of over 80 down to the mid-40 level. Anything over the 70 level for the relative strength index (RSI) is considered overbought. The stock is still above its 50-day Simple Moving average near $85, which may provide some near-term support if the stock continues its slide. Valuation may still be an issue with a forward PE of over 150 as of yesterday’s close. Will investors start to dip their toes back into the stock after the recent slide or is the momentum still with the bears at this point?

Featured clips

Najarian: Quantum & Nuclear 'Will Dominate the News' after NVDA Earnings

Morning Movers

► Play videoCharles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.